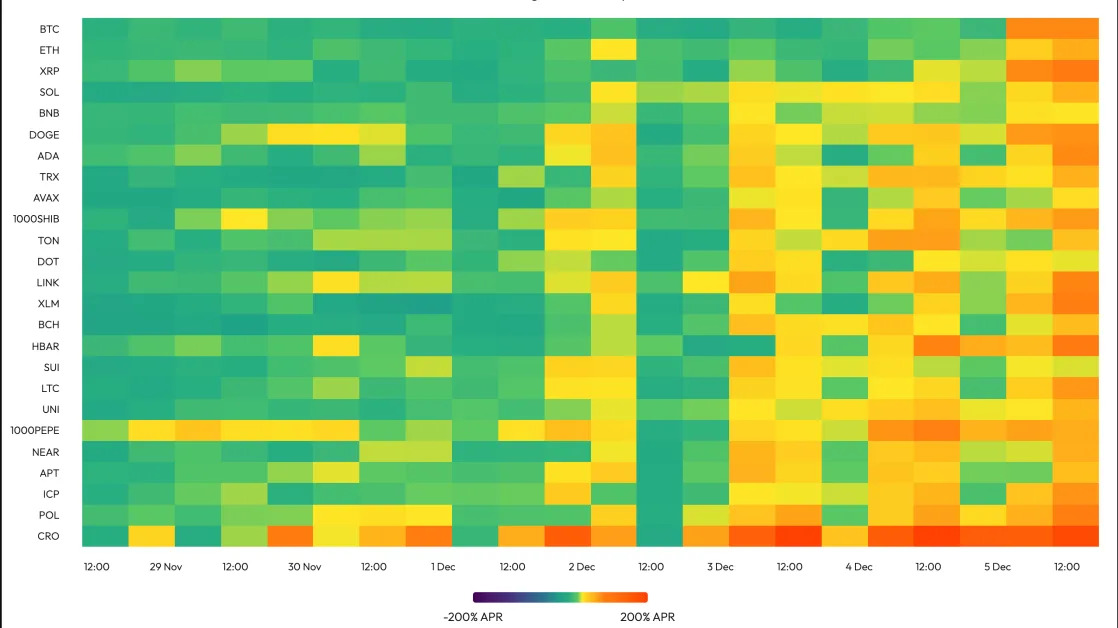

President-Elect Donald Trump Is Poised to Make This Holiday Season Extra Special for Bitcoin, XRP, and the Rest of the Crypto-verse

While Bitcoin (CRYPTO: BTC), the world's largest cryptocurrency, has performed well all year, the rest of the crypto-verse has President-elect Donald Trump to thank. Crypto prices started moving significantly higher in the weeks leading up to the election, as the betting odds favored Trump winning the election. The good news keeps coming for crypto, and Trump is poised to make this holiday season extra special for Bitcoin and the rest of the crypto-verse.