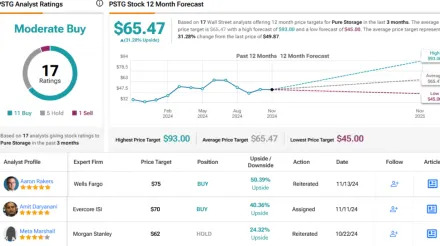

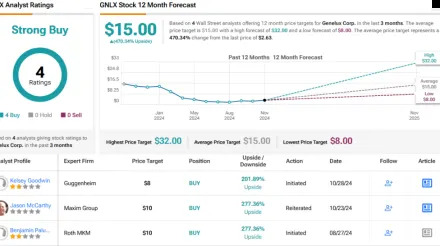

Oppenheimer Signals Buy on 2 Data Storage Stocks — Here’s Why They’re Bullish

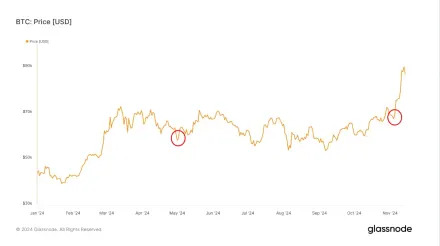

2024 is heading into its final stretch, and it’s natural now to try to figure out what trends will support the stock markets going forward. One key factor that we can’t ignore is the continuing boom in artificial intelligence. Advances in AI technology have boosted the tech sector generally – but those gains have been especially strong in AI-related stock segments such as semiconductor chips, data center services, and data storage. The last in particular deserves a closer look. Data is a main be