Are we at the apex of alternative investments?

Earlier this year, a fossilized stegosaurus skeleton (nicknamed “Apex” due to its rarity and unusual high quality) sold for a whopping $44.6 million to hedgefund billionaire Ken Griffin. That was the highest amount ever paid for dinosaur fossils—handily beating out the nearly $32 million paid for a Tyrannosaurus Rex in 2020.

With astronomical price tags, anyone who may have hoped that they, too, could one day own a dinosaur skeleton are likely feeling that their chances are extinct. But not so fast: Rally, an alternative asset investment platform, is gearing up to launch an IPO for another stegosaurus skeleton , allowing investors to buy shares and effectively own a piece of the past.

The IPO, which becomes active later this month, will let investors buy one of the 200,000 shares of the $13.75 million , 160-million-year-old stegosaurus for $68.75 each, says Rob Petrozzo, cofounder and chief product officer at Rally.

And Petrozzo says the stegosaurus IPO is the fruition of a lifelong dream for him, accomplishing long-term goals for Rally as well.

“This is the most important offering we’ve ever done as a business,” he says, adding that opening up the opportunity to invest in dinosaurs and fossils has always been one of his goals.

“In the past, we’d IPO an asset, then open up for trading—this one is a little different in that the asset is far more valuable than any asset we’ve ever had,” he says. “It’s not the same thing as finding a rare watch.”

Not everyone loves the idea

The stegosaurus skeleton, which is still being excavated at Bone Cabin Quarry in Wyoming, will eventually make its way to New York City, where it will be on display for shareholders, and the public, to see it.

The sale of dinosaur fossils has been a topic of controversy in the past.

“There has been an ongoing debate about the existential nature of ownership, pitting those who believe that artifacts of this sort should be kept in museums (and the rightful museum-country, native to the artifact)—where they are available to the public—against others who maintain that the free market should have its way,” Frederic Bertley, president and CEO of the Center of Science and Industry, wrote in an op-ed for Fast Company in July.

Indeed, most countries outlaw the excavation, sale, and export of fossils. But Petrozzo says that relatively lax rules in the United States, allowing the stegosaurus to go up for sale to investors, makes it all the more special.

“The U.S. is one of the only places on earth where discovery and sale of fossils is legal, so that adds to the scarcity,” he says.

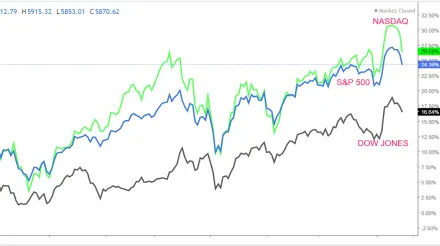

Altogether, it makes for a very rare opportunity for investors to own something that is the ultimate portfolio diversifier, far more distinctive than shares of QQQ or Coca-Cola stock. “This is way more interesting than ticker symbols,” Petrozzo says.

This post originally appeared at

fastcompany.com

Subscribe to get the Fast Company newsletter:

http://fastcompany.com/newsletters