Futures action early Monday suggested the stock market would start the week just shy of its record high as the bullish calls keep coming in.

Oppenheimer Asset Management’s chief investment strategist John Stoltzfus reportedly just set a 7,100 target for the S&P 500 SPX by the end of 2025, which would be the highest on Wall Street.

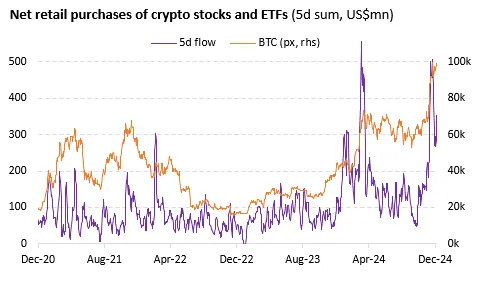

There certainly seems to be a lot of seasonal cheer. However, Marco Iachini, senior vice president research at Vanda Research, and his colleague, vice president data science Lucas Mantle, note that after an election-related jump, overall retail investing is not particularly gung-ho and is within the usual seasonal patterns.

“Overall, inflows in November and December are subdued relative to full-year averages, but even so we can expect retail traders to ramp up short-term purchases a couple more times before the year wraps up – typically in the first days of December (seeing this at the time of writing), and then right before the Christmas break,” says the Vanda team in a note published over the weekend.

This suggests there’s heterogeneity in investor sentiment and that’s usually a healthy backdrop for risk assets, according to the Vanda team.

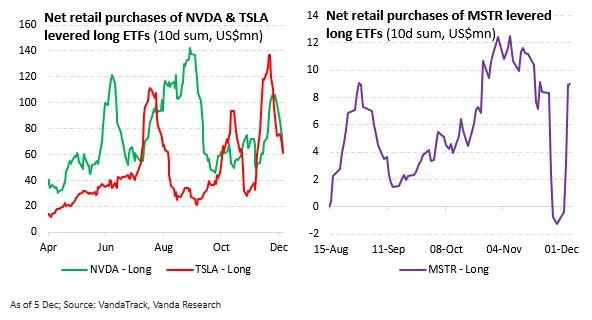

But there’s a problem: retail investor activity in what Vanda considers “riskier pockets of the markets” remains sizeable. For example, flows into small caps IWM have re-accelerated in the beginning of December, while signs of profit-taking around Thanksgiving in crypto-related stocks and exchange traded funds has reversed.

“Should current flows mimic the Dec ’23-Jan ’24 spike rather than the 1Q24 one, then we could see buying activity continuing to accelerate in the new year, especially into the Jan 20th inauguration, which could act as a ‘sell-the-news’ catalyst,” says Vanda.

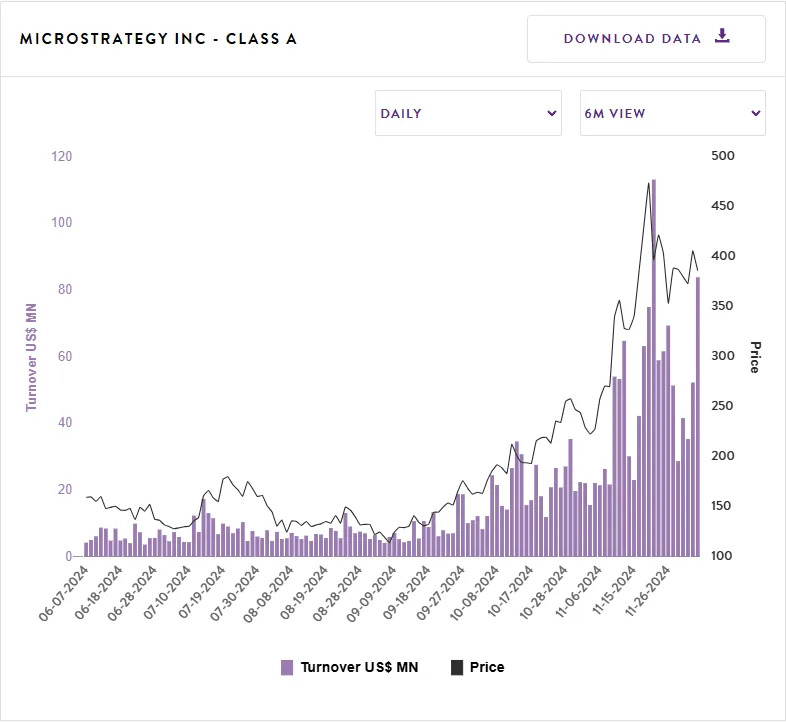

The biggest relative rebound in speculative activity has occurred in bitcoin investor MicroStrategy MSTR, notes Vanda, illustrated by a surge in out-of-the-money call options and the buying of levered long ETFs in the company MSTX MSTU. The purchase of MSTR levered ETFs has risen just as demand for similar products on Nvidia and Tesla — pretty volatile stocks themselves — has declined.

Such a switch from the speculative to the highly speculative is a cause for concern, Vanda implies. “Overall, the top-down upshot is that retail participation continues to look relatively healthy. However, a bottom-up assessment suggests risky behaviors have picked up and could see segments of the retail world get burned should the broad risk environment face a growth or policy curveball,” they say.

“The YOLO crowd remains active in pockets of the market, but for now, the risks are still not systemic. Watch any sudden reversals in MSTR price action as that could spark contagion across the crypto TradFi space,” they conclude.

The market

U.S. stock-index futures ES00 YM00 NQ00 are a fraction lower as benchmark Treasury yields BX:TMUBMUSD10Y inch higher. The dollar index DXY is down, while gold GC00 is trading around $2,657 an ounce.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

6090.27 |

0.96% |

1.58% |

27.68% |

32.27% |

|

Nasdaq Composite |

19,859.77 |

3.34% |

2.97% |

32.30% |

37.88% |

|

10-year Treasury |

4.17 |

-2.80 |

-14.00 |

28.91 |

-6.61 |

|

Gold |

2679.6 |

0.66% |

2.04% |

29.34% |

34.14% |

|

Oil |

68.1 |

-0.10% |

-0.07% |

-4.53% |

-4.62% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

Hong Kong’s Hang Seng index HK:HSI jumped 2.8% after China’s Politburo said it would embrace a “moderately loose” monetary policy and a “more proactive” fiscal policy to support the economy.

Oil prices rose CL.1 as the fall of the Assad regime in Syria was seen to create a political vacuum in the Middle East, and on China stimulus hopes.

South Korea’s KOSPI Composite KR:180721 equity index dropped 2.55% as the political turmoil in the country continued.

Nvidia shares NVDA are down more than 2% after China opened a probe into the AI chipmaker over suspicions it broke anti-monopoly laws.

Shares of Apollo Global Management APO and Workday WDAY are rallying on news they will join the S&P 500 later this month.

Omnicom OMC is in advanced talks to acquire Interpublic IPG, a deal that would create the world’s largest advertising company, according to the Wall Street Journal .

U.S. economic data due on Monday include wholesale inventories for October, released at 10:00 a.m. Eastern.

Best of the web

A kid made $50,000 dumping crypto he’d created. Then came the backlash. (Contains profanity)

How one of the world’s richest men is avoiding $8 billion in taxes.

‘It ruined a lot of years of my life.’ Teens and young adults are hooked on a different kind of gambling.

The chart

Most investors know that December tends to be good for stocks. But as the chart from BTIG’s technical guru Jonathan Krisnky shows, there are also seasonal soft spots within the month. “[I]f there is going to be any hiccup it’s typically between [Dec. 10 and 20], which coincides with option expiration,” he says.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

PLTR |

Palantir |

|

SMCI |

Super Micro Computer |

|

NIO |

NIO |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

MSTR |

MicroStrategy |

|

AMZN |

Amazon.com |

|

SOUN |

SoundHound AI |

Random reads

Assad’s sportscar collection up for grabs.

Most mispronounced words of 2024.

Here’s what Dorothy’s slippers from The Wizard of Oz fetched at auction.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple .