Disclaimer: The analyst who wrote this piece owns shares of MicroStrategy (MSTR).

Bitcoin Development Company MicroStrategy (MSTR) is now the owner of nearly 2% of all the bitcoin (BTC) that will ever be created after adding to its holdings of the token.

The firm disclosed the purchase of 15,400 bitcoin over the week ended Dec. 1 for $15.4 billion, or an average price of $95,976 each on Monday. That brings its holdings to 402,100 tokens worth $38.2 billion at the current price of $95,000. The company's overall average purchase price is $58,263.

This most recent buy was funded with share sales under the company's existing at-the-market program, according to the disclosure.

Executive Chairman Michael Saylor once again on Sunday teased the Monday announcement.

MicroStrategy's 402,100 tokens amount to more than 1.9% of the 21 million bitcoin that can ever be created.

Other developments

Underway is the process for rebalancing the Nasdaq 100 and one discussion point is whether MicroStrategy will be included in the refigured index. An announcement on inclusion is due to take place on Dec. 13.

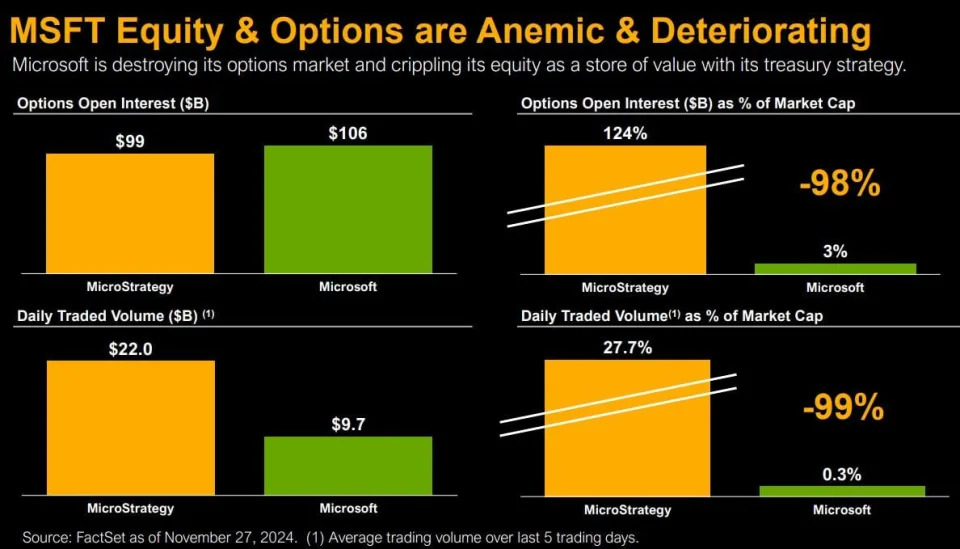

On Sunday Saylor posted that he gave a 3-minute presentation to the Microsoft (MSFT) board regarding bitcoin investment as a diversification strategy. Saylor told the board that its current treasury strategy is weakening the company while its daily traded volume is being outpaced by MicroStrategy, according to a presentation he posted on X. As of Nov. 27, taking the average of the past five trading days, Microsoft has generated $9.7 billion in average daily trading volume against MicroStrategy's $22 billion. They both have similar options open interest, despite MicroStrategy being just 2.5% the size of Microsoft.

"If you are going to outperform you are going to need bitcoin, and your bonds are undermining your options market and your equity liquidity," Saylor told the Microsoft board.

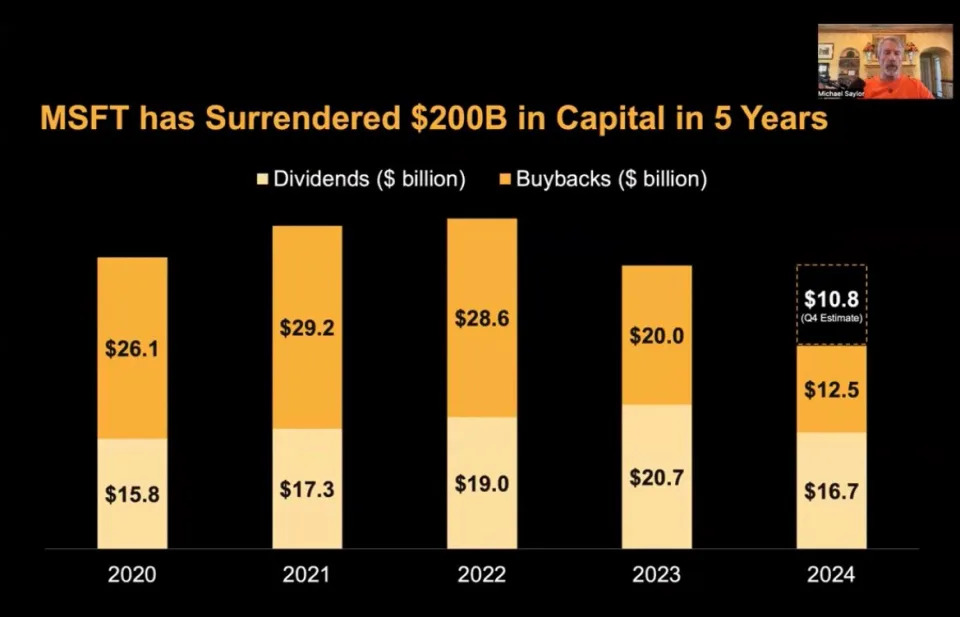

Saylor said the board had surrendered $200 billion in capital in the past five years through dividends or stock buybacks. These funds would have been better used to buy bitcoin as a treasury asset, he said. Bitcoin is up over 1,200% in the past five years, which shows a massive opportunity missed by Microsoft.

MSTR shares rose 1.23% on Monday and remain higher by 450% year-to-date.

MARA also adds

Bitcoin miner MARA Holdings (MARA) — which has been trying to replicate Saylor's strategy of raising money in capital markets to fund bitcoin purchases — announced Monday the purchase of another 6,484 BTC during the period between Oct. 1 and Nov. 30 for approximately $618.3 million in cash at an average cost of approximately $95,352. The company additionally launched a proposed private offering of $700 million in zero-coupon convertible senior notes due 2031. The proceeds will primarily be used to acquire further bitcoin and repurchase existing convertible notes due 2026. MARA as of Nov. 30 holds a total of 34,959 bitcoin worth $3.3 billion at the current price.

UPDATE (Dec. 2, 16:09 UTC): Adds Saylor's presentation to Microsoft starting in paragraph seven.