(Bloomberg) -- The final day of each month has become the busiest trading session for US Treasuries, according to two Federal Reserve Bank of New York researchers.

There’s been a marked change in trading volume over the past four years at that time as well as a drop in transaction costs that coincide with the growth of passive funds that track index changes, Henry Dyer, Michael Fleming and Or Shachar wrote in a post Tuesday on the New York Fed’s Liberty Street Economics blog.

“Asset managers are increasingly managing relative to indices that are rebalanced at the end of each month and this may be causing investors to increasingly trade at that time.” Dyer, Fleming and Shachar said.

Since 2020, trading activity in Treasury notes and bonds has been approximately 33% higher on average on the last trading day of the month, the researchers found. This volume surge was virtually nonexistent prior to 2015 and analysis shows that liquidity conditions also improve as the month draws to a close.

Exchange-traded funds that track US Treasuries have grown by more than 10-fold between 2013 and mid-2024, the team said. That was greater than the two-fold increase in the amount of Treasury debt outstanding during that time.

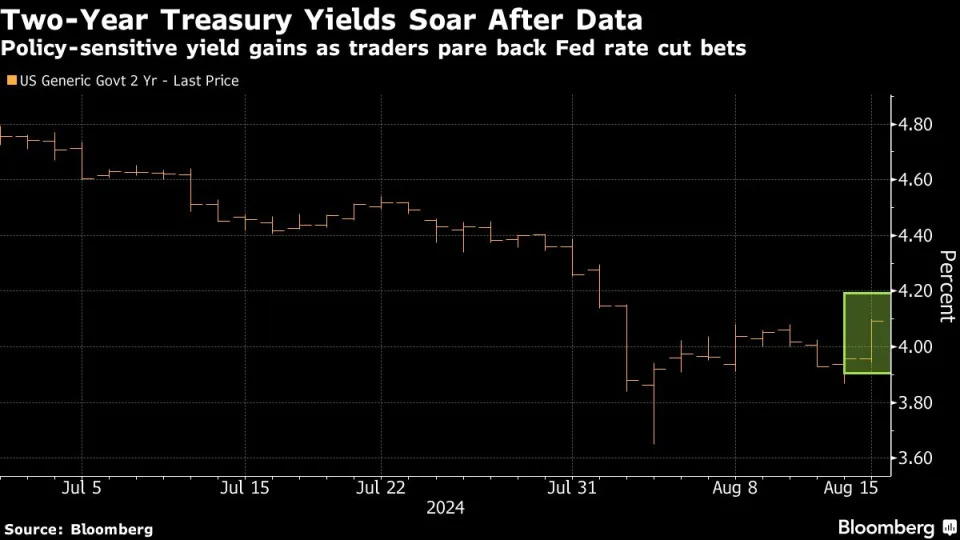

It’s been a robust year in general for Treasury trading amid the heightened uncertainty about the path of Federal Reserve monetary policy and interest rates. Average daily notional volumes in August was more than $1 trillion, roughly double what it was a decade ago and 37% higher than a year ago, according to Coalition Greenwich.

But the surge in activity at month-end and dip in transactions costs don’t necessarily indicate that this period is an especially good time to trade, the New York Fed researchers said.

“The evidence of periodicity in returns from other studies suggests that advantageous times to trade vary for other reasons and differ between buyers and sellers,” they said. “These monthly patterns also change over time” and therefore warrant “close watching.”