Nvidia ( NVDA ) stock fell Friday along with other chipmakers after a December jobs report pushed out expectations for additional rate cuts from the Federal Reserve and ahead of expected chip export restrictions from the Biden administration.

Nvidia stock dropped 3%, while peer AMD ( AMD ) fell 4.8% and the PHLX Semiconductor ( ^SOX ) index dropped over 2.4%.

The Biden administration is rushing to release new rules limiting exports of AI chips used in data centers by certain companies to certain countries, Bloomberg reported Wednesday — an attempt to curb the development of artificial intelligence in US adversary countries such as Russia and China.

As much as 40% of Nvidia chips end up in China, according to DA Davidson analyst Gil Luria.

China does not have access to the advanced chipmaking technology (called EUV lithography), which is essential to the country’s ability to produce AI chips domestically.

“While there have been some restrictions on chip sales already, there have been reports of advanced NVIDIA chips making it to China, likely due to the fact that NVIDIA has limited control over its resellers,” Luria told Yahoo Finance in an email. “If the US demands NVIDIA take responsibility for where its chips are ultimately used, this would put much of this revenue at risk.”

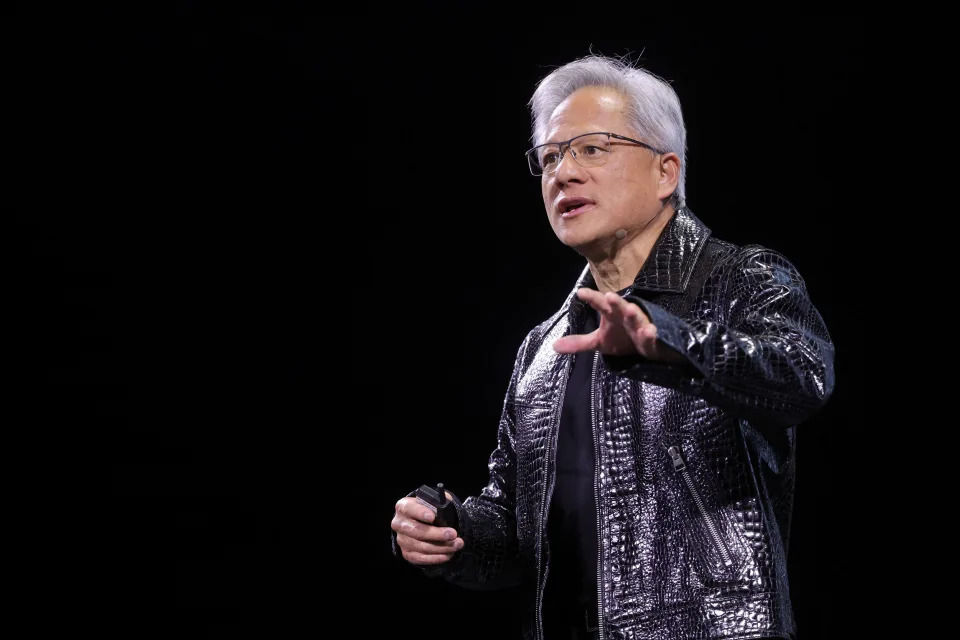

Nvidia vice president of global affairs Ned Finkle said in a statement shared with Yahoo Finance Friday that the restrictions would “harm the U.S. economy, set America back, and play into the hands of U.S. adversaries.”

“This last-minute Biden administration policy would be a legacy that will be criticized by US industry and the global community," he added.

DA Davidson's Luria said that Nvidia’s vocal opposition to the upcoming Biden export restrictions is "making investors even [more] concerned about the impact of new rules" on Friday.

The tech policy think tank Information Technology & Innovation Foundation echoed Nvidia's concerns about the upcoming rules, stating that "placing caps on U.S. exports of AI GPUs will limit market opportunities for U.S. companies while providing an open door for foreign suppliers of AI chips."

"[While] the challenge of such advanced chips reaching US competitors through third-party countries is quite real, the proposed framework fails to address the core challenge in a targeted way, and would have potentially catastrophic consequences for US digital industry leadership," said Stephen Ezell, the foundation's vice president of global innovation policy.

Nvidia’s decline Friday comes after a volatile week for the stock as investors digested the company’s announcements during the tech industry’s annual CES trade show. After rising to a record closing price on Monday, the chipmaker’s stock fell more than 6% Tuesday before extending its decline to end the week.

In a note to clients on Friday, analysts at Bank of America said that while AMD, Nvidia, and other chipmakers focused on unveiling consumer AI computers at CES, demand from customers and enterprises for such devices has "generally been lackluster to date."

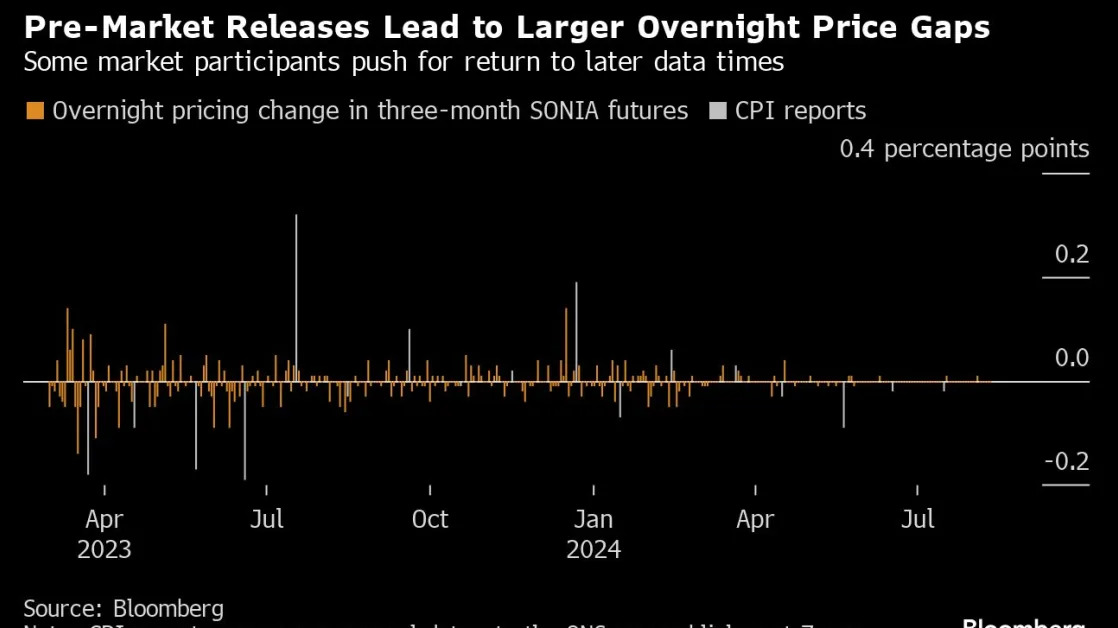

Friday's jobs report also pushed back expectations for Fed rate cuts this year , weighing broadly on risk assets. The tech-heavy Nasdaq ( ^IXIC ) fell as much as 2% in response.

The drop in chip stocks Friday came despite leading semiconductor manufacturer TSMC ( TSM ) posting December quarter sales that beat Wall Street’s expectations .

In a separate note on Friday, BofA analyst Vivek Arya said Nvidia stock could stay volatile until its quarterly earnings report on Feb. 26 because of the upcoming restrictions. Arya added that any decline in revenues would be “offset by stronger demand elsewhere” and maintained his Buy rating on the stock.

Advanced Micro Devices ( AMD ) also came under additional pressure on Friday as Goldman Sachs analyst Toshiya Hari downgraded the chipmaker to a Hold rating.