US data has Fed striding toward rate cut next week, and tip-toeing into 2025

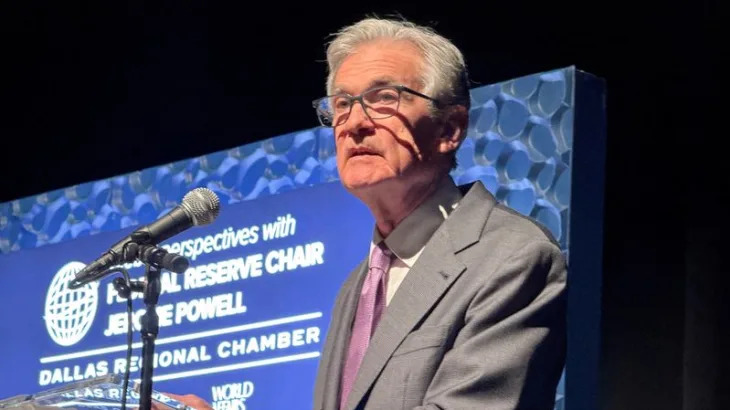

Investors view it as a near given that the U.S. Federal Reserve will cut interest rates by a quarter of a percentage point at its Dec. 17-18 meeting, with more attention focused on policymakers' new economic projections released alongside the decision. Those projections will include an updated look at how much further Fed officials think they will reduce rates in 2025 and perhaps into 2026, an exercise that will have to account for data in the meantime showing stickier-than-expected inflation, a healthy labor market, a U.S. election result that could shift the global trade and immigration landscape, and ongoing geopolitical risks. With so much to assess, a multitude of new risks, and a lot of uncertainty, many analysts expect the collective messaging from the central bank's policy statement on Wednesday, Fed Chair Jerome Powell's post-meeting press conference and the updated projections to be somewhat hawkish - with the Fed perhaps closer to a rate-cut stopping point, or at least very reluctant to commit to many more reductions in borrowing costs, than it was just a few months ago.