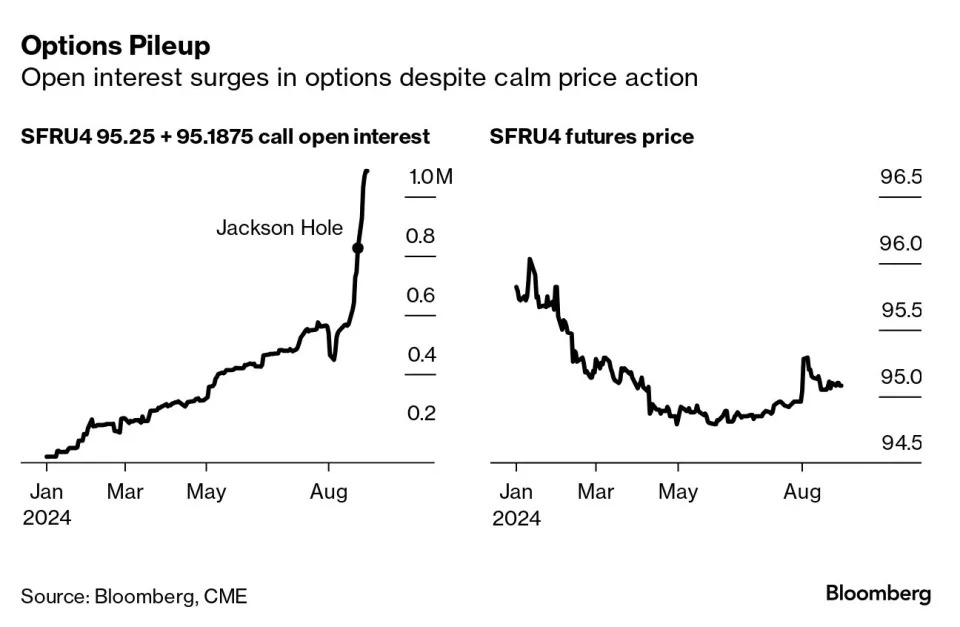

US Yield Curve Disinverts as Soft Labor Data Fuels Fed Cut Bets

(Bloomberg) -- A key segment of the US Treasury yield curve briefly turned positive as weaker-than-anticipated labor-market data bolstered bets on steep interest-rate cuts by the Federal Reserve.Most Read from BloombergHow Air Conditioning Took Over the American OfficeHong Kong’s Arts Hub Turns to Selling Land to Stay AfloatThe Outsized Cost of Expanding US RoadsTreasuries jumped on Wednesday — led by shorter-maturity notes that are more sensitive to the Fed’s monetary policy — after US job open