Information

- Dec 18, 2024

Stock market today: Dow, S&P 500, Nasdaq clobbered as Fed, Powell signal fewer rate cuts in 2025

Stocks eyed a rebound Wednesday, with the blue-chip Dow looking to snap its longest losing streak since 1978

- Dec 18, 2024

Federal Reserve cuts its key rate by a quarter-point but envisions fewer reductions next year

The Federal Reserve cut its key interest rate Wednesday by a quarter-point — its third cut this year — but also signaled that it expects to reduce rates more slowly next year than it previously envisioned, mostly because of still-elevated inflation. The Fed’s 19 policymakers projected that they will cut their benchmark rate by a quarter-point just twice in 2025, down from their estimate in September of four rate cuts.

- Dec 18, 2024

Stocks dive after Fed cuts rates, signals slower easing pace in 2025

NEW YORK (Reuters) -U.S. stocks plunged on Wednesday, with all three major indexes posting their biggest daily decline in months, after the Federal Reserve cut interest rates by a quarter of a percentage point but disappointed some investors with projections that signaled a more cautious path of easing next year. The Fed cut rates by 25 basis points to the 4.25%-4.50% range and its summary of economic projections (SEP) indicated it will make rate cuts totaling a half percentage point by the end of 2025 given the solid labor market and the recent stall in lowering inflation. "If you look at the changes to the statement of economic projection, they really had no choice," said Ellen Hazen, chief market strategist at F.L.Putnam Investment Management in Wellesley, Massachusetts.

- Dec 18, 2024

US stocks fall sharply and Dow tumbles 1,100 points after the Fed hints at just 2 rate cuts for 2025

U.S. stocks tumbled to one of their worst days of the year after the Federal Reserve hinted Wednesday it may deliver fewer shots of adrenaline for the U.S. economy in 2025 than earlier thought. The Dow Jones Industrial Average lost 1,123 points, or 2.6%, and the Nasdaq composite dropped 3.6%. The Fed said Wednesday it’s cutting its main interest rate for a third time this year, continuing the sharp turnaround begun in September when it started lowering rates from a two-decade high to support the job market.

- Dec 18, 2024

Fed lowers rates but sees fewer cuts in 2025 due to stubbornly high inflation

WASHINGTON (Reuters) -The U.S. central bank lowered interest rates on Wednesday, but Federal Reserve Chair Jerome Powell said more reductions in borrowing costs hinge on further progress in lowering stubbornly high inflation, remarks that showed policymakers are beginning to reckon with the prospects for sweeping economic change under an incoming Trump administration. Powell's explicit - and repeated - references to the need for caution from here jolted Wall Street, sending stocks sharply lower and spurring a dialing back of market estimates of how far borrowing costs are likely to fall over the coming year. "I think we're in a good place, but I think from here it's a new phase and we're going to be cautious about further cuts," Powell said at a press conference following the end of the Fed's latest two-day policy meeting.

- Dec 18, 2024

Why Everything Everywhere All at Once isn’t just a movie — it’s the market

John Petrides, Portfolio Manager at Tocqueville Asset Management, spoke with Quartz for the latest installment of our “Smart Investing” video series.

- Dec 18, 2024

Wall Street falls sharply as Fed indicates fewer rate cuts in 2025 to fight inflation

Central bank lowers benchmark federal funds rate by a quarter of a percentage point to between 4.25% to 4.5%

- Dec 18, 2024

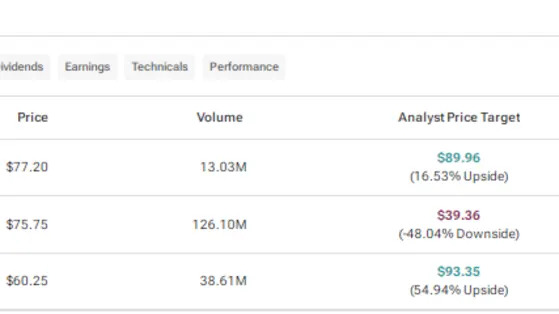

NKE, PLTR, or UBER: Which Large-Cap Stock Is the Best Pick?

Investors often look for opportunities to invest in large-cap stocks as they are generally associated with companies having a proven track record and well-established business models. The large-cap stocks have a market capitalization between $10 billion to $200 billion. Using TipRanks’ Stock Comparison Tool, we placed Nike (NKE), Palantir (PLTR), and Uber Technologies (UBER) against each other to find the large-cap stock that is the best pick, according to Wall Street analysts. Nike (NYSE:NKE) S

- Dec 18, 2024

Dollar index hits two-year high after Fed delivers rate cut

The U.S. dollar advanced against its peers on Wednesday, hitting its highest level in two years, after the Federal Reserve delivered a widely expected interest rate cut while also indicating it would slow the pace of its monetary policy easing cycle. The Fed lowered its benchmark policy rate by 25 basis points to the 4.25% to 4.50% range, with officials signaling they would likely pause future rate cuts next year given a stable labor market and inflation. The yield on benchmark U.S. 10-year notes rose 6.1 basis points to 4.446%, hitting a four-week high.

Popular Post

- English High Court Rules Tether's USDT Stablecoin Counts as Property Sep 13, 2024

- Peru’s Economic Recovery Stalls in June as Growth Comes in Below All Forecasts Aug 15, 2024

- Why Is NewAmsterdam Pharma Stock Trading Higher On Tuesday? Dec 09, 2024

- Ethereum Can't Keep Up With Bitcoin Or Solana: What's Going On? Aug 07, 2024

- Memecoins Reach $140B Market Cap and Gain Ground in Crypto Economy Dec 05, 2024

- Forget New York Community Bancorp: Billionaires Are Buying Up This Bank Stock Instead Aug 24, 2024

- Positive U.S. developments could propel Bitcoin beyond $130,000 Nov 26, 2024

- General Motors Warns of $5 Billion-Plus Profit Hit Related to China Market Challenges Dec 03, 2024

- Oil Rises for Second Day as Storm Hits Gulf, Algo Selling Slows Sep 12, 2024

- Stock market today: Dow closes above 44,000, tech shares stumble as traders eye inflation data Nov 12, 2024