Well, that was quite the market freakout after the Federal Reserve’s decision to cut interest rates. Not only did the Fed lift its outlook for interest rates in 2025 by a half percentage point, its members gave up on the idea that inflation will return to the 2% target next year, an idea that they had confidence in as recently as September.

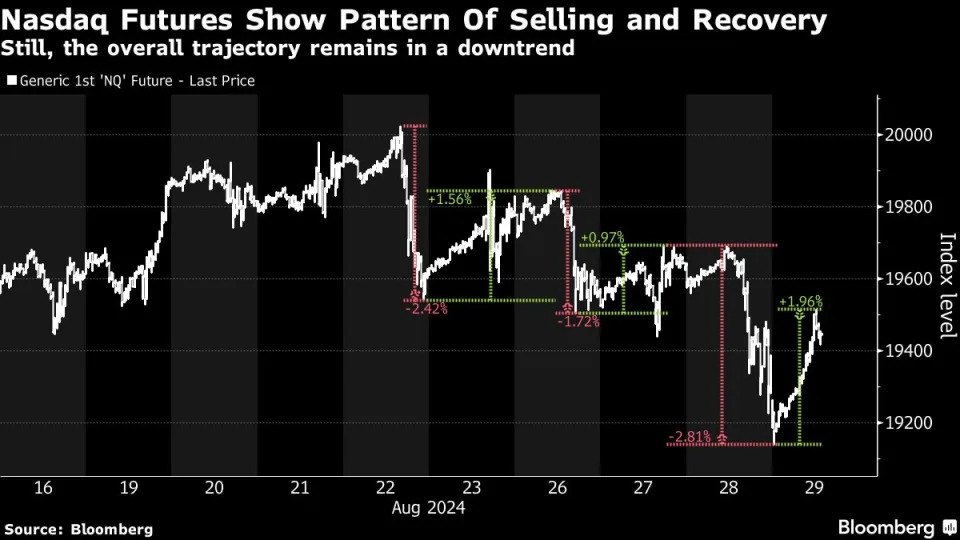

Onto Thursday and the question is whether the sell-off will continue.

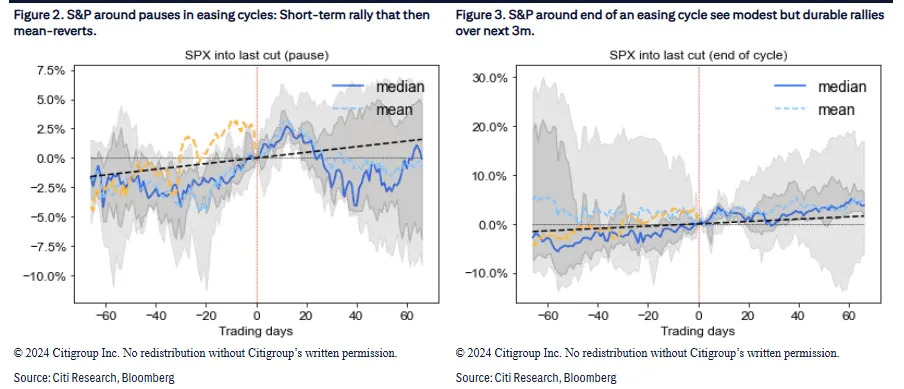

Citigroup has published a timely piece looking at the history of Fed pauses during previous monetary easing cycles, now that a January change looks remote (with just a 9% chance of a cut, per the CME FedWatch tool).

Since the late 1980s, there have been 12 occasions of rate cuts that were followed by a hold decision. And there were three with big bond-market sell-offs like that which was witnessed on Wednesday: two at the end of the cutting cycle, in 1998 and 2003, and one that just turned out to be a pause, in 1989.

“While 1998 could be a template (Fed cutting into an essentially strong U.S. economy), 1989 could be, too. Back then the economy moved eventually into recession, which remains a Citi Econ strongly non-consensus call,” said Citi strategists led by Dirk Willer.

What typically happens in a skip scenario on interest rates is stocks are higher, but only for about a month, before selling off. That’s because it is the deterioration in economic data that leads to the need for further easing. By contrast if it’s the final Fed cut, the rally is more durable. The 1989 scenario, where bonds sold off, saw a rally followed by a 10% drawdown; the 1998 and 2003 final cuts saw rallies over the next three months. “Overall, the data is broadly constructive for equities, at least in the short term,” they say.

Small caps IWM outperform defensives if it’s an end-of-cycle pause, they say. “The small-caps vs utilities trade has meaningful upside if we have seen the last cut of the cycle whereas if it is just a pause it tends to range trade,” they say. “This broadly still favors small caps over utilities.”

As for bonds, the skip leads to higher yields — with more meaningful rises when the pauses happen at the end of the cycle. “Overall, this study is not reassuring for U.S. yields, which reaffirms our current underweight of U.S. rates in the global asset allocation,” they say.

The dollar traditionally has follow-through at the end of the cycle but is choppy if it really is a pause, and gold is generally higher on skips regardless if the easing cycle continues.

One other point the Citi team make is on seasonality. The market downturn on Wednesday returned the S&P 500 to the median path. “This year, we had tracked ahead of normal seasonals, but after the move on FOMC day we are now back to the median performance, setting us up for the last part of the seasonal rally into year end,” they say. Don’t put away your Santa hat just yet.

The market

After the 1,123-point nosedive in the Dow Jones Industrial Average DJIA , U.S. stock futures ES00 NQ00 saw a bit of rebound early Thursday. The yield on the 10-year Treasury BX:TMUBMUSD10Ycontinued to rise. The dollar USDJPY surged against the Japanese yen after the Bank of Japan left interest rates unchanged.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5872.16 |

-3.48% |

-0.76% |

23.11% |

24.98% |

|

Nasdaq Composite |

19,392.69 |

-3.21% |

2.25% |

29.19% |

31.23% |

|

10-year Treasury |

4.539 |

20.50 |

11.40 |

65.81 |

65.18 |

|

Gold |

2633.6 |

-2.65% |

-1.44% |

27.12% |

27.99% |

|

Oil |

69.86 |

-0.21% |

-0.38% |

-2.06% |

-5.51% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

Initial jobless claims came back down again, falling 22,000 to 220,000. The Philadelphia Fed manufacturing index fell to its worst reading since April 2023. U.S. GDP for the third quarter was revised higher to an annualized rate of 3.1% from 2.8%.

The U.S. government appears set for a shutdown after an Elon Musk-led effort to kill funding legislation that included pay raises for lawmakers.

Micron Technology MU stock was skidding as the microchip maker forecast revenue well below Wall Street expectations, blaming conditions for flash memory and other segments.

Home builder Lennar LEN l ate Wednesday missed earnings expectations as it said high mortgage rates put off customers .

The housing slump also hit furniture maker MillerKnoll MLKN

Nike NKE and FedEx FDX report results after the close.

Best of the web

How the White House functioned with a diminished Biden in charge.

The big connection between the yen and tech stocks has been severed.

Paul Krugman: Health insurance is a racket.

The chart

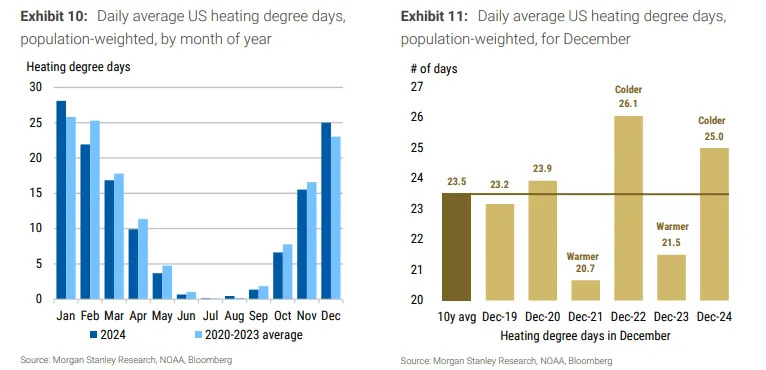

Morgan Stanley fixed-income strategists say a January rate cut from the Fed shouldn’t be entirely dismissed. They cite the traditional relationship between weather and economic activity, and note that colder-than-average weather has prevailed across the U.S. “Given that risks embedded into market prices increasingly reflect upside risks to economic data, while downside risks related to weather go unnoticed, we suggest investors continue to hedge against the risk of a January rate cut by the Fed,” they say.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

PLTR |

Palantir Technologies |

|

MU |

Micron Technology |

|

MSTR |

MicroStrategy |

|

NUKK |

Nukkleus |

|

TNXP |

Tonix Pharmaceuticals |

|

AAPL |

Apple |

|

QUBT |

Quantum Computing |

Random reads

Thou shalt not underbid: A Ten Commandments tablet sold for more than $5 million at auction.

Continuing with the religious theme: Jesus models are in demand.

ChatGPT can now be reached by a 1-800 phone number.