The stocks of the ‘Magnificent Seven’ technology giants will likely continue to outperform in 2025, even though a market crash is now “inevitable,” Bank of America’s analysts have said.

In a note, equity derivatives analysts led by Benjamin Bowler explained that interest rate cuts and the continuing artificial intelligence boom are likely to see America’s mega-cap technology companies continue rallying next year.

In the view of Bank of America’s analysts, the situation means investors now still have more to gain by staying invested in the ‘Magnificent Seven’ tech companies in 2025, despite the risks posed by the bubble popping.

“Not owning enough US stocks or large-cap stocks or Tech stocks has been a painful stance for many years, and we think it’s still a major risk in 2025,” the Bank of America analysts said.

The term ‘Magnificent Seven’ refers to the grouping of Apple AAPL, Amazon.com AMZN, Alphabet GOOGL GOOG, Meta Platforms META, Microsoft MSFT, Nvidia NVDA and Tesla TSLA.

Together, the seven mega-cap technologies stocks have delivered gains of 75% in the year-to-date. Bank of America’s analysts, nonetheless, said they believe it is now inevitable the rally that started with the launch of ChatGPT in Nov. 2022 will end in some form of “bust.”

The S&P 500 SPX index is currently up by 28% in the year-to-date and is up 49% since OpenAI launched ChatGPT. Bank of America’s analysts noted that valuations are now “historically stretched going into the new year” after two years worth of 20%+ gains.

“While de-regulation or technological innovations have historically supercharged equity booms, such booms have also always been followed by busts,” the analysts said.

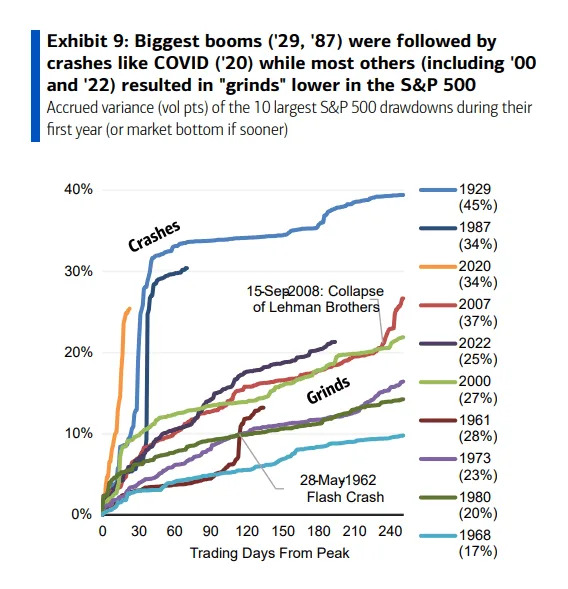

Bank of America’s analysts noted the biggest stock market booms have historically been followed by the largest crashes, with the two biggest booms in history ending in the Wall Street Crash of 1929 and Black Monday in 1987.

“With the current S&P draw-up already exceeding >30% and valuations approaching stretched levels, history suggests it’s too late to avoid a bust at this point,” the Bank of America analysts added.