Professional investors have become “super bullish” on stocks, according to a popular Bank of America survey. That doesn’t bode well for the market’s short-term returns.

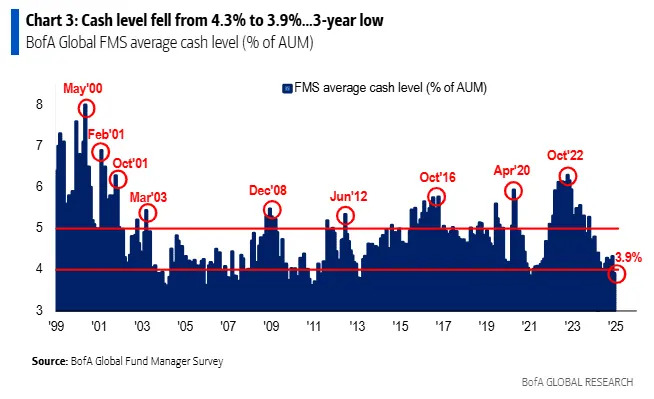

BofA’s weekly fund managers survey showed respondents had once again lowered their average allocation to cash to less than 4% of their portfolios. According to Michael Hartnett, an equity strategist at BofA Global Research. That has triggered the bank’s “cash rule” indicator, a notable sell signal, for the second time in three months.

Back in October, the bank’s analysts cautioned against reading too much into the cash-rule indicator, noting that other sentiment gauges derived from the survey hadn’t yet reached alarming levels.

That appears to be changing this time around. In addition to slashing their allocation to cash, traders have also dialed up their exposure to stocks. According to the survey, respondents’ allocation to U.S. stocks has hit its highest level on record based on data stretching back to the early 2000s.

Investors’ brightening outlook on global growth appeared to drive much of the increase in their appetite for risk.

Falling cash allocations have in the past been a reliable signpost that a near-term pullback lay ahead.

“Since 2011, there have been 12 prior ‘sell’ signals which saw global equity (ACWI) returns of -2.4% in the 1 month after and -0.7% in the 3 months after the ‘sell’ signal was triggered,” Hartnett said.

A broader sentiment gauge based on investors’ stated allocations to cash, stocks along with expectations about global growth saw its biggest monthly increase since June 2020.

The BofA indicator was the latest warning that investors’ increasingly sanguine outlook on stocks risked tipping over into euphoria. A recent confidence survey showed consumers’ stock-market optimism had reached a record high, surpassing even levels that preceded the dot-com bust.

U.S. stocks were trading lower on Tuesday, with the Dow Jones Industrial Average DJIA headed for a ninth straight daily drop — what would be its longest losing streak since 1978, according to Dow Jones Market Data. The S&P 500 SPX and Nasdaq Composite COMP were lower as well.