Key Takeaways

U.S. equities fell in early afternoon trading as the Nasdaq pulled back from its record-setting close yesterday, and the Dow Jones Industrial Average continued its losing streak. The S&P 500 also declined as the market awaits tomorrow's Federal Reserve decision on interest rates.

Amentum Holdings ( AMTM ) was the worst-performing stock in the S&P 500 when executives said in the company's earnings call that they see fiscal 2025 growth being affected by an expected winding down of certain government programs.

Shares of health insurers including Humana ( HUM ) and UnitedHealth Group ( UNH ) tumbled after President-elect Donald Trump said he wanted to cut out the "middle man" in health insurance.

Nvidia ( NVDA ) shares dropped further a day after the once-hot chipmaker's stock slipped into correction territory .

Pfizer ( PFE ) shares advanced when the drugmaker gave 2025 guidance in line with estimates even though it expects to take a $1 billion hit from changes to the Medicare Part D prescription drug program.

Shares of Tesla ( TSLA ) reached yet another record high on an upgrade from Mizuho, which joined other analysts in predicting the electric vehicle (EV) maker will benefit from the policies of the incoming Trump administration.

SolarEdge Technologies ( SEDG ) shares soared on a double upgrade from Goldman Sachs, which sees the solar power firm making a turnaround in 2025.

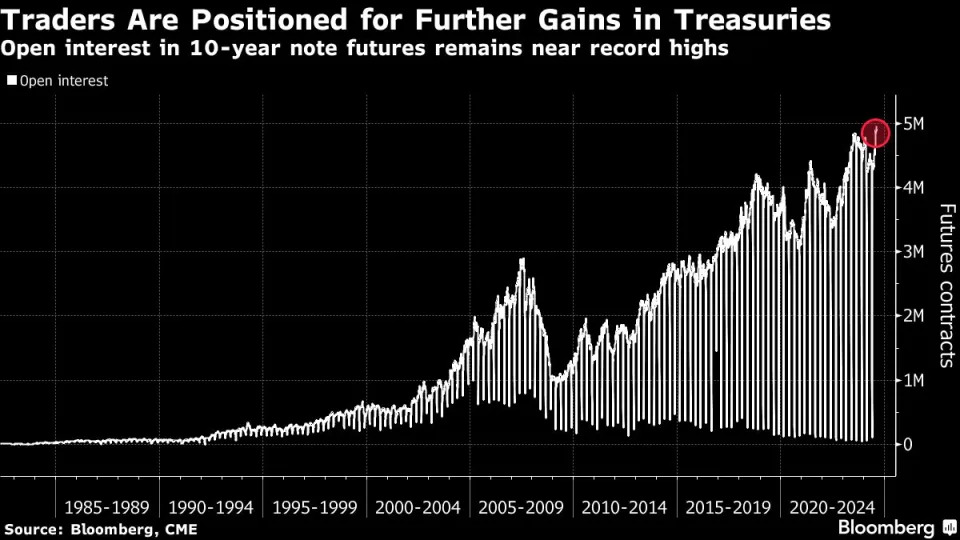

Oil and gold futures fell. The yield on the 10-year Treasury note was down. The U.S. dollar gained on the euro, but lost ground to the pound and yen. Bitcoin came off its new record of $108,000 but still was higher.

Read the original article on Investopedia