Blame the Grinch? Wall Street has been feeling increasingly doubtful about year-end festive cheer, with the rally in stocks taking a breather in the past week as markets brace for the Federal Reserve’s final meeting of 2024.

Investors hoping for the tech-led bull market to sweep up more stocks in December have been largely disappointed, raising concerns about potential fragility in markets and leaving S&P 500 index value stocks SPYV with a record losing streak.

The blue-chip Dow DJIA logged its seventh straight session of declines Friday, its longest stretch of losses since February 2020. Talk also resurfaced about an “overdue” correction, especially with the Fed expected to greenlight another small interest-rate cut this coming week, before then pivoting to a slower pace of monetary easing next year.

“I would love to see a meaningful pullback in equities,” said Talley Leger, chief market strategist at the Wealth Consulting Group.

Leger still expects stocks to see the typical year-end bounce from holiday shopping and seasonal cheer, but thinks “we could get a little bit of turbulence in 2025.”

Read: Fed to cut rates next week, bringing an end to first phase of easin g

Pullback watch

The S&P 500 index SPX closed virtually flat on Friday, but it still was on track for back-to-back yearly gains of more than 20% for 2024 and 2023, an impressive feat giving Wall Street’s earlier widespread recession fears.

Stocks don’t always go straight up in bull markets, but this one has yet to log any pullbacks of at least 15% since October 2022, according to Dow Jones Market Data. The previous stretch of two-plus years without a drawdown of that magnitude was from 2011 to 2018.

“I have been thinking of that old ‘Titanic’ scene,” said David Laut, chief investment officer at Abound Financial. “Your arms are wide open on the bow.”

While investor sentiment has soared in anticipation of deregulation and additional corporate tax cuts during President-elect Donald Trump’s second term, it also brings the threat of inflation and import tariffs, disappointing tech earnings or another catalysts that could cause investors to duck and head for cover.

“Why not take some money off the table, move down the multiples spectrum?” Laut said, adding that he’s paring back large-cap exposure for a more balanced framework.

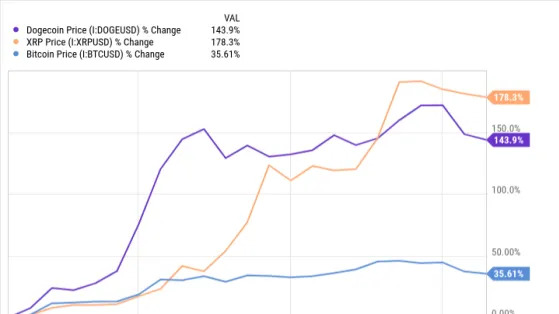

In his view, that includes mid-cap and small-cap stocks RUT, emerging-market equities, having cash at the ready for opportunities and a combined 5% gold GC00 and crypto BTCUSD allocation.

What’s more, for every dollar invested in November in the stock market’s SPDR S&P 500 ETF Trust – SPY index, SPY 31 cents would be allocated to the small group of powerful megacap technology stocks known as the “Magnificent Seven,” underscoring the lopsided nature of this bull run.

“I’d rather be opportunistic,” Laut said, of his strategy heading into 2025.

Related : Nasdaq reaches 20,000 for the first time. Why that could spell trouble for investors in early 2025.

Cues from the ’90s

Wall Street foresees the Fed lowering its benchmark interest rate by another 25 basis points on Wednesday, following a two-day policy meeting . Fed Chair Jerome Powell has taken pains while at the helm of the central bank since 2018 not to surprise markets.

Powell also has made defeating inflation and fostering a soft landing for the economy cornerstones of his second term at the Fed, which isn’t up until mid-2026.

“This environment is feeling a lot like the mid-1990s,” said Leger at the Wealth Consulting Group, pointing to the “run-up to the tech mania 1.0” and when the Fed was last cutting rates into a “pretty favorable economic environment.”

In that regard, Leger sees the Fed taking a more selective approach to cutting rates at its meetings next year, especially if inflation continues to look “sticky” or “stubborn.”

Odds favor the Fed lowering its short-term rate to a range of 4.25% to 4.5% this week, roughly 1% above the range many on Wall Street now think will become it’s “terminal range.”

While the central bank under Chair Alan Greenspan cut rates in 1998 after the collapse of Long-Term Capital Management, it also hiked them quickly back up to 6.5% in a failed attempt to cool the dot-com bubble.

“Expectations for rate cuts are coming down,” said George Cipolloni, portfolio manager of Penn Mutual Asset Management of the 10-year Treasury yield’s BX:TMUBMUSD10Y rise by roughly 8 basis points on Friday alone.

That brought the economy’s benchmark lending rate to 4.398%, while adding to its weekly climb of nearly 25 basis points, the biggest move in over a year, and a huge jump when the Fed has been trying to lower borrowing costs.

“There are certain indicators showing inflation is not going away as quickly as hoped,” Cipolloni said. “The market wants easing, it wants cuts, but the fly in the ointment for everything is going to be yields,” he said. “Everyone wants lower yields, but, man, it’s going to be tough.”

The Dow Jones Industrial Average fell 1.8% for the week, its biggest such drop since late October, the S&P 500 shed 0.6%, while the Nasdaq Composite Index COMP gained 0.3% for the week, according to Dow Jones Market Data.

For the year, the Dow is up 16.3%, the S&P 500 is 27% higher and the Nasdaq is up by 32.7%, according to FactSet.

On deck, the Fed’s rate decision on Wednesday will be the week’s main event, followed by the central bank’s preferred personal-consumption expenditures PCE inflation gauge for November on Friday. Monday also brings updates on the manufacturing side of the economy, followed by retail sales Tuesday and home starts on Wednesday. Thursday will see revised GPD for the second quarter.