Bitcoin wallets holding less than 1 BTC, also known as "shrimp" wallets, are expected to increase by nearly 9% in the near term, according to analyst Axel Adler. As of writing, there are around 323,000 shrimp wallets, and Adler forecasts this number will rise to 351,000. This increase began when Bitcoin was priced at $61,000, at which time there were about 265,000 shrimp addresses. Since then, the number of these wallets has risen by 21.9%, and Bitcoin’s current price is $101,720.

The surge in shrimp wallets signals growing retail interest in Bitcoin, with small-scale investors continuing to accumulate the cryptocurrency despite its price surpassing the $100,000 mark. Adler noted in a Dec. 14 post on X that these holders are demonstrating strong confidence in Bitcoin’s long-term growth, even as its value has risen significantly.

Meanwhile, long-term Bitcoin holders—those who have held their coins for at least 155 days—have started reducing their holdings. Data from Dec. 9 revealed that over the past 30 days, long-term holders sold 827,783 BTC. Some analysts believe this substantial sell-off could signal a potential market peak, indicating that the selling pressure might lead to a decline in Bitcoin’s price if demand for buying weakens.

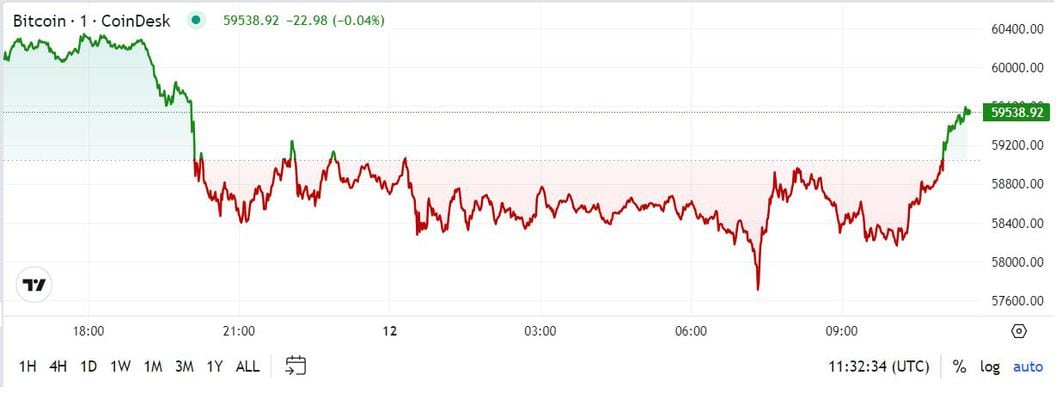

Bitfinex analysts, however, offer a different view. They suggest that future Bitcoin price declines are unlikely to be as steep as the 10% drop experienced in early December. The analysts attribute this to a reduction in realized profit-taking and sell-side pressure, which could moderate future price corrections. They stated that with less selling pressure, the next price declines may be less abrupt.

The growing number of shrimp wallets reflects increasing retail participation in the Bitcoin market, while the activity of long-term holders shows a shift in investor behavior. The fact that small investors are still buying Bitcoin at elevated prices indicates strong market confidence, while the sell-off by long-term holders could point to concerns about potential market saturation or a price top.

This contrast in investor behavior, with retail buyers continuing to accumulate Bitcoin while long-term holders reduce their holdings, suggests a divergence in market sentiment. As Bitcoin's price continues to fluctuate, the actions of both retail and long-term investors will play a significant role in shaping its short-term and long-term price movements.