Bitcoin (CRYPTO: BTC) is having its moment, and for good reason. The digital asset has soared 85% in the past three months (as of Dec. 11), and this year, it's up an astonishing 140%.

This continues an impressive ascent for the world's most valuable cryptocurrency. It's crazy to think that Bitcoin went from just an idea 16 years ago to an asset worth just over $1.9 trillion today.

But the bulls are hoping the good times keep rolling. Can Bitcoin's market cap skyrocket to $10 trillion by the end of 2034?

On the road to $10 trillion

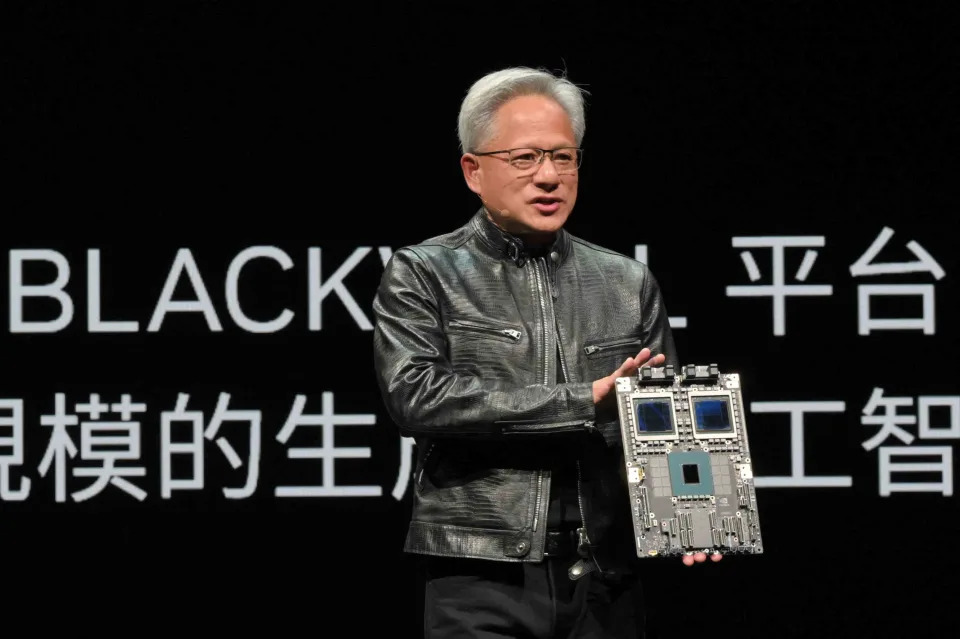

Bitcoin, which has already become a more mainstream financial asset, would undoubtedly rise above certain enterprises if it reached the 14-figure club. As of this writing, the most valuable business in the world is Apple . The consumer-tech titan sports a market cap of $3.7 trillion. Behind that is AI infrastructure powerhouse Nvidia , worth $3.4 trillion.

For Bitcoin to get to $10 trillion in 10 years, its market cap would need to increase at a compound annual rate of 17.9%. Just in the past five years, the cryptocurrency has seen its price rise at a yearly pace of 69.5%. So there's a lot of room for the gains to come down as we look ahead.

Temper expectations

A decade or more ago, Bitcoin was nothing more than an interesting project that was only for those who were familiar with computer science. I bet the early adopters couldn't have imagined what the asset would eventually become, with a growing financial ecosystem supporting it, as well as recognition from power players in Wall Street and Washington.

However, Bitcoin is now a more legitimate financial asset that's maturing. Therefore, it's reasonable to expect forward returns to come down from historical gains as the asset starts to attract more of the world's wealth, volatility decreases, and uncertainty is reduced.

Scarcity is key

Bitcoin's defining characteristic is that there will only ever be 21 million coins in circulation. This hard supply cap is enforced by the halving schedule , which cuts in half every four years the rewards that miners receive for processing transactions and securing the network.

In other words, Bitcoin's inflation rate is known in advance. Unless all stakeholders want to undermine the value of the protocol, this setup isn't going to change.

It makes sense why more investors want to own an asset that has a fixed supply. Fiat currencies, arguably Bitcoin's main competitor, are constantly being debased in order to fund burgeoning debt burdens, a big issue that is present here in the U.S. In this light, Bitcoin can be viewed as a digital version of gold , where people can store their value to protect or even grow their purchasing power.

As a digital and global communications protocol with no CEO or employees, Bitcoin is unlike a business that sells real world products and services and generates revenue and cash flow. Consequently, it's impossible to try and run a valuation exercise on the crypto using a discounted cash-flow model or comparing various earnings multiples.

How should you think about Bitcoin's ultimate upside? Assuming the crypto can one day reach $18 trillion, which is the value of all the gold mined on Earth, it implies a potential ninefold increase in value. As a decentralized digital asset with a fixed supply, Bitcoin likely will continue attracting more of the world's wealth as a store of value.

This perspective makes it totally reasonable and in the realm of possibilities to see Bitcoin's market cap expand about fivefold, or a compound annual rate of 17.9%, over the next 10 years to get to $10 trillion. At the end of 2034, the digital asset may even have substantial upside from that point forward.

Before you buy stock in Bitcoin, consider this: