Bitcoin rallied to a new all-time high of $106,554 on Sunday, breaking its own record of $103,000 which it recorded on Dec. 5.

The surge in the price of Bitcoin was mainly driven by bullish sentiment, fueled by the U.S. President-elect Donald Trump’s comments about creating a national Bitcoin reserve and institutional moves signaling growing confidence in the asset.

President-elect Donald Trump, who won the 47th U.S. presidential election, reiterated his vision for a U.S. Bitcoin reserve on December 12. Trump’s swearing-in ceremony will take place on January 20.

"We're gonna do something great with crypto because we don’t want China, or anybody else … but others are embracing it, and we want to be ahead," Trump said .

Trump first floated the idea during his campaign, promising to create a “strategic national Bitcoin reserve” to ensure the United States maintains dominance in the cryptocurrency sector.

This week, he doubled down on the promise, fueling speculation that an executive order could formalize Bitcoin’s status as a reserve asset early in his presidency.

The U.S. government holds 212,847 BTC, valued at $22.3 billion, from law enforcement seizures. Whether Trump’s reserve would include these holdings or require additional market purchases remains unclear.

Anthony Pompliano, entrepreneur and well-known Bitcoin advocate, tweeted : "It is hilarious to watch bitcoin run on Sunday nights because Wall Street can't do anything until tomorrow morning when the stock market opens. It is like getting invited to Christmas dinner but having to sit at the kids table."

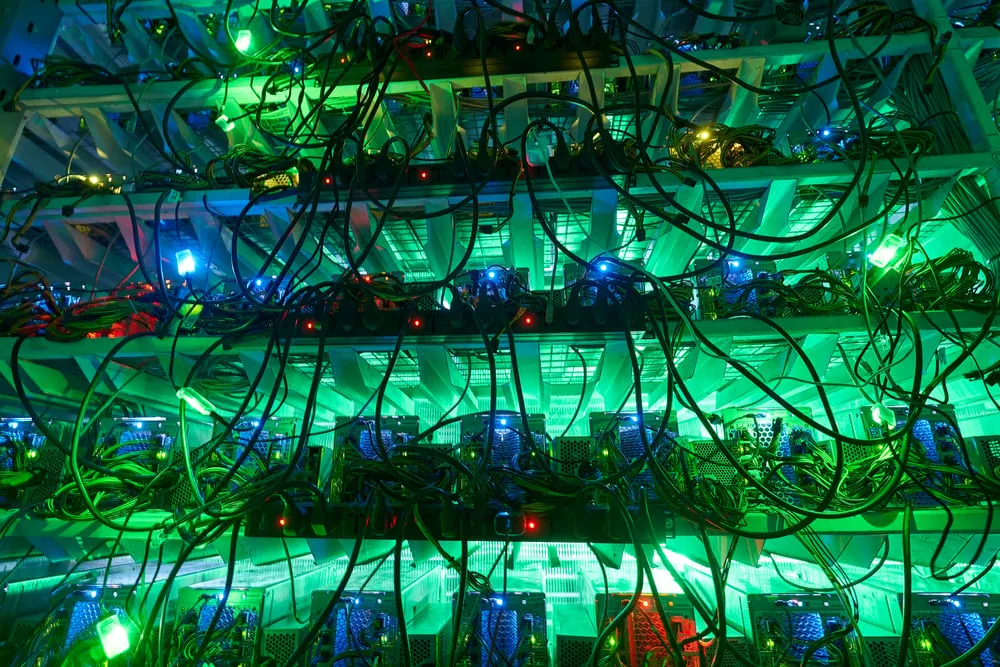

MicroStrategy’s Relentless Bitcoin Buying Spree

Another critical factor driving Bitcoin’s momentum is institutional backing, exemplified by Michael Saylor’s MicroStrategy. The company on Dec. 15, hinted at another Bitcoin purchase , potentially marking its first acquisition at an average price exceeding $100,000.

MicroStrategy’s Bitcoin holdings stand at 423,650 BTC, valued at over $43.6 billion, with Saylor confirming consistent weekly purchases.

Digital Asset Investment Products See Record-Breaking Inflows

According to the CoinShares report , digital asset investment products witnessed inflows of $3.2 billion last week, marking the 10th consecutive week of positive flows. This brings the total inflows for 2024 to $44.5 billion—more than four times the total inflows of any previous year.

Bitcoin continues to dominate, with $2 billion in inflows last week. This brings total inflows since the U.S. election to $11.5 billion.

Short Bitcoin products also recorded $14.6 million in inflows last week, although total assets under management remain relatively low at $130 million, reflecting cautious sentiment among bearish investors.

Ethereum recorded its seventh consecutive week of inflows, adding $1 billion last week. Over the past seven weeks, inflows have reached $3.7 billion, signaling a "dramatic improvement in sentiment," according to the report.