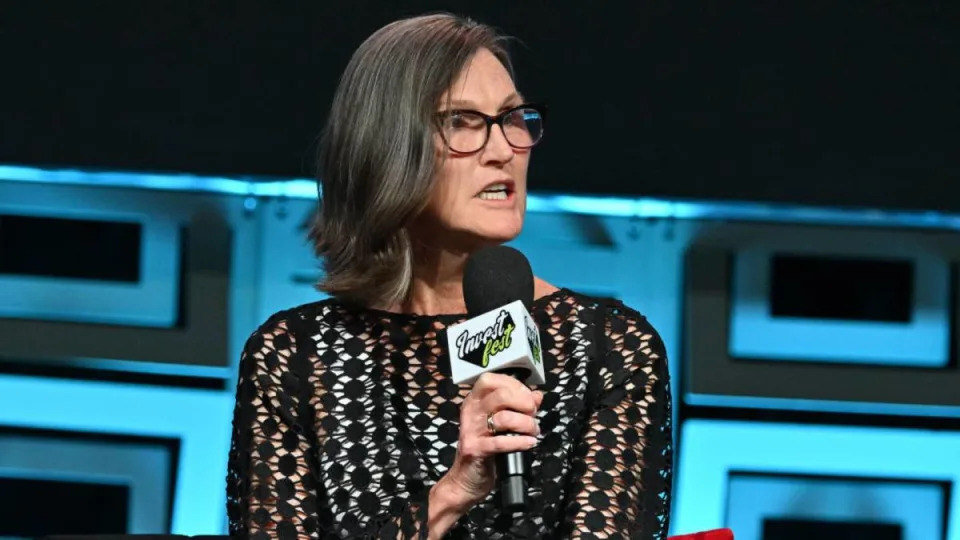

ARK Invest CEO Cathie Wood has boldly sought tech stocks that could have a “disruptive” future impact, even if the stock is unprofitable.

Her ARK funds recently had a significant buy on Tempus AI. She bought 732,873 shares from Dec. 6 through Dec. 12, with a total value of roughly $30 million as of Dec. 13’s close.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

Tempus AI ( TEM ) is a health technology company founded in 2015. It uses artificial intelligence to make diagnostics more precise.

The company states that its goal is to integrate AI, including generative AI, into every aspect of diagnostics, helping physicians and researchers make personalized and data-driven decisions.

"The ability to deploy AI in precision medicine at scale has only recently become possible," Tempus AI said in an SEC filing.

"Advances in cloud computing, imaging technologies, large language models, and low-cost molecular profiling, along with the digitization of vast amounts of healthcare data, have created a landscape that we believe is finally ripe for AI."

Tempus AI went public on June 14, 2024, with its initial public offering priced at $37 a share. Wood initiated a buy shortly after the market debut.

Tempus AI’s Q3 revenue beat estimates, driven by data services

Tempus AI has not yet turned a profit. It reported losses of $290 million and $214 million for 2022 and 2023, respectively.

In November, Tempus AI reported a Q3 loss per share of 46 cents, falling short of the consensus estimate loss of 31 cents.

Revenue for the quarter increased by 33% to $180.9 million, slightly above analyst expectations of $179.52 million.

Related: Analyst resets price target on key AI stock after runup

This was partly driven by strong performance in its data services segment, which saw a year-over-year revenue growth of 64.4%.

"The overall business performed well in the quarter, as demonstrated by accelerating volume growth in our genomics business and accelerating revenue growth in our data and services business, specifically within Insights," said Eric Lefkofsky, founder and CEO of Tempus AI.

The company also announced the $600 million acquisition of Ambry Genetics, a genetic testing company, aiming to broaden its testing portfolio and expand disease coverage.

"Ambry is uniquely positioned given that its revenues are currently growing at north of 25% a year and it generates meaningful EBITDA and cash flow," Lefkofsky said.

Tempus reaffirmed its FY24 revenue guidance of approximately $700 million, in line with the consensus estimate of $698.09 million.

The outlook represents 32% year-over-year growth and includes an expected $50 million improvement in adjusted EBITDA.

Analyst sets higher stock price target for Tempus AI

Wood is not alone. While Tempus AI stock has lost a third of its value this month, several other analysts believe in its potential for future upside.

Bank of America raised Tempus AI’s stock price target to $54 from $52 with a neutral rating, thefly.com reported on Dec. 13.

The analyst says the Life Sciences Tools sector underperformed in FY24 as Pharma and Biotech customers reined in spending after overspending during the pandemic.

Related: Here's what a veteran trader who forecast Palantir's stock rally says now

Entering 2025, "the setup is almost identical," says BofA. However, the analyst adds, "There are finally some encouraging signs on the horizon."

In October, BofA downgraded Tempus AI to neutral from buy, citing valuation and softness that are likely to persist in the first half of 2025.

Wolfe Research analyst Doug Schenkel recently initiated coverage of Tempus AI with an outperform rating and a $60 price target.

Tempus AI has been "best-in-class" in the diagnostic data category as measured by monetization, the analyst says.

Schenkel expects Tempus to generate a 30% revenue compound annual growth rate through 2028 as it expects more market penetration and database monetization.

Guggenheim analyst Subbu Nambi also initiated coverage of Tempus AI with a buy rating and $74 price target, thefly.com reported on Dec. 9.

More Tech Stocks:

Nambi desceibes Tempus as a "pioneer" in intelligent diagnostics. It operates in "high-growth, attractive" oncology markets, with its unique data and comprehensive diagnostics menu seen as "key competitive advantages."

Tempus AI closed at $41 per share on Dec.13. The stock is up only 2.5% this year since its June IPO.

Related: Veteran fund manager delivers alarming S&P 500 forecast