Key Takeaways

Constellation Energy ( CEG ) shares rose Thursday after Bank of America analysts upgraded the energy company's stock and lifted their price target to near Wall Street's average.

The analysts upgraded their rating of Constellation stock to "buy" from "neutral" and raised their price target to $269, a bit below the Visible Alpha consensus near $280, from $237. (The stock finished Wednesday just under $237.)

They pointed rising power demand and the potential for more exclusive agreements to power data centers like Constellation announced earlier this year with Microsoft ( MSFT ).

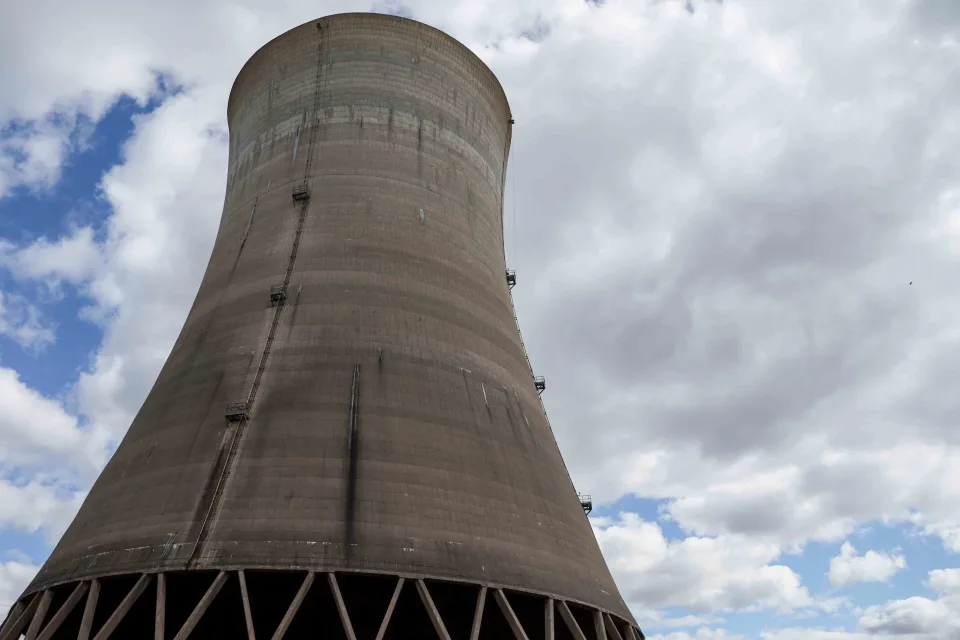

Constellation Provides 'Unique Investment Opportunity' in Nuclear Industry

The analysts called Constellation a "unique investment opportunity" and said it has a number of positives like its recent growth, business model, and a "compelling valuation relative to peers."

Constellation remains undervalued despite "changing dynamics in the power market” like rising energy prices, which drove Constellation and other nuclear stocks higher earlier this year, and demand for power that the analysts see outpacing supply.

A number of analysts grew more bullish on Constellation after the Microsoft deal, which will see Unit 1 of the Three Mile Island complex in Pennsylvania restarted to provide power to a Microsoft data center. The BofA analysts also noted risks including the possibility of lower prices, uranium supply chain issues, and regulatory uncertainty.

Last month, the Federal Energy Regulatory Commission (FERC) temporarily blocked a data center power deal between Talen Energy ( TLN ) and Amazon ( AMZN ). The analysts wrote Thursday that the remaining uncertainty could delay future deals between energy companies and tech giants.

Constellation shares, which were recently up nearly 3%, have more than doubled in value since the start of 2024.

Read the original article on Investopedia