Check back for updates throughout the trading day

U.S. stocks were mixed in mid-day Tuesday trading, with modest moves higher for both Treasury yields and the dollar, as investors continued to focus on a key inflation reading later in the week to extend the market's end-of-year rally.

Updated at 1:08 PM EST

Big auction week

The U.S. Treasury sold $58 billion in new 3-year notes at a high yield of 4.117% in the first of three coupon-bond auctions this week that are expected to raise around $120 billion.

Investors placed bids worth around $150 billion for the paper on offer, generating a so-called bid-to-cover, or demand ratio of 2.58, just ahead of the six-auction average of 2.56.

Foreign interest, however, was notably lower, with overseas buyers taking down around 64.1% of the sale, compared to the six-auction average of 69.7%.

Updated at 11:58 AM EST

Rising yields

Stocks are giving back their modest early gains into the mid-day session as Treasury yields nudge higher ahead of a $58 billion auction of new 3-year notes later in the afternoon.

Benchmark 10-year paper was last marked 3 basis points higher on the session, and around 6 basis points north of Monday levels, to trade at 4.241%, while 2-year note yields rose another 3 basis points to 4.166%.

The S&P 500 was last seen less than a point higher from last night's close, with the Nasdaq up 28 points and the Dow up 24 points

Mixed open

The S&P 500 was marked 4 points, or 0.06% higher in the opening minutes of trading, with the Nasdaq rising 80 points, or 0.41%.

The Dow fell 132 points while the mid-cap Russell 2000 slipped 4 points, or 0.16%.

Updated at 9:23 AM EST

Willow-pilled

Google parent Alphabet ( GOOGL ) shares are powering higher in early trading following an outlook boost from Piper Sandler tied to the tech giant's ad revenue prospects and its broader AI investment thesis.

“Estimates into next year look achievable, especially ad revenue at ~10%, while Cloud & YouTube Subscriptions will continue to show elevated growth,” said Piper Sandler analyst Thomas Champion.

Investors are also reacting to the release of the group's new Willow quantum computing chip, which boasts some of the fastest high-level calculation speeds in human history.

Alphabet shares were last marked 4.5% higher in premarket trading to indicate an opening bell price of $185.12 each.

Updated at 8:55 AM EST

Meet the new boss

Small business sentiment levels rose to the highest levels in nearly three-and-a-half years in November, according to the benchmark survey published by The National Federation of Independent Business, following the sweeping election victory of Donald Trump and his Republican colleagues earlier this month.

“The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners,” said chief economist Bill Dunkelberg.

“Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty," he added. "Owners are particularly hopeful for tax and regulation policies that favor strong economic growth as well as relief from inflationary pressures. In addition, small business owners are eager to expand their operations.”

Updated at 8:29 AM EST

Tesla booster

Tesla shares are moving higher following a key price target upgrade from Morgan Stanley's Adam Jonas, who named the EV maker as a 'top pick' in the bank's stable of recommendations.

“Elon Musk's entry into the political sphere has expanded investor thinking around Tesla’s fundamental outlook .. we expect to see Tesla’s [total addressable market] aperture expand to far broader domains, many of which are not included in buy-side or sell-side financial models," Jonas and his team wrote.

Tesla shares were marked 0.91% higher in premarket trading to indicate an opening bell price of $393.35. Such a move would extend the stock's 2024 gain to around 58% with a market value of $1.22 trillion.

Related: Analyst overhauls Tesla stock price target as 'top pick' in sector

Stock Market Today

Stocks ended lower on Monday, with megacap tech names leading declines for the S&P 500 and the Nasdaq amid a cautious session that was clouded by geopolitical risks and muted early trading volumes.

Investors are likely to get risk appetites in check over the coming session, with Wednesday's November CPI in focus as the last major inflation reading prior to the Federal Reserve's final policy meeting of the year next week in Washington.

Economists see core inflation holding at 3.3% in the November report, with headline prices rising modestly, to 2.7%, when the report is published at 8:30 am Eastern Time on Wednesday.

Traders see an 86.1% chance that the Fed will lower is benchmark Federal Funds Rate by a quarter of a percentage point to between 4.25% and 4.5%, but have pared bets on follow-on cuts into next year as price pressures remain stubbornly high and new policies from the incoming Trump administration as likely to exacerbate them.

Benchmark 2-year Treasury note yields were marked 3 basis points higher in overnight trading at 4.133% ahead of a $58 billion auction in new 3-year paper later today, while 10-year notes were trading 3 basis points higher at 4.219%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.11% higher at 106.322.

On Wall Street stocks are looking at another flat open, with futures contracts tied to the S&P 500 suggesting a modest 3-point opening bell gain, while those linked to the Dow Jones Industrial Average priced for a 5-point pullback.

Related: Major analyst revamps S&P 500 target for 2025

Futures tied to the tech-focused Nasdaq suggest a 20-point decline with Palantir Technologies ( PLTR ) , Nvidia ( NVDA ) and Tesla ( TSLA ) three of the more active names in the premarket.

Oracle ( ORCL ) shares were another notable mover, falling 8.4% following a disappointing set of fiscal-third-quarter earnings after the bell last night.

Boeing ( BA ) shares were marked 0.5% higher following reports that the planemaker restarted production of the 737 Max following last month's strike by around 33,000 factory workers, which shut it down for around seven weeks.

More Wall Street Analysts:

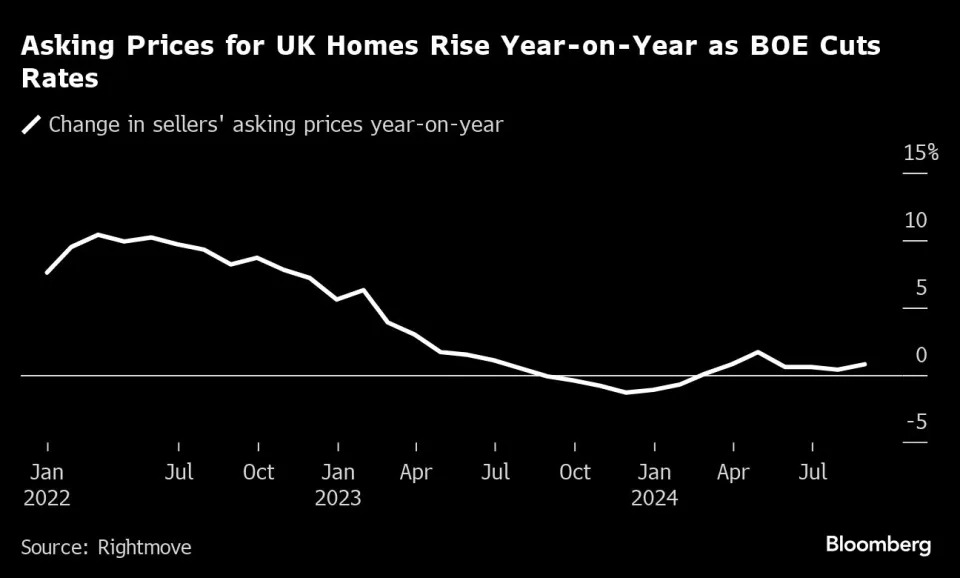

In overseas markets, the regional Stoxx 600 benchmark looks set to snap an eight-day winning streak and was marked 0.23% lower in midday Frankfurt trading. Britain's FTSE 100 was down 0.6% in London.

Overnight in Asia, the regional MSCI ex-Japan benchmark slipped 0.34% into the close of trading, with Japan's Nikkei 225 rising 0.53% in Tokyo.

Related: Veteran fund manager delivers alarming S&P 500 forecast