Key Takeaways

Apple ( AAPL ) shares could remain on watchlists Tuesday after setting a new all-time high (ATH) yesterday and registering their 21st record close of the year.

Sentiment surrounding the stock may have received a boost after Melius Research analyst Ben Reitzes told CNBC's "Squawk on the Street " in a recent interview that the iPhone maker sits well positioned to benefit from a multi-year cycle of product launches, adding that the company’s integration with OpenAI’s ChatGPT provides potential revenue opportunities through pro-version upgrades.

Apple shares traded sideways for most of the third quarter as investors digested the delayed rollout of the tech giant’s highly anticipated Apple Intelligence features and its impact on device sales. However, the stock has regained its upward trajectory, rallying more than 12% from its early November low and trading 28% higher since the start of the year as of Monday’s close.

Below a take a closer look at the technicals on Apple’s chart and identify key price levels that investors may be watching out for.

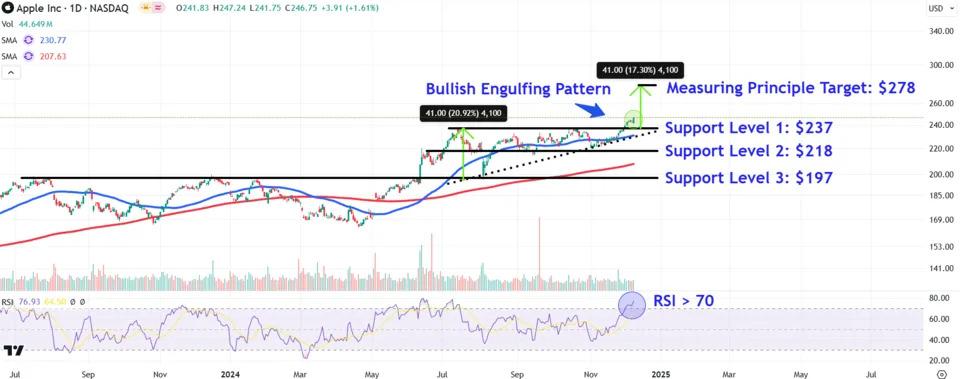

Ascending Triangle Signals Bullish Continuation

Apple shares broke out from a five-month ascending triangle earlier this month, signaling a continuation of the stock’s longer-term uptrend.

The stock has continued to move higher, albeit on lackluster volume , with the price completing a bullish engulfing pattern as it set a fresh record high in Monday’s trading session.

While the relative strength index (RSI) confirms bullish price momentum, the indicator also flashes overbought conditions that could lead to near-term profit taking.

Let’s apply technical analysis to project where the stock’s price may be headed next if the current continuation move plays out and also identify three key support levels that could attract buying interest during retracements .

Chart-Based Price Target to Watch

Investors can project a potential bullish price target by using the measuring principle , a technique that analyses chart patterns to predict future moves.

When applying the tool to Apple’s chart, we calculate the depth of the ascending triangle near its widest section and add that amount to the pattern’s top trendline .

In this case, we add $41 to $237, which forecasts an upside price target of $278, about 13% above Monday’s closing price.

Key Support Levels to Monitor

Upon an initial dip, investors should watch how the price responds to the $237 level. The stock may find buying interest in this area near the ascending triangle’s top trendline, which may flip from a location of prior resistance into future support.

The bulls’ failure to defend this area could see the shares decline to around $218, a price where they may attract support near the June peak , which closely aligns with troughs in July, September, and November.

Finally, a deeper correction in Apple shares may lead to a retest of long-term support near $197. Investors would likely look for buy-and-hold opportunities in this area around a multi-month trendline that connects a range of comparable trading levels on the chart from July 2023 to August this year.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info.

As of the date this article was written, the author does not own any of the above securities.

Read the original article on Investopedia