Hong Kong officials and industry insiders touted the city's cryptocurrency trials and regulatory stability as strengths for the market at the Belt and Road Forum on Thursday, as the crypto euphoria surrounding the re-election of Donald Trump to the US presidency pushed the price of bitcoin past US$100,000 this week.

"Trump is unpredictable. He may change his mind tomorrow; you never know," said Joseph Chan - chair of the think tank Silk Road Economic Development Research Centre, one of the organisers of the event - who moderated a panel at the forum on Web3 and the digital economy.

"Hong Kong's regulation is more consistent, which I believe is the right approach."

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge , our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

The local Belt and Road Forum event held at the Conrad Hong Kong this week is one of a series of events promoting China's state-backed Belt and Road Initiative .

It aims to promote trade and development across Asia, Europe and Africa. Hong Kong has been a key pillar of the initiative in its role as a facilitator of cross-border payments, with the local government recently emphasising the role that blockchain could play in this area.

Hong Kong Chief Executive John Lee Ka-chiu said in opening remarks delivered via video that tokenisation - putting real-world assets on a blockchain - is growing in influence as a key technology in the finance sector.

He also addressed the technology's ability to facilitate cross-border payments. Both were key topics at this year's FinTech Week in October.

"Our robust capital support forms a solid foundation to foster the digital economy," Lee said. "This is bolstered by a vibrant fintech ecosystem encompassing over 1,100 companies."

Hong Kong Chief Executive John Lee gives the opening address at the Belt and Road Forum 2024, with the theme of "Digital Economy and Payment Settlement". Photo: Yi Luo alt=Hong Kong Chief Executive John Lee gives the opening address at the Belt and Road Forum 2024, with the theme of "Digital Economy and Payment Settlement". Photo: Yi Luo>

For the past two years, Hong Kong has been trying to court the Web3 industry back to the city after some big names pulled out during the pandemic amid regulatory uncertainty.

A new mandatory licensing scheme was meant to solve any remaining ambiguity regarding the government's stance, but it has proven costly and onerous , attracting few applicants.

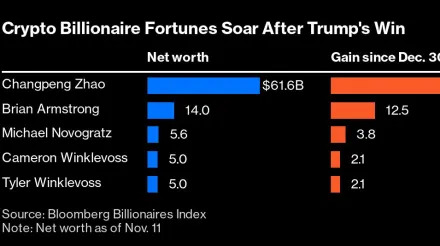

Meanwhile, excitement in the US hit an all-time high this week when president-elect Trump said he would appoint digital-asset proponent Paul Atkins to chair the Securities and Exchange Commission, sending bitcoin to an all-time high.

The current chair, Gary Gensler, has been immensely unpopular in the crypto community because of his regulatory actions, and said he would step down when Joe Biden leaves office on January 20. Trump also ran on a crypto-friendly platform during his campaign.

Chan acknowledged the major policy shift in Hong Kong, saying it had some catching up to do.

"It joined the game late but has grown fast," he said. "Although a newcomer in this field, Hong Kong aims to lead globally."

Chan predicted that this could happen in the long term, but he does not see it happening in the next few years, while Trump is still in office.

"Because the policy suddenly eased with Trump taking office, the US may have an upper hand in the next three years," Chan said.

"But in the next five to 10 years, Hong Kong could play a bigger role. Its sound regulation will attract more participants because investors are better protected."

Others in the industry see things differently. He Yifan, founder and CEO of the Hong Kong-based blockchain company Red Date Technology, previously told the Post that "if [mainland] China doesn't open up to crypto before Trump leaves office, then it probably won't ever open up".

The Chinese government is the world's second-largest holder of bitcoin owing to assets confiscated through legal proceedings, after only the US government.

There have been multiple court cases on the mainland upholding the right to own cryptocurrencies , but Beijing maintains a strict ban on commercial activities with the assets, fearing financial instability.

This article originally appeared in the South China Morning Post (SCMP) , the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.