A previous version of this article misspelled Winston Chua’s name.

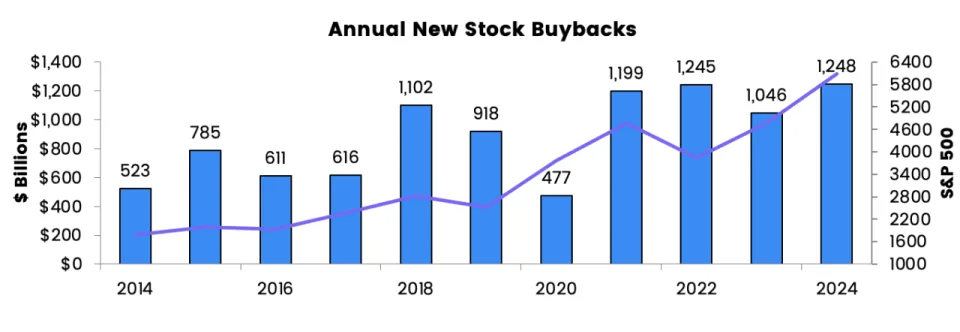

U.S. stocks have been on a record run ahead of the year-end holidays — and so have plans by corporate executives to reward shareholders, as well as themselves , with stock buybacks.

Bullish momentum has pushed up the S&P 500 index SPX beyond the 6,000 mark, with the equity gauge heading for a near 30% gain on the year and a 58.5% combined two-year advance. That would represent its biggest back-to-back advance since 1998, according to Dow Jones Market Data.

“The raw fuel for buybacks is there,” said Matt Stucky, chief portfolio manager at Northwestern Mutual, pointing to robust corporate earnings even as the Federal Reserve has kept interest rates relatively high.

“In recent months, consumer and business confidence has moved upward, a prerequisite for upping buyback plans,” Stucky said.

Corporate executives have responded to the backdrop by announcing plans for more share buybacks, pushing the yearly volume to a record high of $1.248 trillion, according to Winston Chua, an analyst at EPFR.

AT&T Inc.’s T announcement this week of a roughly $20 b i llion buyback plan , plus a roughly equal in size dividend program over the next three years, helped tip the year’s tally to a fresh record.

Buybacks at record prices can attract criticism, namely that executives might risk overpaying for their stock, or that they could instead focus on growth by investing in their own companies or through mergers or acquisitions.

Stucky noted legendary investor Warren Buffett lately has been taking a careful approach to stock buybacks at Berkshire Hathaway, BRK.A BRK.B even through most investors, with the existing 1% buyback tax, still view them as favorable.

The big three stock benchmarks DJIA COMP were mixed Thursday ahead of Friday’s monthly jobs report. But they have been powering to fresh highs this week, with recent gains driven by solid corporate earnings and optimism around plans by the second Trump administration to cut taxes and regulation, while promoting “America first” policies.

The Trump transition team didn’t immediately respond to a request for comment to this article.

Read : U.S. economy poised to dominate for the next 20 years — at the cost of growing inequality, economist says