This story was originally published on CFO.com . To receive daily news and insights, subscribe to our free daily CFO.com newsletter .

Investors and product developers have often fallen victim to speculation-driven hype throughout economic history. From tulips in the 1630s to the bull market that led to the stock market crash of 1929, the dot-com bubble of the late 1990s, and the NFT craze of 2021 , these examples show how powerful, investor-backed phenomena can spiral out of control when stakeholders focus on cashing in — and out — at the right time.

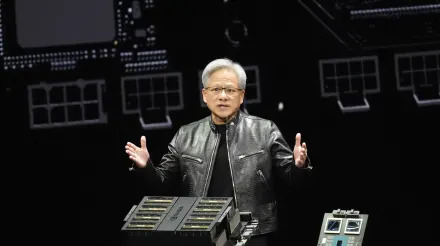

Today, some say a bubble is forming around AI products and infrastructure. Nvidia, for instance, has seen explosive growth in size and revenue. While chip developers thrive, those creating AI products appear to be racing to the bottom . Many industry tradeshows are now saturated with AI offerings, and the knowledge gap between developers, sales teams and marketers has led to AI solutions being created without clear use cases seemingly for the sake of branding. Sound familiar?

Product development issues

AI faces challenges in both user and enterprise applications. Smart chip production in Taiwan is threatened by geopolitical instability , and nearshoring efforts are still in their infancy. The challenges of creating advanced chips, combined with disruptions to supply chains and the diminishing relevance of Moore’s Law , have made it difficult to predict the output and cost of components essential for AI. For investors and CFOs, these uncertainties have fueled doubt about companies like NVIDIA sustaining growth under adverse conditions.

Large language models (LLMs), a segment highlighted by Hewlett Packard Enterprise CFO Marie Myers during a recent keynote , are an area of rapid and arguably excessive development. Myers noted that customized LLM development is underway, but as data sources dwindle and off-the-shelf models become widely available, CFOs are already questioning the practicality of such products.

For LLMs, the shortage of training data is a significant hurdle. OpenAI, whose leadership , entity structure and product reliability have been questioned, offers a user-focused product largely unsuitable for enterprise tasks. While companies like OpenAI and Microsoft offer enterprise LLMs that operate within firewalls to protect data, these products are still evolving. It’s unclear how they will differentiate themselves in future markets without access to proprietary datasets.

OpenAI’s partnership with Apple may solve the proprietary dataset problem for them in the short term, with the company granting access to massive data sets from user data on iPhones. This development has raised concerns among business leaders. Tesla and SpaceX CEO Elon Musk, who was a former board member at OpenAI, has called this an "unacceptable security violation" and has considered banning Apple products from his companies if ChatGPT becomes integrated into Apple’s iOS systems.

How finance can help outwit overzealous salespeople

Many technology companies, particularly in fintech, have borrowed a tactic from the dot-com era, rebranding themselves with “AI” to capitalize on the hype. This trend has created an oversaturated market of similar tools, with sales often driven by promises of broad automation rather than solving specific challenges.

CFOs, who often have firsthand experience with automation and AI in finance, can recognize these overpromises. However, organizations looking to integrate technology into other areas may find themselves sold on solutions that are overhyped, underdeliver and tend to come from vendors who allocate more resources to sales and marketing than to implementation.

This dynamic underscores the importance of cross-departmental collaboration . Finance teams, with their experience in implementing technologies for accounts receivable/payable, ERP, budgeting, forecasting, reporting and audit, are well-positioned to assess the functionality and ROI of new tools.

People aren’t going away

Unlike previous bubbles, AI tools were initially marketed as a way to replace labor at scale but have since shifted toward augmenting labor in various industries. Jeff Bezos, Amazon’s founder and executive chairman, recently emphasized AI’s transformative potential, calling it a “ horizontally enabling layer .” He said, “It can be used to improve everything; it will be in everything. I guarantee you there is not a single application you can think of that is not going to be made better by AI.”

CFOs should reassure their teams that AI is unlikely to pose a direct threat to their jobs, but someone who knows how to supplement their jobs with AI will likely replace someone who does not in the future.

By focusing on upskilling employees, CFOs can prepare their organizations to implement AI tools effectively and foster a sense of knowledge as things like artificial general intelligence and super intelligence, both things OpenAI CEO Sam Altman recently spoke about when talking about the future societal impact, come into fruition. He warned that although changes might appear to be short-lived now, the most impactful results of AI are yet to come and will require human beings to always work.