The tail end of a historically bullish day for bitcoin was met with a flash crash that briefly knocked nearly 7% off the cryptocurrency, though analysts remain positive on its overall rally.

After hitting a high of $103,853 on Thursday, the price of bitcoin BTCUSD began drifting lower, briefly plunging all the way to $92,251. Bitcoin was last trading 1.2% lower at $97,859 on Friday.

On Wednesday, bitcoin breached the $100,000 level for the first time, after President-elect Donald Trump said he would nominate perceived crypto-friendly Paul Atkins to chair the U.S. Securities and Exchange Commission. Comments from Fed Chairman Jerome Powell who likened bitcoin’s role to gold were also seen as supportive .

Read: What’s next after bitcoin tops $100K? What one top Wall Street technician says.

A “flash crash” is usually defined as a sudden, dramatic plunge in the price of an asset or market that quickly reverses and cryptocurrencies are some of the most volatile assets around.

Sean Farrell, head of digital asset strategy at Fundstrat Global Advisors, told clients that just after the broader market close in the U.S. on Thursday, there were $400 million in liquidations in the perpetual futures market — derivative contracts with no expiration date — for bitcoin. Given the leverage he has seen building in the market lately, the sharp slump was “just a function of having a lot of speculation in the market.”

The move is “not atypical to bull markets,” said Farrell, adding that a similar move was seen back in March, also alongside lots of liquidations, though “not quite to this level.”

He views such pullbacks as healthy. “It’s always great to…wipe out some unhealthy leverage, especially ahead of an anticipated economic data point,” he said, referring to Friday’s nonfarm payrolls numbers.

“If it [data] comes in strong, I think we saw most of the selling that would have otherwise sold on a stronger print do that today [Thursday]. And so I think this could be a case of sell the rumor buy the news situation,” Farrell said, adding that they are “buyers of this dip.”

Read: This analyst talked of $100,000 bitcoin a decade ago — here’s what he says now

Economists expect a net 214,000 jobs were created in November , and some worry a too-strong report could derail hopes for a Federal Reserve interest rate cut this month.

Yuya Hasegawa, crypto market analyst at Japanese cryptocurrency exchange Bitbank, said a “weak U.S. equity market and short-term overheatedness may have lured investors to book [bitcoin] profits, which caused $67 million worth of long positions to liquidate in a matter of [a ] few hours.”

“Breaching the $100k psychological barrier and spike in volatility might seem like a major ceiling for some investors, but it is too early to judge that bitcoin’s long-term trend has reversed,” Hasegawa said, in a note shared with MarketWatch.

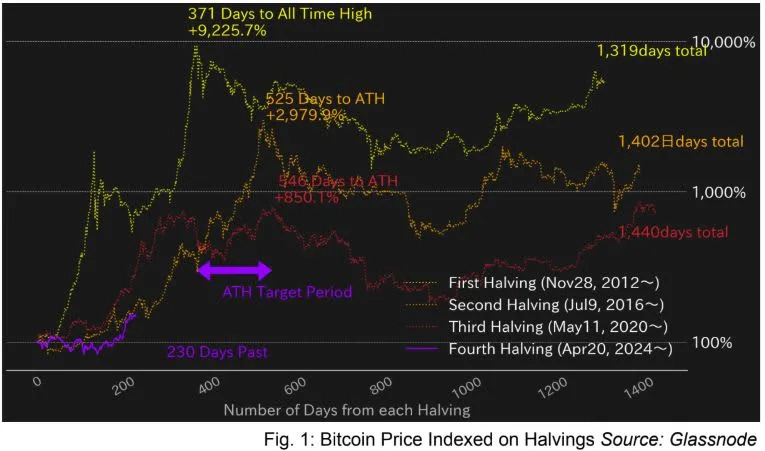

He notes only 230 days have passed since bitcoin’s halving in April , an event that cuts rewards for those mining bitcoin in half and helps limit supply. It usually takes from 371 days to 546 days for bitcoin to form a major record high or top, from the last halving, he said.

Based on past halvings, bitcoin may be roughly halfway through the cycle’s major top, said Hasegawa. “Additionally, it might seem like the current bitcoin market is overbought, but in comparison to the past bull runs, the current price performance is actually the weakest. Therefore, the crash this Thursday could well be a usual correction for bitcoin.”

He offered the below chart to illustrate bitcoin tops after halving events:

Dan Coatsworth, investment analyst at AJ Bell, countered that what investors saw late Thursday on bitcoin wasn’t really a crash, as he estimates a peak-to-trough movement of about 6.6%.

“That would be dramatic for the equity market but not for cryptocurrencies. There are plenty of examples of much larger moves such as bitcoin falling by 83% on 10 April 2013 and seven years later it lost half its value over two days during the global market crash spurred on by the COVID pandemic,” he said in a note. “Bitcoin has earned a reputation for being a volatile asset and this week’s price action is tame relative to history.”