Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Future Fund LLC Managing Partner Gary Black criticized Tesla Inc. ‘s (NASDAQ: TSLA ) Bitcoin (CRYPTO: BTC ) holdings Wednesday, arguing they have minimal impact on the electric vehicle maker’s stock value as the cryptocurrency reached record highs.

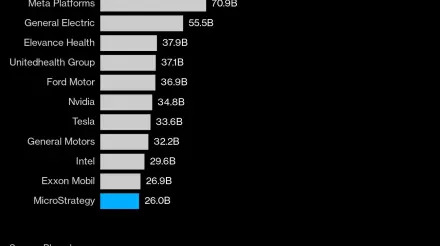

What Happened : “The price of Bitcoin is not relevant to Tesla’s stock price,” Black wrote on X, noting that even at $100,000 per Bitcoin, Tesla’s holdings amount to roughly $0.33 per Tesla share. “My issue has always been capital allocation – shareholders can buy Bitcoin themselves.”

Don't Miss:

Black emphasized Tesla should prioritize its core business investments. “I want Tesla to build new plants, introduce new EV models, expand its energy business, invest in robotaxi,” he stated. “If there is cash left over, management can buy back Tesla stock.”

The comments came as Bitcoin surpassed $100,000 for the first time , reigniting debate about Tesla’s cryptocurrency investments. Black has consistently opposed Tesla’s Bitcoin holdings, arguing in June 2021 that they distract from the company’s EV mission and raise questions about earnings quality.

See Also: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it ?

Why It Matters : Black’s The Future Fund Active ETF (NYSE: FFND ) reduced its Tesla position to 4.31% from 12.2%, making it their fifth-largest holding .

The Future Fund’s average Tesla stock purchase price since early 2023 has been $162, with sales averaging $252. Despite recent criticism from Tesla bulls, Black defended his investment strategy, stating, “That’s what professional investors do – buy low, sell high.”

Tesla maintains its position as the EV market leader with a market cap exceeding $1 trillion.

Interest Rates Are Falling, But These Yields Aren't Going Anywhere

Lower interest rates mean some investments won't yield what they did in months past, but you don't have to lose those gains. Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities.

Arrived Home's Private Credit Fund’s has historically paid an annualized dividend yield of 8.1%* , which provides access to a pool of short-term loans backed by residential real estate. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

This article Gary Black Says Tesla's Bitcoin Holdings Not 'Relevant' To TSLA's Stock Price, Urges Focus On EV Expansion And Share Buybacks originally appeared on Benzinga.com