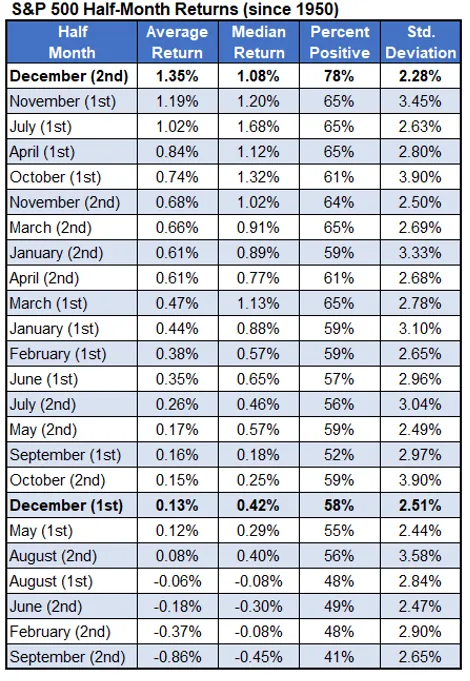

December is a particularly interesting month for stock market seasonality. The table below summarizes the S&P 500 Index’s (SPX) monthly returns since 1950. Historically, December has been a strong performer, ranking second only to November in average return and first in percentage of positive returns. Though we have already started the month, investors still have more than a week to act, as gains have typically been concentrated in the second half of December.

While we explore the specifics below, let’s also break down the impact of November’s strong performance on December’s seasonality.

A Tale of Two Halves

The next table breaks down SPX returns by half-months, listing each month’s performance for its first and second halves separately. The first half of December ranks 18th out of the 24 half-months going by average return. The second half of December, however, stands out as the strongest half-month of the year. It has the highest average return, the highest percentage of positive returns by 13% (78% vs. 65% for the next highest), and it has the lowest standard deviation of returns. Based on this, you’re not missing out by waiting before buying.

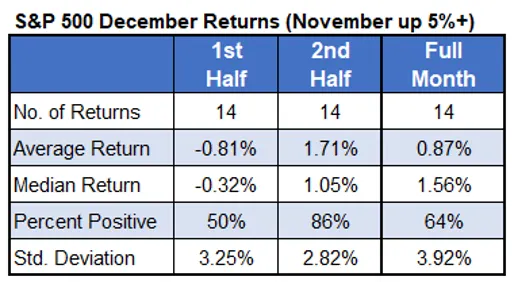

S&P 500 Up Big in November

The SPX had a big November, climbing 5.7%. I broke down December returns since 1950 following months in which the index gained over 5%. In these cases, the contrast between the first and second half of December was even more striking. Out of 14 such instances, the first half of December averaged a loss of 0.81%, with only 50% of the returns positive. In contrast, the second half outperformed its already strong historical average, gaining 1.71% on average, with 86% of the returns positive. Based on this, it might be better to wait before buying, based on December’s strong seasonality.