It’s the time of year when many investors click on their brokerage account and set up their strategy for the next 12 months.

Matthew Bartolini, head of SPDR Americas Research at State Street Global Advisers, says there’s a key reason why a typical 60/40 portfolio –60% stocks, 40% bonds – is at risk.

He notes in the firm’s 2025 outlook that the rolling 12-month correlation of U.S. stocks and bonds has been positive for over 600 days, which is the longest streak since between 1992 and 1995. That link suggests that bonds won’t necessarily be a cushion if stocks fall, as indeed they weren’t in 2022.

That’s not the only risk – concentration risk has risen, in terms of companies, sectors and countries, he says. (Think Magnificent Seven, tech, and the U.S.)

“The key takeaway? Stock, sector, and geographical diversification attributes are as weak as ever for core equity exposures within the traditionally balanced portfolio,” he says.

His view is that investors should turn to so-called real assets – like gold, Treasury inflation-protected securities, commodities, infrastructure, natural resources, real estate and (intriguingly) digital assets. Related: Bitcoin boosts 60/40 returns without adding much volatility, fund manager finds

Those assets could help hedge against inflation, generate yield or act as a diversifier to broad equities and fixed income, he says.

Bartolini also suggests allocations to private assets, though he does warn about their illiquidity.

The market

Another record-setting day looked to be in the cards, as U.S. stock futures ES00 NQ00 were pointing higher after well-received tech results.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

6049.88 |

0.85% |

2.04% |

26.84% |

32.98% |

|

Nasdaq Composite |

19,480.91 |

1.60% |

5.65% |

29.77% |

36.90% |

|

10-year Treasury |

4.258 |

-0.60 |

-17.70 |

37.71 |

14.93 |

|

Gold |

2666.2 |

1.13% |

-0.06% |

28.69% |

30.48% |

|

Oil |

70.22 |

2.11% |

-2.34% |

-1.56% |

1.40% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

ADP estimated 146,000 private-sector jobs were created last month. The economics calendar also includes the ISM services report, the Beige Book and a moderated discussion with Fed Chair Jerome Powell at 1:40 p.m.

France is holding a no-confidence vote , as the spread between French and German bonds nears its widest since the eurozone debt crisis.

South Korea has scheduled an impeachment vote on its president, Yoon Suk Yeol, after he declared martial law.

Salesforce.com CRM reported solid bookings even as its earnings missed expectations.

Chipmaker Marvell Technology MRVL gave a profit and sales outlook above Wall Street estimates.

Identity-management company Okta OKTA reported better-than-expected results.

General Motors GM said it’s going to take writedowns and impairments of more than $5 billion due to its China business .

Best of the web

Convert of doom: MicroStrategy and the dark arts of ‘volatility arbitrage.’

Trump weighs replacing Hegseth with DeSantis for defense secretary.

Welcome to the post-American new world disorder , a piece which was written ahead of the South Korean turmoil.

The chart

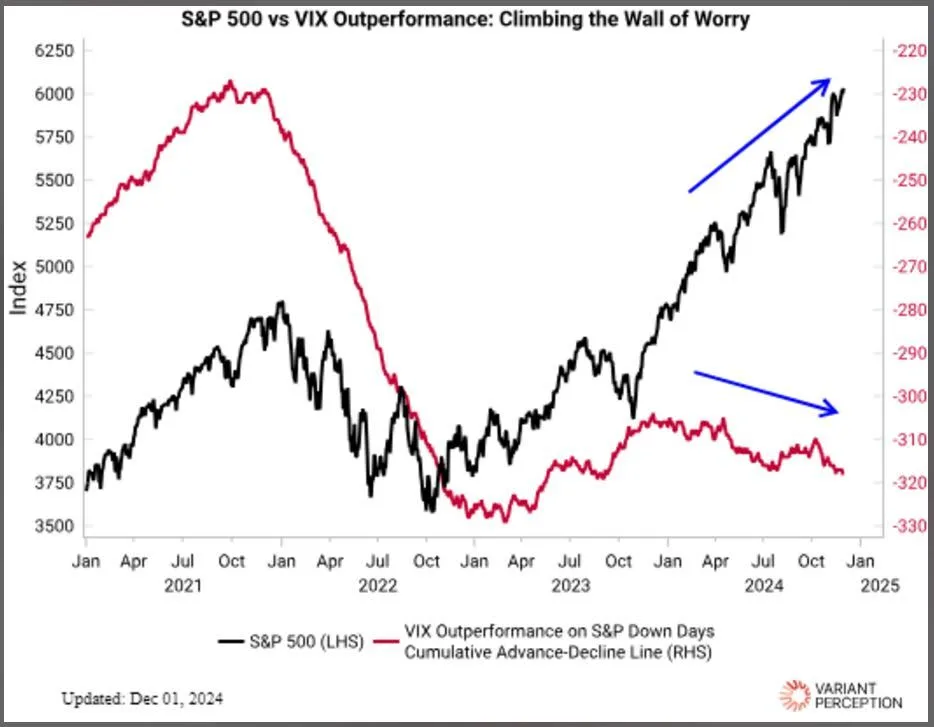

An interesting chart from Variant Perception – they charted the VIX outperformance on days when the S&P 500 went down, vs. the S&P 500. Their conclusion was that in 2021 and 2023, the markets climbed a wall of worry, but in 2024, this stopped happening – “showing a lack of desire to hedge, even after the August vol event.”

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

TSLA |

Tesla |

|

GME |

GameStop |

|

PLTR |

Palantir Technologies |

|

SMCI |

Super Micro Computer |

|

MSTR |

MicroStrategy |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

AAPL |

Apple |

|

AMZN |

Amazon.com |

|

NIO |

Nio |

Random reads

The instant reaction to martial law being declared in South Korea: instant noodle sales surged.

A painting over a New Hampshire bakery turns into a free-speech battle.

Today is America’s greatest holiday, National Cookie Day , and plenty of freebies abound.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple .