The world's largest asset manager says it's not too late to turn bullish on US stocks heading into 2025.

In its outlook for the new year, BlackRock upgraded its "Overweight" rating on US stocks, turning even more bullish than its prior recommendation even as the S&P 500 trades at all-time highs.

The firm was previously "+1" overweight relative to "Neutral" and is now "+2" overweight, with its highest overweight rating being "+3."

BlackRock's recommendation to stay "pro-risk" toward US stocks is the opposite of Bank of America strategist Michael Hartnett, who recommended this week that investors should bet on international stocks in 2025 due to the fear that America's exceptionalism trade is about to end.

But BlackRock isn't buying it.

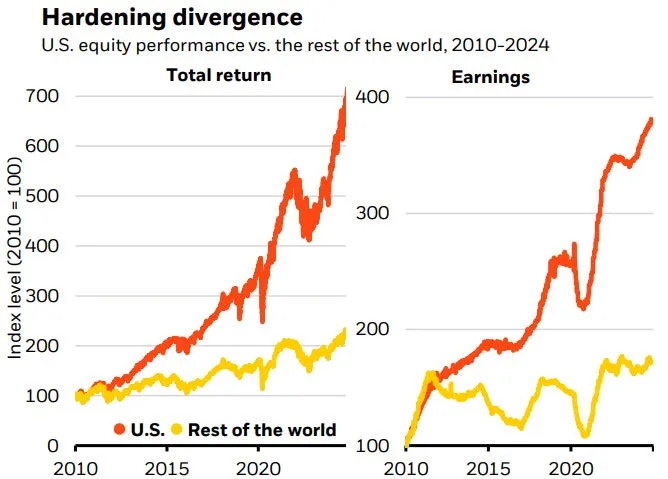

"U.S. equities have persistently outpaced their global peers," BlackRock's Investment Institute wrote in their 2025 outlook. "We think that could continue."

The driving force behind BlackRock's doubling down on the US stock market rally to continue is the belief that "mega forces" like artificial intelligence are disproportionately set to benefit American companies.

"We think the AI mega force will benefit U.S. stocks more and that's why we stay overweight, particularly relative to international peers such as European stocks," BlackRock said.

The firm also believes potential tax cuts and an easing regulatory environment under the incoming Donald Trump administration should support continued economic growth.

One top concern for US stock market investors has been valuations, which, based on metrics like price-to-earnings ratios, are hitting historical extremes.

However, BlackRock dismissed the valuation concern by highlighting that the US economy looks a lot different than it did in the past, as technology and services take center stage at the expense of manufacturing.

"The equity market's changing sectoral composition reflects the transformation taking hold. So, comparing today's index to that of the past is like comparing apples to oranges," BlackRock said.

Valuation measures have also proven to be a poor timing tool for getting in or out of the stock market, the firm said.

"We are risk-on for now but stay nimble."

The firm said factors that could force it to change its bullish tune include a significant surge in long-term bond yields or an escalation in trade protectionism.

Read the original article on Business Insider