(Bloomberg) -- President-elect Donald Trump’s pick of a crypto proponent to be the next head of the US securities regulator lifted Bitcoin to $100,000 for the first time as traders warmed to the prospect of relaxed regulations.

Listen and follow The Big Take daily podcast on Apple Podcasts, Spotify or wherever you listen.

The digital asset rose as much as 6.1% to $103,801 on Thursday. The crypto market overall has jumped by roughly $1.3 trillion since Trump’s election victory on Nov. 5 on a platform that includes a tight embrace of the crypto sector.

Trump selected Paul Atkins to replace outgoing Securities & Exchange Commission Chair Gary Gensler, who cracked down on digital assets after a 2022 market rout exposed fraudulent practices and sparked costly blowups.

The announcement ended a period in which Bitcoin had flirted with the $100,000 level, but failed to break through, after rallying to a fresh record following Trump’s win.

‘Turning Point’

“This is a momentum rally,” said Jason Titman, chief executive of crypto brokerage Swyftx. “Global spot volumes are above mid-pandemic levels and the nomination of Paul Atkins as SEC chair just added to the carnival atmosphere.”

Bitcoin on Nov. 22 was less than $300 from achieving $100,000 but fell back while remaining in sight of the landmark level. Crypto’s adherents view the six-figure number as a validation of controversial claims that Bitcoin is a modern-day store of value and a hedge for inflation risk. For critics, the digital asset lacks any fundamental value and is too exposed to speculative whims.

“Today’s milestone marks a turning point in Bitcoin’s journey from a niche asset to a mainstream financial instrument,” Binance Chief Executive Officer Richard Teng said in an emailed statement.

Bitcoin traded at around $103,000 at 8:54 a.m. in New York on Thursday. The picture was more mixed for smaller tokens, with Ether advancing about 2% and coins like Avalanche and XRP down slightly.

ETF Demand

US exchange-traded funds for Bitcoin have attracted a net inflow of about $32 billion this year, including over $8 billion since Trump became president-elect, data compiled by Bloomberg show. The combined trading volume for digital assets and related derivatives across centralized exchanges climbed to a record of more than $10 trillion last month, according to CCData.

Trump has vowed to undo a Biden administration clampdown on digital assets, install friendly regulators and turn the US into the global home of crypto. The Republican even backed the idea of a strategic national Bitcoin reserve, though there are doubts over whether the latter objective is feasible.

Trump used to be a crypto skeptic but pivoted as the sector unleashed an election campaign war chest to further its interests.

“Investors must remember that an asset doesn’t go up in a straight line forever,” said Josh Gilbert, market analyst at eToro. “Drawdowns for Bitcoin are par for the course, but it feels like it’s going to take something big to slow down Bitcoin right now.”

Mt. Gox

Meanwhile, the bankrupt Mt. Gox crypto exchange on Thursday moved more than $2.4 billion worth of Bitcoin to an unnamed digital-asset wallet, according to blockchain intelligence company Arkham Intelligence. Mt. Gox activity sometimes raises concerns about a supply overhang from creditors looking to sell returned Bitcoin, but traders appeared to shrug off the transfer.

The crypto market outside of Bitcoin was mixed. Meme-crowd favorite Dogecoin rallied, Ether was steady and XRP retreated. The pattern of trading indicated investors were diverting some funds to market-leader Bitcoin.

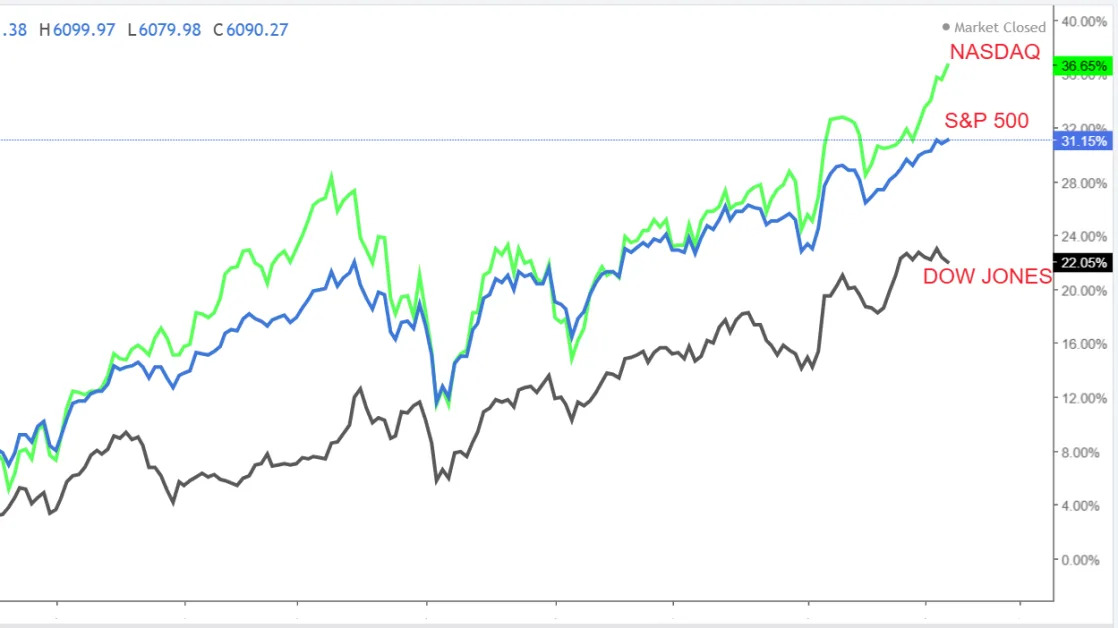

There was little spillover into broader markets from Bitcoin’s historic advance. Global stocks and Treasury yields treaded water, while a dollar index dipped.

Listen to the Next Africa podcast on Apple, Spotify or anywhere you listen

(Updates the price of Bitcoin.)