After playing hide-and-seek over the past couple of weeks, Bitcoin finally crossed the historic $100,000 milestone for the first time, driven by optimism for a cryptocurrency-friendly regulatory environment under President-elect Donald Trump. Growing institutional interest, the launch of ETFs and option trading approval also led to a solid run. The world's largest cryptocurrency is now up more than 140% in 2024 and 48% since the election.

Amid the rally, Bitcoin ETFs also saw smooth trading this year. We have highlighted five ETFs that are leading the way since their inception this year. These are

Grayscale Bitcoin Trust ETF

GBTC,

BlackRock iShares Bitcoin Trust

IBIT,

Fidelity Wise Origin Bitcoin Trust

FBTC,

ARK 21Shares Bitcoin ETF

ARKB and

Bitwise Bitcoin ETF

BITB.

With the astounding surge, investors are concerned about whether the rally will continue or not. Let's dive into the facts below:

Trump Era

President-elect Donald Trump has ushered in a new era of friendlier U.S. regulation for crypto. Trump vowed to make the United States “the crypto capital of the planet.” In the latest move, Trump nominated Paul Atkins as chair of the Securities and Exchange Commission, fulfilling his most important campaign promise to the crypto industry. Atkins was seen as a crypto-friendly pick for the position (read: Bitcoin Nears $100K: ETFs to Ride on Its Unstoppable Rally).

Other key developments, including Elon Musk heading the newly established Department of Government Efficiency and plans for a dedicated White House crypto policy role, fueled the remarkable rally. Trump also plans to build a national Bitcoin reserve, signaling a strong personal and policy interest in digital assets.

ETFs Launch

The approval of U.S.-listed Bitcoin ETFs earlier this year played a significant role in Bitcoin’s rise. These funds, which were previously blocked by the SEC due to investor protection concerns, have allowed a wide range of investors to gain exposure to Bitcoin without directly owning the asset, thereby underscoring the potential growth of cryptocurrency in mainstream investment platforms. Investors are pouring a record amount of capital into Bitcoin ETFs.

After seeing record inflows of about $6.4 billion in November, Bitcoin ETFs saw $1 billion in inflows in the initial days of December. This reflects growing confidence in Bitcoin ETFs as mainstream adoption increases.

Options trading for spot bitcoin ETFs also went live on Nov. 19, with BlackRock being the first to launch options trading for BlackRock iShares Bitcoin Trust (IBIT). Grayscale and Bitwise will follow suit. Grayscale has initiated options for its Grayscale Bitcoin Trust (GBTC) and its Bitcoin Mini Trust (BTC), whereas Bitwise will soon debut option trading on Bitwise Bitcoin ETF Trust (BITB). Other Bitcoin ETFs, such as Fidelity Wise Origin Bitcoin Fund (FBTC) and the ARK 21Shares Bitcoin ETF (ARKB), are expected to have options available soon.

Institutional Investing

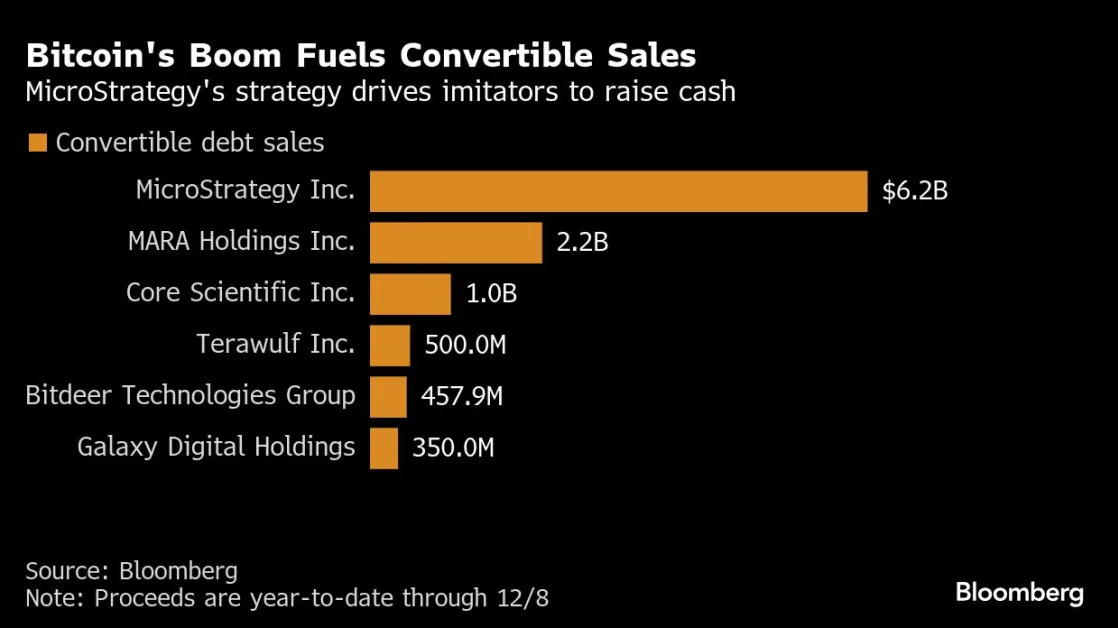

MicroStrategy (MSTR) is on a buying spree for Bitcoin. It added 15,400 bitcoins to its holdings, spending $1.5 billion between Nov. 25 and Dec. 1. This follows purchases of more than 27,000 Bitcoin between Oct. 31 and Nov. 10. MicroStrategy now owns around $30 billion in Bitcoin. This has bolstered enthusiasm in the cryptocurrency markets.

More Upside in the Cards?

With the United States adopting pro-crypto policies, other countries are also shifting toward a more favorable stance. Notably, China has lifted restrictions on personal crypto ownership, marking a significant policy change. Meanwhile, Brazil and Russia are exploring the use of Bitcoin as part of their reserves, highlighting its expanding role in the global economy. Analysts, drawing from historical post-halving performance, project that Bitcoin could reach a peak of approximately $150,000 by 2025 (read: Bitcoin to Hit $2,00,000 in 2025? ETFs in Focus).

As such, the cryptocurrency market is witnessing a surge in optimism as governments and institutions worldwide increasingly embrace blockchain technology. This shift is paving the way for broader adoption and investment in digital assets, fueling expectations of sustained growth in the years ahead.

Let us delve into the abovementioned ETFs in detail:

Grayscale Bitcoin Trust (GBTC) – Up 119.4%

Grayscale Bitcoin Trust is the first Bitcoin ETF that enabled investors to gain exposure to Bitcoin in the form of security while avoiding the challenges of buying, storing and safekeeping Bitcoin directly. It owns and passively holds actual Bitcoins through its Custodian, Coinbase Custody. Grayscale Bitcoin Trust has an AUM of $20.8 billion and charges 1.50% in annual fees from investors. It trades in an average daily volume of 4 million shares and is a cheaper version of Bitcoin.

BlackRock iShares Bitcoin Trust (IBIT) – Up 119%

iShares Bitcoin Trust seeks to reflect the performance of the price of Bitcoin. It enables investors to access Bitcoin within a traditional brokerage account. The fund charges 25 bps in annual fees from investors. IBIT has an AUM of $48 billion and trades in an average daily volume of $44 million shares (read: November Turns S&P 500's Best Month in 2024: ETF Area Winners).

Fidelity Wise Origin Bitcoin Trust (FBTC) – Up 112%

Fidelity Wise Origin Bitcoin Trust also offers exposure to the price of Bitcoin without buying Bitcoin directly in brokerage, trust and tax-advantaged accounts. It has accumulated $19 billion in its asset base. It charges 25 bps in annual fees and trades in an average daily volume of 6 million shares.

ARK 21Shares Bitcoin ETF (ARKB) – Up 111.4%

ARK 21Shares Bitcoin ETF has amassed $4.7 billion in its asset base. It seeks to track the performance of Bitcoin, as measured by the performance of the CME CF Bitcoin Reference Rate – New York Variant. It has an expense ratio of 0.21% and trades in a volume of 1.6 million shares per day on average.

Bitwise Bitcoin ETF (BITB) – Up 111.2%

With an AUM of $4 billion, Bitwise Bitcoin ETF invests directly in Bitcoin and is easily accessible from a brokerage account. It has the lowest fees among spot Bitcoin ETFs at 0.20% and trades in a volume of 2.6 million shares per day on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research