MIAMI BEACH, Fla. – Prominent industry stakeholders are cautioning that the 2025 growth rate in air cargo volumes could be cut by half, or more, from this year’s elevated levels. The prognostications coincide with data showing demand momentum for air cargo continued in November, traditionally a super busy month when traffic reaches its high point of the year.

Expectations for air cargo heading into 2024 were for 1% to 2% growth. After 12 consecutive months of double-digit gains and elevated yields, many air logistics professionals are looking for the good times to continue rolling.

But in a quarterly analysis issued Monday, Denmark-based logistics giant DSV said it expects air cargo volumes to be flat in 2025 compared to this year as businesses fully adapt to ocean supply chain disruptions that pushed more freight to air and cross-border e-commerce tapers off. If the prediction pans out, it would mark a significant change from the 11% year-over-year air traffic growth so far in 2024. It would also follow the 15-to-20-month cycle that is normal for the air cargo sector.

DSV projected the surge in e-commerce demand from Chinese marketplaces will slow because many markets are saturated with sellers and governments like the United States are preparing stricter customs regulations for low-value shipments that skirt import duties and compliance requirements.

Tightening eligibility of Chinese parcel shipments that currently qualify for duty-free status could reduce airfreight volumes to some degree next year and beyond, but Chinese sellers like Temu, Shein and AliExpress are already adjusting their fulfillment models to ship frequently ordered products by ocean and distribute them from U.S. warehouses, said Kathy Liu, executive vice president for marketing and sales at Dimerco, a Taiwan-based logistics company, on the Freight Buyers Club podcast .

Freight analytics firm Xeneta is forecasting air cargo demand will grow 4% to 6% next year, depending on the trade lane, while capacity increases in the 4% to 5% range.

Volatile geopolitical factors and widespread tariffs threatened by President-elect Donald Trump could create headwinds for air cargo in 2025. In the short term, businesses are expected to rush imports before Trump takes office and can implement tariffs early next year. Economists say the higher price of goods could decrease demand. Anticipated U.S. reforms of customs rules governing easy access to low-value parcel shipments could cause a drag on e-commerce flows from China as import fees go up. And China’s gross domestic product will fall to 4.6% in 2025, after missing the government’s 5% target this year, S&P Global estimates.

Air logistics stakeholders also express concern that a tight capacity situation for main-deck freighters could get worse with the impending retirement of older aircraft due to age restrictions, manufacturing struggles that are slowing freighter deliveries and regulatory delays in approval for Boeing 777-300 passenger-to-freighter conversion programs.

There is also less capacity between China and Europe after British Airways, Lufthansa, SAS and Virgin Atlantic reduced passenger frequencies and abandoned routes because of higher costs associated with increased flight time to detour around Russian airspace , which was closed to Western carriers after the invasion of Ukraine. Starting in January, KLM will reduce daily flights to China .

The supply situation will limit air cargo volumes next year, predicted Ryan Keyrouse, the CEO and co-founder of strategic consultancy Rotate.

Air cargo capacity next year will grow at a maximum rate of 4.4% – not counting any aircraft retirements, he said in a presentation at The International Air Cargo Association’s trade show here last month. Airlines will delay freighter retirements as much as possible in the current environment of high yields and low fuel prices, but there won’t be enough freighters to meet demand, he elaborated in an email exchange.

“Given belly capacity is not always added on cargo-relevant routes, and because there’s a limit to how much airlines can shift capacity around, we believe demand growth will be below capacity growth,” he told FreightWaves. By Rotate’s criteria, that would likely mean growth in airfreight traffic of less than 4%.

On the plus side, air cargo could benefit from a looming strike in mid-January by U.S. dockworkers on the East and Gulf coasts concerned about port management’s interest in partially automating container operations. Businesses are expected to redirect critical shipments to air carriers if negotiations remain stalled.

And while changes to de minimis regulations could negatively impact e-commerce, they also could result in a stronger first half for air cargo if shippers pre-buy inventory to avoid potential duties. And developing markets where e-commerce penetration is less mature will provide significant growth potential for air cargo as major online retailers target Latin America, Southeast Asia and the Middle East, Keyrouse said at the event.

“While 2024 is shaping up to be a banner year for air cargo, we must look to 2025 with some caution. The incoming Trump Administration’s announced intention to impose significant tariffs on its top trading partners — Canada, China and Mexico — has the potential to upend global supply chains and undermine consumer confidence. The air cargo industry’s proven adaptability to rapidly evolving geopolitical and economic situations is likely to be tested as the Trump agenda unfolds,” said Willie Walsh, director general of the International Air Transport Association, in a news release on Tuesday.

Has growth peaked?

Volumetric weight moved by airlines was 10% higher in November than in the prior year, extending the streak of double-digit gains each month since last December, according to new data from Xeneta. But there are hints growth may be slowing before it normally does in mid-December as global tonnage growth in the last week of November was flat from the prior week, WorldACD reported.

(IATA, which calculates demand differently and reports a month later than others, said October air cargo traffic increased 9.8% year over year vs 11% per Xeneta.)

Air logistics executives previously anticipated a muted peak season because demand was already elevated by diversions from unreliable ocean shipping, businesses frontloading orders to minimize potential shipping delays and the constant fire hose of e-commerce exports from China regardless of season. In fact, carriers on major routes out of China report they are busy but not overwhelmed.

Cargo capacity is only up about 3% in the fourth quarter compared to the same period last year. Utilization of all-cargo aircraft is exceptionally high, and they are nearly always fully loaded on the main headhaul routes from Asia to North America and Europe. Despite the wide imbalance between supply and demand, the market has been quite stable, without the chaotic scramble for shipping space seen a year ago.

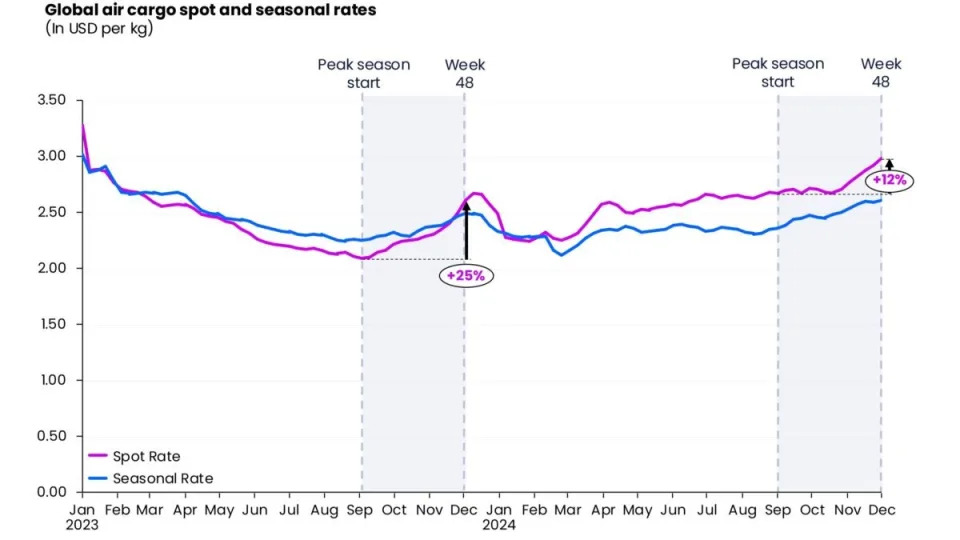

Faster demand than supply growth contributed to global short-term air rates in November reaching their highest level in nearly two years at $2.90 per kilogram, the sixth consecutive month of double-digit year-over-year growth, Xeneta reported. Spot rates are outpacing contract rates.The persistent supply-demand balance pushed load factors, a measure of capacity utilization, to 63% – the highest level in more than 30 months.

Rate pressure is strongest out of North American and European markets, largely due to airlines reshuffling cargo fleets to take advantage of high demand and yields in the Asia-Pacific region.

Westbound trans-Atlantic rates were up 8% weekly, while eastbound trans-Pacific rates to North America flattened, according to WorldACD. More specifically, the average rate from China to North America actually dipped 4% week over week to $6.62 per kilogram, while China-Northern Europe weekly prices fell 10% – a function of the aircraft additions and businesses planning ahead to adjust their shipping schedules, said Freightos, a freight marketplace and pricing index.

WorldACD noted that trans-Atlantic capacity has fallen 3% annually in the past three weeks behind a 10% drop in freighter capacity. Another reason that Asia Pacific rates have softened is that more forwarders this year locked in bookings before the peak season, leaving less freight susceptible to the volatile spot market.

Niall van de Wouw, chief airfreight officer at Xeneta, attributed the lack of chaos to better inventory management and advance preparations by carriers and freight forwarders.

“Shippers got better prepared setting up terms and conditions to make sure they [booked capacity earlier] and we don’t see the crazy rates we saw last year. I think it’s a big compliment to the industry that they’re able to move these kinds of volumes under these kinds of rates for businesses and consumers around the world,” he said Tuesday on a webinar hosted by logistics provider Flexport.

E-commerce effect

E-commerce has been the driving force behind air cargo’s growth in the past 15 months, with more than half of all air exports from China generated by online marketplaces, according to experts and logistics providers. Global e-commerce sales have doubled over the past five years to more than $6 trillion and continue to grow about 8% annually, with the fast growth in the emerging markets of South Asia and Southeast Asia, research from eMarketer shows. It projects business-to-consumer e-commerce sales to reach $8 trillion in 2027 and represent more than 22% of total retail sales.

But the e-commerce wave is also masking declines in other air cargo commodities, such as automotive parts and pharmaceuticals, that have begun shifting to ocean transport, said Adriaan den Heijer, executive vice president Air France-KLM Cargo, on the Flexport webinar.

“If you take out the impact of the Red Sea [shipping closure] and e-commerce, there’s a very small percentage remaining of traditional B2B airfreight,” van de Wouw added.

RELATED READING:

E-commerce to drive air cargo industry expansion through 2043

‘No big bang’ for peak season air cargo business

Lufthansa Cargo bolsters China partnerships as trade grows

The post Analysts predict air cargo bull market will cool 50% in 2025 appeared first on FreightWaves .