Groucho Marx famously quipped, “I refuse to join any club that would have me as a member,” and that sprung to mind reading one strategist’s lament.

“Now that ‘consensus’ has become that everything President-elect Trump does is ‘just a start’ to his bargaining, I’m a little concerned that the market has become a little too complacent. Yes, we were arguing for this view, but it is surprising how quickly it seems to have morphed into a consensus trade,” says Peter Tchir of Academy Securities.

Consensus also has settled on their view of the U.S. stock market for 2025. Not a single forecast from the sell-side is calling for the stock market to weaken. The median Wall Street target is for the S&P 500 to advance to 6,600, which is a 9% rise from current levels, according to MarketWatch’s tabulation.

Strategists at Mizuho Securities USA led by Steven Ricchiuto say that projected rise would keep price-to-earnings multiples in the 23 to 24 times range that is considered expensive, but not terribly overvalued.

“This continued bull market call appears realistic, especially if you believe inflation will remain below 3%. This would allow the Fed to remain focused on gradually cutting the Fed funds rates toward 4%, which the futures market is currently discounting,” they say.

Arguably, they say, strategists are actually somewhat cautious given the projected rise in earnings. They do say there’s good reason for that apprehension, given the market has outpaced earnings in each of the last two years, and Trump’s ambitious agenda could risk sparking inflation.

“Rising long-term rates and a reinversion of the curve at a higher level of rates is the critical risk to the financial markets in 2025,” they say.

If growth accelerates against a labor market already at full employment, there’s risk of pushing domestic inflation up, and a weaker currency would dampen global goods deflation.

The markets

Trump’s latest tariff threat set a mild risk-off tone: U.S. stock futures ES00 NQ00 were lower, bond yields BX:TMUBMUSD10Y rose, the dollar DXY gained and gold GC00 fell. French stocks and bonds were hit by the country’s own political difficulties.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

6032.38 |

1.41% |

5.73% |

26.47% |

32.06% |

|

Nasdaq Composite |

19,218.17 |

1.30% |

6.21% |

28.02% |

35.09% |

|

10-year Treasury |

4.216 |

-6.30 |

-7.30 |

33.51 |

-4.27 |

|

Gold |

2660.9 |

1.31% |

-3.09% |

28.43% |

29.91% |

|

Oil |

68.71 |

-0.54% |

-4.16% |

-3.67% |

-6.25% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

A busy weekend on the politics front: President-elect Donald Trump threatened a 100% tariff rate on the BRICS countries if they seek to replace the U.S. dollar, as he also held what appeared to be inconclusive talks with Canadian Prime Minister Justin Trudeau and nominated Kash Patel to the as-yet not-vacant job of director of the Federal Bureau of Investigation .

President Joe Biden pardoned his son, Hunter , after previously promising not to.

A big day on the U.S. economics calendar includes the release of the Institute for Supply Management’s manufacturing index as well as a speech at 3:15 p.m. from Fed Gov. Christopher Waller. New York Fed President John Williams is due to speak after the close, at 4:30 p.m.

Intel INTC announced the immediate retirement of CEO Pat Gelsinger, and turned to two executives as interim co-CEOs. Intel shares jumped on the move.

Stellantis shares STLA slumped as the CEO of the Chrysler maker, Carlos Tavares, resigned.

PG&E PCG priced $2.4 billion worth of stock and convertible bond offerings.

Best of the web

Corporate America launches unorthodox campaign to gain Trump’s attention.

France riled by Trump pick of Charles Kushner as Paris envoy.

Why did Syria’s civil war reignite?

The chart

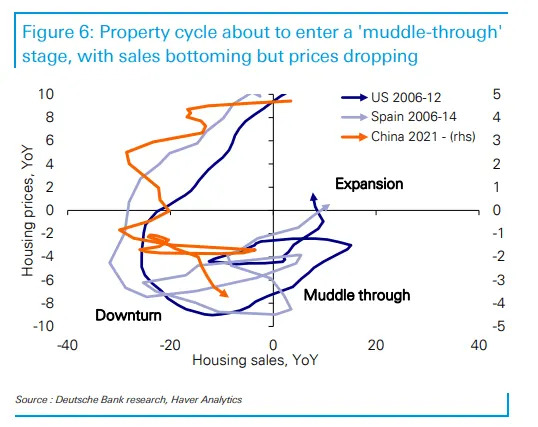

On a day China’s government bond yields fell to a record low, here’s what amounts to optimism. China’s housing market is about to enter the ‘muddle through’ stage of the cycle — where sales will bottom but prices drop, says Yi Xiong, Deutsche Bank’s chief economist there. He’s forecasting 4.8% GDP growth this year and 4.6% next year, along with a 10% tariff hike from the U.S. in the first half of the year and another 10% in the second half.

Top tickers

Here were the top performing stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

MSTR |

MicroStrategy |

|

PLTR |

Palantir Technologies |

|

SMCI |

Super Micro Computer |

|

AMC |

AMC Entertainment |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

AMZN |

Amazon.com |

|

RKLB |

Rocket Lab USA |

Random reads

‘Brain rot’ is Oxford’s word of the year.

Perhaps relatedly to the above item, Costco is going to stop selling books .

There are caffeine jolts, and then there’s an 11-foot-high iced latte.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple .