(Bloomberg) -- Gold eked out small gains as the dollar extended losses after the latest US data showed a key inflation gauge picked up last month, reinforcing expectations that the Federal Reserve will adopt a measured approach to lowering interest rates.

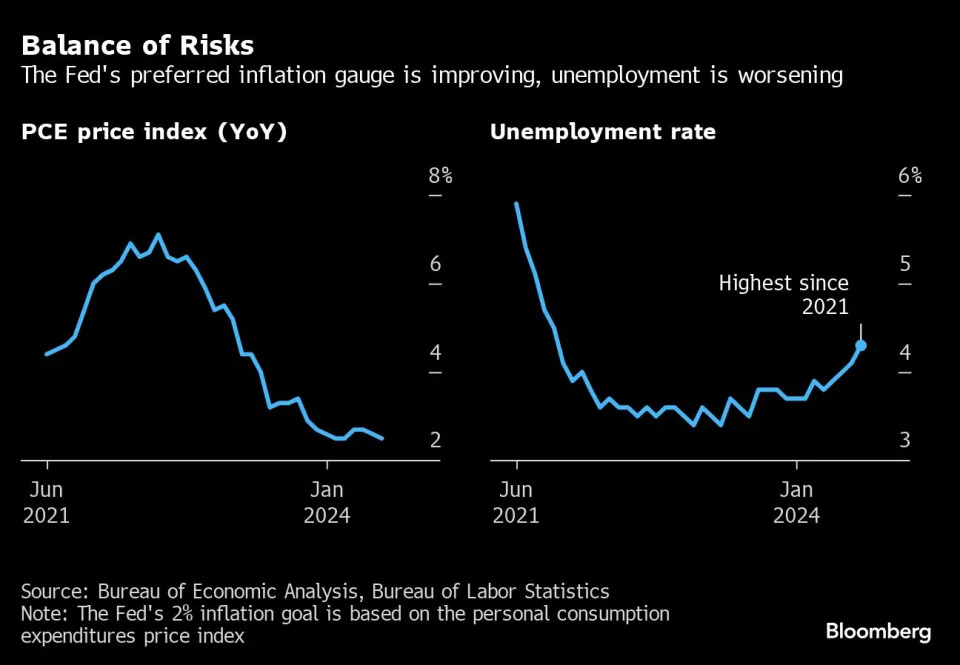

The Fed’s preferred measure of underlying inflation — the so-called core personal consumption expenditures price index — increased 2.8% from October last year and 0.3% from a month earlier, according to Bureau of Economic Analysis figures published Wednesday. The price index strips out volatile food and energy items.

The print came after policymakers indicated in the minutes of their November meeting their support for a careful approach to rate cuts. Lower rates typically benefit bullion as it pays no interest.

Data earlier Wednesday also showed the US economy expanded at a solid pace in the third quarter, largely powered by a broad-based advance in consumer spending and steady business investment. Separate figures showed initial jobless claims were little changed and pending sales of US homes unexpectedly rose.

Spot gold rose 0.3% to $2,641.11 an ounce as of 10:46 a.m. in New York. The precious metal is up about 28% this year.

Gold fell earlier in the week, as Israel and Lebanese militant group Hezbollah came to an agreement on a 60-day suspension of hostilities, which started early Wednesday. Easing geopolitical tensions typically weigh on gold, diminishing its appeal as a safe haven asset.

Silver and palladium dropped on Wednesday, while platinum rose. The Bloomberg Dollar Spot Index declined about 0.5%.

--With assistance from Jason Scott and Jack Ryan.