Cryptocurrencies like Bitcoin (CRYPTO: BTC) have absolutely taken off since Election Day. Investors are betting that a lighter and friendlier regulatory environment under the Trump administration will continue to boost the sector to new highs. Additionally, crypto is getting more exposure than ever before and many view Bitcoin as a potential hedge to inflation, which could still be an issue next year. Ethereum (CRYPTO: ETH) , the second-largest cryptocurrency in the world, has an interesting relationship with Bitcoin . The two are not the same but are often grouped because they are seen as sector pioneers. The relationship between Bitcoin and Ethereum is now doing something not seen since April 2021, which could trigger a big move for Ethereum.

The Ethereum-Bitcoin Ratio

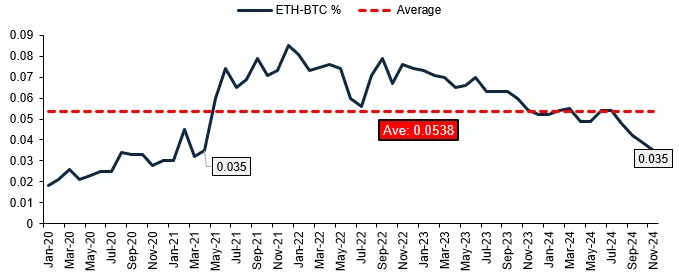

Given their history and the fact that cryptocurrencies can be hard to value because they have no intrinsic value, many investors have looked for trends between the prices of Ethereum and Bitcoin. After all, groups of stocks are often compared to one another to determine relative valuation. A simple way to track Bitcoin and Ethereum is by looking at the relationship between Ethereum's and Bitcoin's prices by dividing the price of Ethereum by the price of Bitcoin. Seeing where this ratio has trended over time can offer clues as to which looks undervalued or overvalued relative to the other.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

As you can see in the chart, the Ethereum-Bitcoin ratio recently fell toward 0.035, the lowest level seen since April 2021. The average ratio dating back to 2020 is 0.0538. Ethereum has performed well since Election Day, up roughly 38% compared to Bitcoin's 44%. However, Bitcoin has widely outperformed this year.

Crypto has held up pretty well during an uncertain time and high-interest-rate environment where investors have -- until recently -- been much more worried about inflation and whether it would slow. Bitcoin has held up remarkably well as investors have grown more confident that the token can hedge against inflation with its finite supply.

Going back to the Ethereum-Bitcoin ratio, the last time it fell to these levels Ethereum rallied 120% during the next two months. Bitcoin and Ethereum trade around the clock, so obviously things can change quickly. The ratio stood at 0.380 on Nov. 30, so Ethereum has already started to close the gap a little.

Can Ethereum rally?

Of course, past trends do not always indicate future success. As you can see in the chart above, the Ethereum-Bitcoin ratio has gone lower before, so it could also move lower now.

However, I think recent trends in the Ethereum-Bitcoin ratio set up favorably for Ethereum, especially if the crypto rally continues. As seen in the stock market this year, markets and sectors tend to broaden over time. A big part of crypto has always been sentiment. Bitcoin and the market have rallied significantly, but it usually takes time for sentiment to peak and then decline again. I don't think the positive sentiment on crypto has topped out yet. The improving regulatory environment could be a tailwind that carries well into 2025, and the more crypto rallies, the more larger investors will be forced to chase it.

Ethereum doesn't hedge inflation like Bitcoin, but it offers value in other ways. Its relatively new proof-of-stake method for validating transactions is much more energy-efficient than Bitcoin. Developers view Ethereum as the prime network for creating decentralized applications and non-fungible tokens, and its smart contract capabilities will likely have use cases in many industries.

Bitcoin and Ethereum are solid long-term crypto assets, in my view, so both can continue to do well. However, given Bitcoin's impressive run already it's possible the rally broadens to other tokens like Ether , although trying to predict near-term price movements of cryptocurrencies is very difficult.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »