It may feel like politics — and the policy implications of Donald Trump’s impending return to the White House — are the only thing driving the markets right now. Get ready for a reality check.

This week’s labor-market data, including the all-important November jobs report due on Friday, carry big implications for the Federal Reserve’s interest rate-cut plans. And that, in turn, will matter very much to stock-market investors, bond traders and everyone else involved in financial markets.

”I think the market would like to see something positive, but not too positive” when it comes to Friday’s jobs numbers, said Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management Co.

“If it’s incredibly positive, then that raises questions about whether the Fed will actually cut rates,” Schutte said.

That could be problematic for a stock market sitting on historically stretched valuations. Optimism for an extended rally into 2025 rests in part on expectations for Fed rate cuts that will help pull down market interest rates and make those valuations more appealing. Higher interest rates make it tougher to justify high valuations because they lower the present value of future profits and cash flows.

Schutte’s point about valuations and the Fed may resonate with investors who know, or lived through, recent stock-market history.

As Nicholas Colas, co-founder of DataTrek Research, observed in a note last week: “Readers of a certain vintage will recall that the 1990s dot-com bubble ended when, in Q1 2000, the Fed made it clear that they would raise short-term rates above their mid-1990s highs” just above 6%.

The bubble popped, Colas said, because neither equity valuations nor investor sentiment were ready for the Fed’s message or hikes that took the fed funds rate to 6.5% by mid-2000.

“Yes, it was a small set of hikes, but they sent the message that the FOMC wanted to slow the U.S. economy. This was enough to chill the market’s animal spirits, and dramatically so,” he wrote, noting that an imminent repeat of that episode wasn’t the base case at DataTrek, which remains positive on the equity outlook.

Fed-funds futures traders have priced in a 66% probability policymakers will deliver a rate cut of 25 basis points, or a quarter of a percentage point, next month, according to the CME FedWatch Tool , following up on a half-point cut in September and a quarter-point cut earlier this month. Those expectations firmed up somewhat after the October personal-consumption expenditures index, the Fed’s preferred inflation gauge, ticked higher but matched economists’ expectations on Wednesday.

The Fed used fears of a further deterioration in the labor market to justify kicking off its monetary easing cycle with an outsize rate cut in September. Federal Reserve Chair Jerome Powell used his speech at an annual symposium in Jackson Hole last summer to draw a line in the sand against further deterioration in the labor market.

Since the Fed began cutting, resilient economic data and those sticky inflation readings have led some investors to look for a potential pause when policymakers meet next month.

For the Fed’s part, minutes from the November meeting released last week showed uncertainty over where exactly the neutral rate lies — the level at which the Fed’s policy rate neither boosts nor slows the economy — and led participants to argue for a more “gradual” pace of cuts.

The problem for the Fed is that plugging the current inflation data into the Taylor Rule — a formula used by economists to gauge where interest rates should be based on inflation levels and economic growth — suggests the fed-funds rate should stay right where it is, said Steve Blitz, chief U.S. economist at TS Lombard, in a note last week.

“While I believe they are still biased to cut, the November payroll data end up being critical for this data-dependent FOMC,” he wrote, referring to the Fed’s rate-setting Federal Open Market Committee.

Meanwhile, stocks are entering December with significant momentum. The S&P 500 SPX rose 1.1% in a week shortened by the Thanksgiving Day holiday Thursday and an abbreviated Friday session, logging its 53rd record close to gain 26.5% on the year. The Dow Jones Industrial Average DJIA briefly topped the 45,000 milestone and ended at a record, while the Nasdaq Composite COMP logged a monthly gain of over 6%.

See: Stocks ride to best month in a year as ‘Red Sweep’ unleashes ‘animal spirits’

Treasury yields offered some relief for any worried equity investors this past, holiday-shortened week, with the 10-year Treasury yield BX:TMUBMUSD10Y retreating nearly 22 basis points to 4.192%, its lowest since Oct. 21. It had jumped to more than 4.5% earlier this month, part of a rise that had taken the yield from around 3.6% in late September.

With bulls feeling the glow of post-election euphoria and upbeat seasonal factors, the near-term risk may be that investors themselves are feeling too good about the market’s prospects.

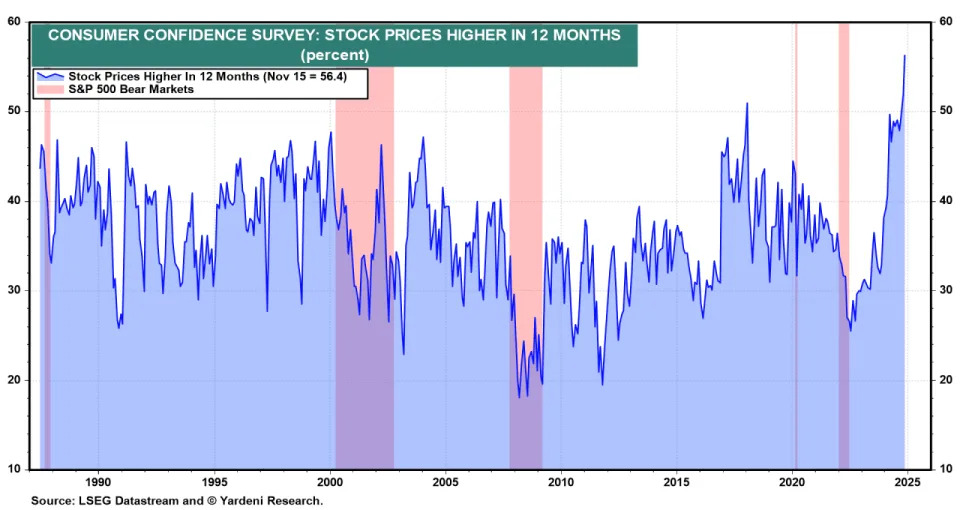

Last week’s November consumer-confidence index survey showed expectations for stock prices to be higher in 12 months at an all-time high, noted economist Ed Yardeni of Yardeni Research, in a note.

“If there’s one thing Americans seem to agree on, it is that stocks are going up…From a contrarian perspective, this suggests that a pullback is likely,” he said (see chart above).

Getting back to the fundamentals, the economic data and the post-election rally aren’t as disconnected as may appear.

“Markets care about real political change, not so much politics,” said Lauren Goodwin, economist and chief market strategist at New York Life Investments, in an interview. “Another way of putting it is that that the trades we think are more durable are those that are backed up by broader economic themes.”

Trump’s victory has investors penciling in stronger economic growth, partly due to expectations for tax cuts and deregulation, lifting stocks. It has also sparked fears of resurgent inflation, lifting bond yields. But it’s important to note that those market moves are also what an investor would expect given resilient economic data and inflation data that’s been coming in a bit hotter than expected.

As Paul Christopher of Wells Fargo Investment Institute told MarketWatch shortly after election day, the Trump trade “is working in the same direction of the dominant trend.”

This week’s jobs data may have something to say about that trend.

See: Stocks are rallying hard as the economy refuses to buckle. Will it last in 2025?