The Dow Jones Industrial Average ascended to the 45,000 level for the first time Friday but failed to close above that threshold as it extended a 2024 rally that’s driven major benchmarks to a series of records.

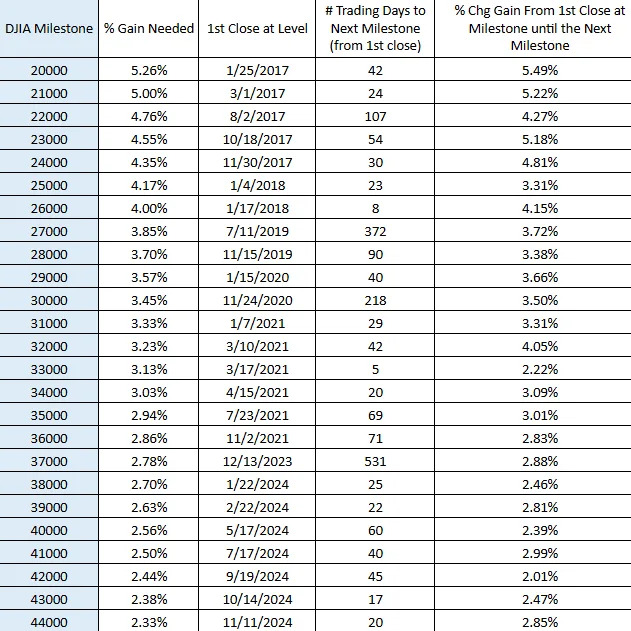

It also underscored the diminished meaning of frequently celebrated 1,000-point milestones as they represent successively less impressive percentage gains.

The 45,000 mark for the Dow is “not necessarily a psychologically important milestone but a barometer of some of the biggest stocks in the U.S. economy leading the broader market as the rising tide does have a tendency to lift all boats,” said JJ Kinahan, chief executive officer of IG North America and president of Tastytrade, in an interview earlier this month.

The Dow DJIA traded as high as 45,071.29 during the abbreviated Friday session and ended the day up 188.59 points, or 0.4%, at 44,910.65. That was good for its 47th record close of 2024, bringing its year-to-date gain to 19.2%. The S&P 500 SPX rose 0.7% for its 53rd record finish of the year, bringing its gain so far in 2024 to 26.5%. The gains came in thin holiday trading conditions, with stock trading closing early at 1 p.m. Eastern after being closed Thursday for Thanksgiving Day.

Had the Dow finished above 45,000, it would have done so just 13 trading days after it first cleared the 44,000 level, on Nov. 11, according to Dow Jones Market Data.

That would’ve been the third fastest move from one 1,000-point milestone to the next on record, even as it would represent a gain of just 2.2%. The fastest was the run between 25,000 and 26,000, which took eight trading days — and represented a gain of 4%.

The Dow tracks the market performance of 30 U.S.-listed large-cap companies. Over the past century, the index has changed its components more than 50 times, most recently swapping Intel Corp. INTC for Nvidia Corp. NVDA as the AI darling cemented its position as the world’s most valuable company.

The weighting of technology stocks within the Dow has increased over the past decades, Kinahan observed in a MarketWatch interview. “In the 1990s, the stocks in the Dow were all about manufacturing and autos, but now it’s changed significantly to reflect the companies that are making the biggest difference in the economy.”

That’s why, as one of the oldest and most commonly followed stock indexes in the world, the Dow’s crossing every thousand-point milestone could generate enthusiasm on Wall Street.

Hitting each 1,000-point milestone was a big deal for the stock market, but it no longer has that much impact given the diminishing percentage gains required to attain each successive target, said Matt Stucky, chief portfolio manager of equities at Northwestern Mutual Wealth Management.

“The way to think about the change in the Dow is percentage gains, not levels,” Stucky told MarketWatch via phone. “Now each additional big round number is less material because the percentages are less than what they were.”

Ever since the Dow surpassed the 40,000 threshold earlier this year, a 1,000-point increase in the index has represented less than a 3% gain, compared with around 5% in 2017 and 10% in the late 1990s, according to Dow Jones Market Data (see table below).

Investors obsessed with big, round numbers may want to widen their sights a bit, perhaps reserving the celebrations for 5,000-point milestones. If so, Dow 50,000 is just a roughly 11% gain away.