JPMorgan has filed for a new ETF that aims to provide exposure to Nasdaq-100 stocks while using options to hedge against market downturns, according to a recent Securities and Exchange Commission filing .

The JPMorgan Nasdaq Hedged Equity Laddered Overlay ETF will invest at least 80% of its assets in equity securities, while employing an options strategy to provide continuous market hedging, according to the filing. The fund represents JPMorgan’s latest expansion of its $165.8 billion ETF business.

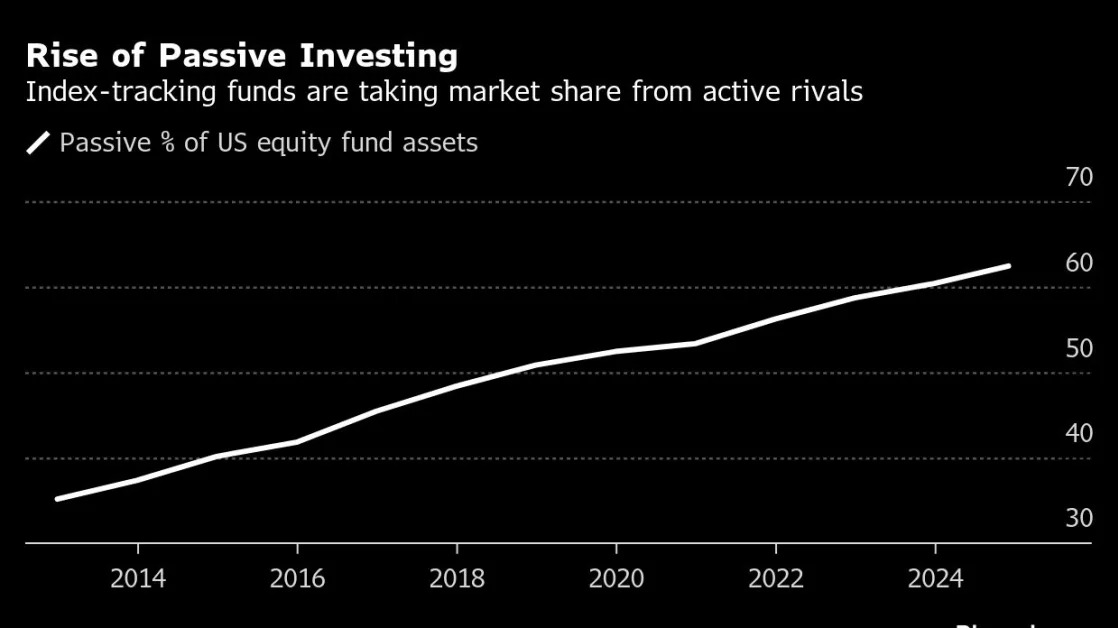

The proposal comes as investors increasingly seek downside protection in their portfolios through options-based strategies, with JPMorgan’s existing options ETFs like the JPMorgan Equity Premium Income ETF (JEPI) attracting $36.1 billion in assets, which highlights the strong demand for ETFs that combine equity exposure with options strategies.

Laddered Options Approach

The fund aims to implement a “laddered” options approach by typically holding positions for three different three-month periods staggered one month apart. This strategy is designed to help mitigate risks associated with having just one hedging period.

According to the filing, the fund will purchase put options at higher strike prices while selling puts at lower strikes, creating spreads that aim to protect against market declines. The fund will also sell call options to offset costs, though this could limit upside potential in rising markets.

“The fund’s investment strategies may not always provide greater market protection than other equity investments, particularly in rising equity markets when the fund is expected to underperform traditional long-only equity strategies,” the filing noted.

The fund will be managed by Hamilton Reiner, Eric Moreau, Andrew Stern, Matt Bensen, and Judy Jansen. The filing did not disclose an expense ratio or name which exchange the fund would trade on.

JPMorgan’s filing comes as the firm continues to expand its active ETF lineup, which includes the $26.9 billion JPMorgan Ultra-Short Income ETF (JPST) , according to etf.com data. Both JEPI and JPST rank among the largest actively managed ETFs in the industry.

Permalink | © Copyright 2024 etf.com. All rights reserved