Real world asset (RWA) tokenization has been growing in popularity among institutions with financial giants such as BlackRock entering the space with their own tokenized assets.

Leveraging blockchain technology, this allows traditional assets to be issued, managed, and distributed more efficiently compared to their off-chain counterparts, especially private and alternative assets.

Security Token Market has covered this space since 2018 and, from tracking 600-plus tokenized products, here are some themes we’re seeing along with their performance.

You're reading Crypto Long & Short , our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

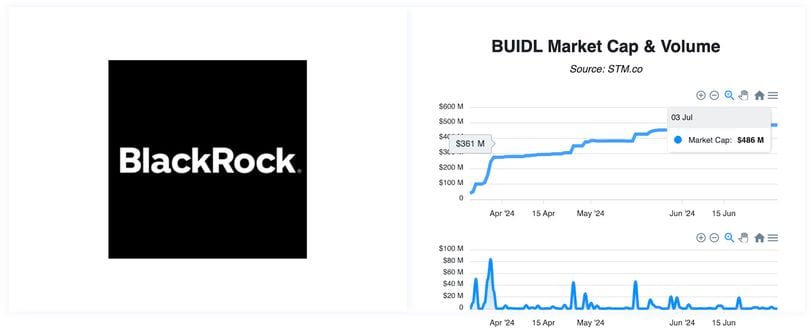

Looking at the talk of town, the BlackRock USD Institutional Digital Liquidity Fund ( $BUIDL ) is a prime example of an asset institutions are increasingly deploying into: tokenized money market funds. BUIDL saw a 5.93% increase in net inflows closing out June 2024 at $483,311,326.32 in AUM.

How is putting a fund like this on-chain worth the effort?

One answer is because of the utility that comes with it. Issued on the Ethereum public blockchain via Securitize, this token was recently used as collateral on prime brokerage FalconX to secure loans and collateralize derivatives positions.

Meanwhile, in venture capital, Mike Reed from Franklin Templeton shared an anecdote at TokenizeThis 2024 where a venture capitalist mentioned wanting to use their tokenized money market fund ( $BENJI ), to fund portfolio companies. The idea here is that he can directly send his company a yield-generating asset to hold in their treasury and theoretically see how the money is used thanks to the power of blockchain.

Of course there are other examples of cost savings and utility being uncovered through both proofs of concept and in-production use cases. Here are a few:

-

Broadridge reports $1M savings for every 100K repo transactions

-

Through a Project Guardian proof of concept, Onyx by JPMorgan reports cutting rebalancing portfolios from 3,000 steps to a few clicks of a button (assuming 100,000 discretionary portfolios)

-

The proof-of-concept above also resulted in eliminating cash drag from discretionary portfolios by around 18% annually through the use of smart contracts.

-

Figure has tokenized $7B+ worth of HELOCs. By issuing, warehousing and securitizing them, they’ve saved 150 bps out of the process. These savings go to the issuer and the end investor.

-

Hashnote’s USYC product is looking to work with Broadridge to access the intraday market (primarily for banks), boost their yield, and then pass on to their customers.

Keeping these use-cases in mind, what kinds of assets are being tokenized? Security Token Market covers on-chain equity, fund LP units, real estate, debt, and more.

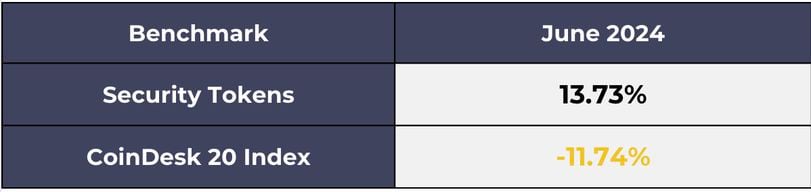

Taking from STM’s RWA Securities Market Update - June 2024 report, a hypothetical security token bundle of all STM-tracked RWAs outperformed the CoinDesk 20 Index, closing out June 2024 at +13.73% versus the index’s -11.74%. The drop in the crypto market could be attributed to macroeconomics as there are expectations of fewer rate cuts .

This paired with spot bitcoin ETF net outflows creates negative sentiment in the crypto space, impacting bitcoin’s price and therefore other cryptocurrencies’ in the CoinDesk 20. With that in mind, the STM Team will also compare performance throughout June 2024 by asset class: see here for our latest research report.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.