In a year that continues to demonstrate crypto's volatility and uncertainty, the prospects for Bitcoin remain strong despite a historically normal summer of stagnation, according to Fundstrat’s Head of Digital Asset Strategy Sean Farrell.

Farrell joined Coinage this week to reiterate his bullish outlook, forecasting that Bitcoin could still hit $115,000 by the end of 2024. This optimism is grounded in a mix of historical patterns, current market dynamics, and the evolving landscape of digital assets.

"Everybody's pretty bearish, but it does seem to me like the bull case is pretty straightforward," he said. "The Fed has pivoted, we have inflation falling, employment and jobs data is still non-recessionary, so in my view the bull case is more easily explained than the bear case."

Of course, Bitcoin’s recent price action has been choppy, with the cryptocurrency sliding from around $62,000 to $58,000 in a matter of days. Farrell attributes this volatility largely to seasonality and a low-liquidity environment that has persisted through much of the summer.

"We've seen a lot of choppy price action," he explains, noting that the summer months typically bring lower trading volumes, which can exaggerate price movements. This seasonal sluggishness, he suggests, is not entirely unexpected and aligns with Bitcoin’s historical performance, where September often proves to be a challenging month.

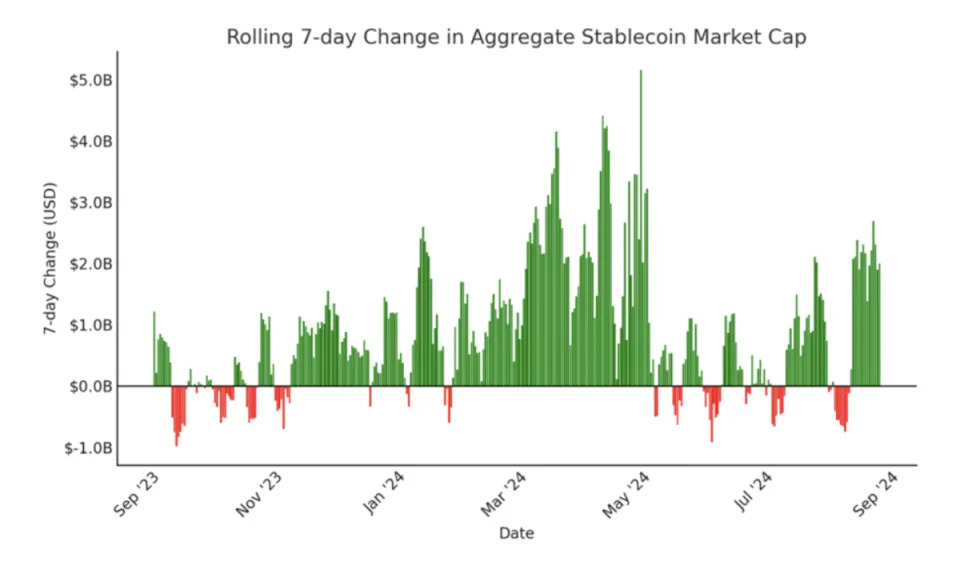

Despite the current lull, Farrell remains confident about Bitcoin's trajectory. His optimism is bolstered by several factors, including the ongoing influx of stablecoins into the market. Stablecoin issuance, often seen as a precursor to capital inflows into the broader crypto market, has been on the rise, hitting new all-time highs.

Farrell points out that while the impact of these inflows on Bitcoin's price has yet to fully materialize, the underlying trend is positive. "Stablecoin inflows are a huge, high-signal variable," he says, emphasizing that these movements from fiat into the crypto economy are often a harbinger of future price appreciation.

However, Farrell acknowledges that there are risks on the horizon. These include potential geopolitical tensions, the possibility of a stag-flationary environment re-emerging, and the ongoing challenges within the Ethereum ecosystem, particularly concerning Layer 2 solutions. Yet, even with these concerns, he believes the overall market structure remains supportive of higher Bitcoin prices.

As the year progresses, Farrell advises keeping an eye on the seasonal patterns and macroeconomic indicators that could influence Bitcoin's price. He suggests that the latter part of the year, particularly after the summer doldrums, could bring renewed momentum. "We're not yet in the months where we historically have seen that happen, but we’re getting closer," he says, hinting at a potential rally as traders return from the summer break.

Ultimately, Farrell’s thesis hinges on the idea that while Bitcoin may face short-term headwinds, the long-term outlook remains robust. His forecast of $115,000 by year-end reflects a blend of cautious optimism and data-driven analysis, underscoring his belief that Bitcoin’s best days in 2024 could still be ahead.