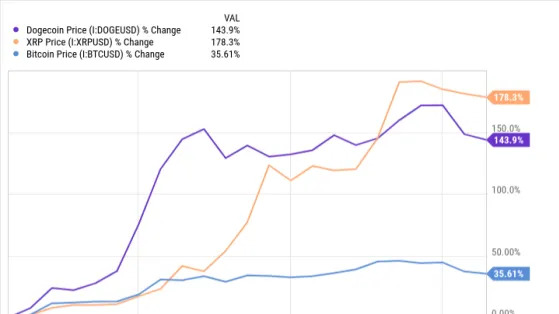

The crypto market is struggling to stage a rebound after a solid first half. On Aug. 27, Bitcoin fell 6%, marking its biggest decline since the turmoil that gripped global markets earlier this month.

However, Bitcoin had a great 2023 and hit an all-time high earlier this year. The recent decline is temporary as the cryptocurrency still has immense potential. Given this situation, it would be ideal to watch out for crypto-centric stocks like Robinhood Markets, Inc. HOOD, Interactive Brokers Group, Inc. IBKR, NVIDIA Corporation NVDA and Block Inc. SQ.

Bitcoin’s Decline Temporary

Bitcoin plunged earlier this month as global markets witnessed a massive selloff triggered by fears that the U.S. economy could slip into a recession. However, the fears were soon eased by some positive economy data that showed a steady decline in inflation.

Markets rebounded and Bitcoin, along with other major cryptocurrencies, also started staging a rebound. However, the rebound rally came to a halt earlier this week, with Bitcoin price slipping to $58,116 on Aug. 27 from a high of $63,209.

On Aug. 30, Bitcoin was hovering around 59,600 as it attempted to make a rebound.

Bitcoin's current downward trend appears to be driven by the recent selloff, which is influenced by macroeconomic factors and other market trends.

Rate Cuts to Boost Bitcoin Stocks

Bitcoin reached an all-time high of $73,750 on March 14. The surge this year gained traction after the Securities and Exchange Commission approved 11 spot Bitcoin exchange-traded funds (ETFs) in January. This approval was intended to offer both individual investors and large institutions a regulated and accessible way to invest in Bitcoin.

However, the rally lost momentum in April, and even the Bitcoin halving event did not manage to drive up the price.

The halving event, which reduces the reward for mining new blocks by half to cap the total Bitcoin supply at 21 million, typically stimulates demand and drives prices higher. Despite this, Bitcoin saw a significant decline.

However, a decline in inflation has finally raised hopes that the Fed will soon start its rate cuts. Also, Federal Reserve Chairman Jerome Powell said last week that rate cuts were on the horizon. Market participants are now expecting a 25-basis-point rate cut in November, followed by two more rate cuts by the end of this year.

Lower interest rates typically reduce the opportunity cost of holding assets that don’t provide yields, such as Bitcoin and other cryptocurrencies. In a low-interest-rate environment, investors are more inclined to seek assets with higher potential returns, even if they involve greater risk.

The shift makes cryptocurrencies, which are known for their volatility and potential for higher returns gains, more attractive to a wide range of investors.

Crypto-Centric Stocks in Focus

We have narrowed our search to four crypto-oriented stocks that have strong potential for 2024. Each of our picks carries either a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here .

Robinhood Markets, Inc. operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin and other cryptocurrencies using its Robinhood Crypto platform.

Robinhood Markets’ expected earnings growth rate for the current year is more than 100%. The Zacks Consensus Estimate for current-year earnings has improved 35.7% over the last 60 days. Robinhood Markets currently sports a Zacks Rank #1.

Interactive Brokers Group, Inc. is a global automated electronic broker. IBKR executes, processes and trades in cryptocurrencies. IBKR’s commodities futures trading desk also offers customers a chance to trade cryptocurrency futures.

Interactive Brokers Group has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.9% over the last 60 days. IBKR currently sports a Zacks Rank #1.

NVIDIA Corporation is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, NVDA’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

NVIDIA has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last 60 days. NVDA presently carries a Zacks Rank #3.

Block Inc. is an online digital and mobile payment platform for consumers and merchants and is the parent company of Square and Cash App. The users of Cash App can buy, sell, send and receive Bitcoin. In addition, SQ’s decentralized tbd platform allows developers to build decentralized finance applications to run on programmable blockchains. SQ is also one of the largest Bitcoin investors.

Block has an expected earnings growth rate of 98.9% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.1% over the last 60 days. SQ currently carries a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research