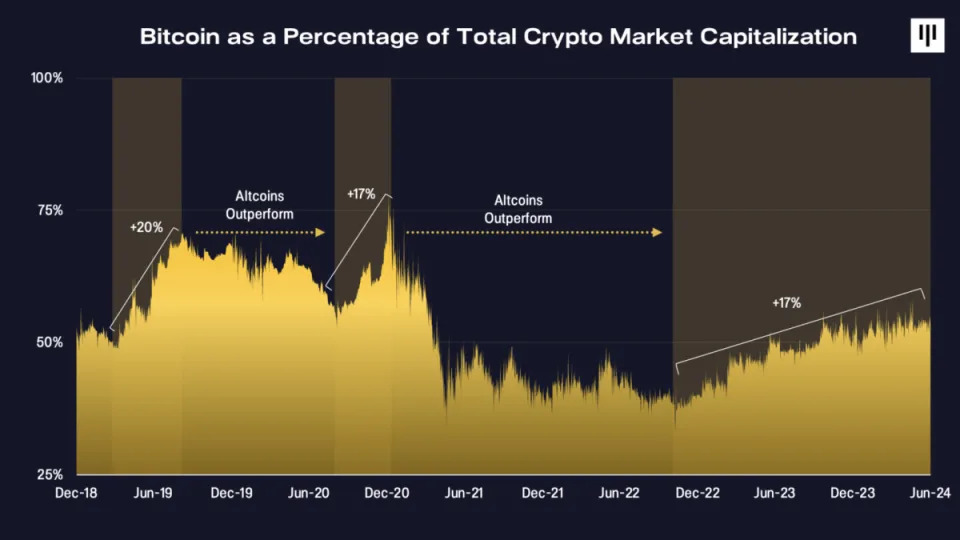

Bitcoin's run in consolidating its share of the overall crypto market might be losing steam, according to one of crypto's top investing firms.

The largest crypto by market cap, Bitcoin, has enjoyed a nice boost from the debut of Bitcoin ETFs this year, but Pantera Capital Portfolio Manager Cosmo Jiang says now might be the time to watch for a rotation into the coins beyond Bitcoin.

Bitcoin currently accounts for about 57% of crypto's $2 trillion market cap — the highest level since March of 2021.

"Bitcoin dominance has continued to go up, if we look at prior cycles the reality is Bitcoin dominance usually does go up," Jiang said, pointing out Bitcoin's surge of 19 percentage points of dominance is in line with prior cycles. "I do think we're at a point where we are closer certainly to the longer tail tokens taking off and really outperforming. But again this all hinges on the fundamentals of these protocols."

Historically, it takes time during a bull cycle for interest in Bitcoin to trickle down to other crypto projects. As Jiang pointed out, that trickle could be larger if excitement from Bitcoin ETFs continues to play out. Portfolio managers at big banks like Morgan Stanley recently got the green light to start selling Bitcoin ETFs to clients , and that could further boost attention into other crypto projects.

Pantera, for its part, has bet heavily on Telegram's TON coin — making it its largest investment into a blockchain's coin in history. Part of the bet is that Telegram already has millions of users, and simply by putting blockchain tech on the backend could result in even higher usage. Other projects are pursuing similar strategies by abstracting away the need for users to even need tokens or crypto wallets.

"It's the fact that if we do believe that these protocols are going from tens of millions of users to billions of users over time, those tokens will be worth more over time and almost definitionally worth way more than Bitcoin, which has already grown penetration by quite a lot," Jiang said. "I'm hopeful that these green shoots on the altcoins will start to bear fruit in the form of better fundamentals, which should translate to price action. We just have to be patient and wait to see that play out."