(Bloomberg) — Brisk July retail sales along with fewer applications for unemployment benefits underscored a US economy with staying power as inflationary pressures gradually subside.

Across the Atlantic, the UK jobless rate fell and wage growth cooled, while euro-zone productivity dropped for a sixth straight quarter and job growth slowed. Meanwhile, foreign direct investment in China slumped on investor concerns about the economy.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

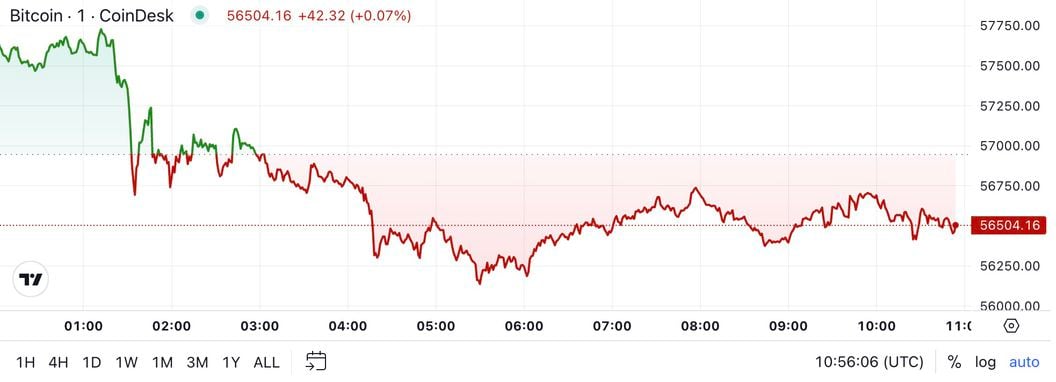

Fresh readings on retail spending and unemployment benefits quelled some of the restiveness about the US economy, parts of which remain restrained by elevated interest rates. The value of retail sales increased in July by the most since early 2023 in a broad advance and firmer sales guidance by Walmart Inc., a barometer of growth, also indicated that shoppers are becoming more selective but are still spending.

Underlying US inflation eased for a fourth month on an annual basis in July, keeping the Federal Reserve on track to lower interest rates next month. While prices fell last month for apparel, new and used cars and airfares, shelter was the most disappointing part of the report, which economists and policymakers have been widely expecting to ease and help move inflation closer to the Fed’s target.

While young college-educated women are sticking with their job search even as the number of vacancies shrinks, many of their male peers are choosing to take a break. The share of male college graduates participating in the workforce has declined in the past year, with 1 in 5 under the age of 25 neither employed nor actively looking for work, according to the latest 12-month average in a Bloomberg News analysis of government data.

Europe

UK unemployment fell unexpectedly after companies hired at the strongest pace since November, a sign of underlying strength in the economy that complicates the Bank of England’s shift toward lower interest rates. Separate data showed regular wage growth cooled to 5.4%, the weakest year-on-year pay increase since the summer of 2022.

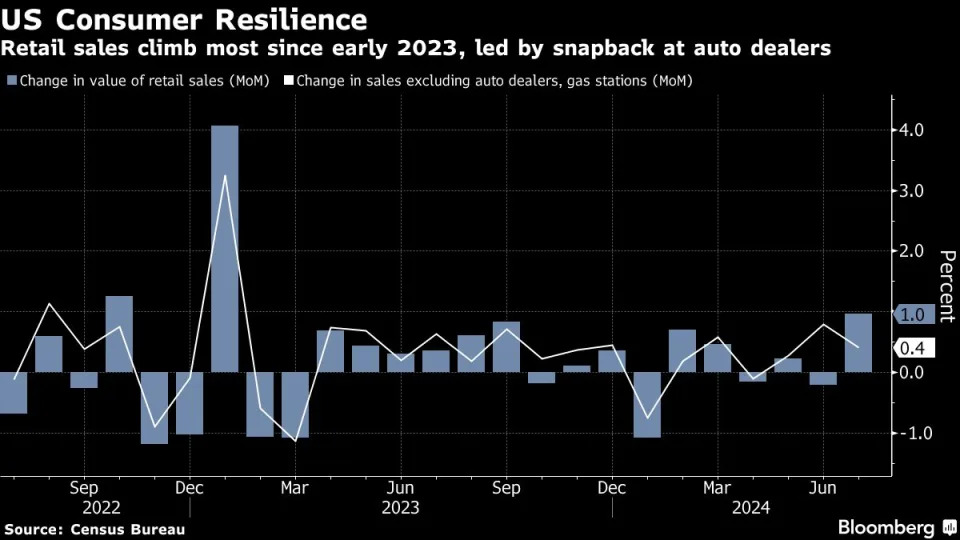

Firms across the euro zone slowed hiring in the second quarter amid mounting signs of economic weakness. The euro economy has sent distress signals recently, with consumers unwilling to spend despite outsized wage increases, private-sector activity grinding to a halt, and confidence in its largest member — Germany — tanking.

Euro-zone productivity barely improved in the second quarter and again missed the European Central Bank’s expectations – a blow for its efforts to bring inflation back to 2%.

The ECB is now likely to cut its deposit rate once a quarter through the end of next year, a timetable that will see its easing cycle end sooner than previously anticipated, according to economists.

Asia

Foreign investors pulled a record amount of money from China last quarter, likely reflecting deep pessimism about the world’s second-largest economy. China’s direct investment liabilities in its balance of payments dropped almost $15 billion in the April-June period, marking only the second time this figure has turned negative.

Australia’s wage growth remained elevated in the second quarter, reflecting persistent inflation pressures in the economy and supporting the Reserve Bank’s view that interest-rate cuts remain some way off.

Emerging Markets

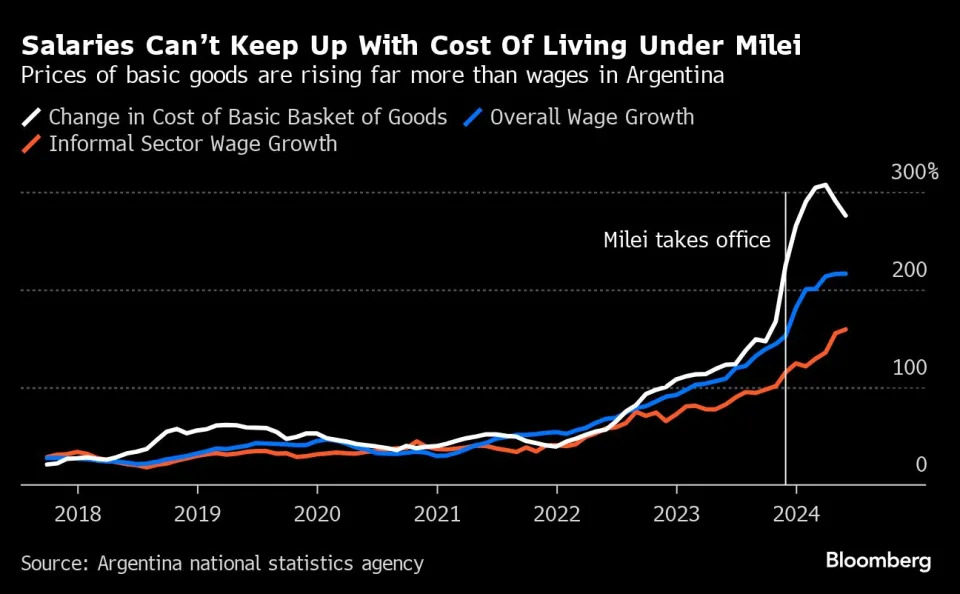

In the eight months since President Javier Milei took office, prices have soared more than 100%, consumer spending tanked and unemployment climbed as Argentines have been submitted to the most brutal austerity shock in recent history. Yet something unexpected has happened on Milei’s watch: For all the ongoing misery, he remains just as popular as when he stormed to power pledging to take a chainsaw to the state.

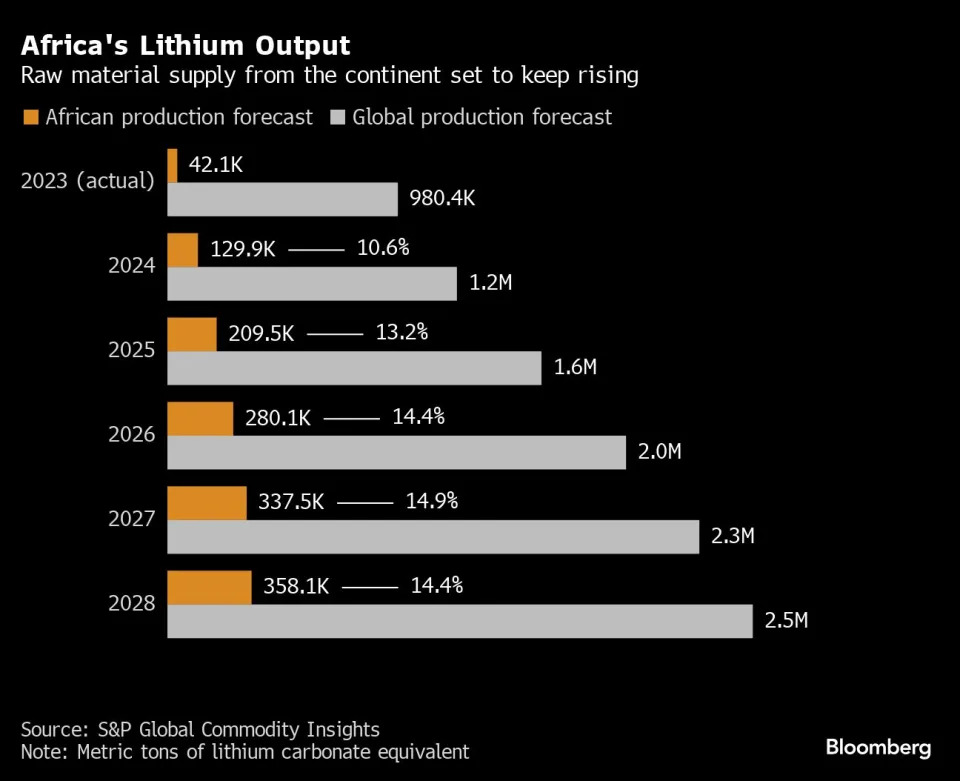

Chinese miners and refiners are driving a surge in African lithium output, shrugging off concerns over a glut to lock in future supplies of the critical battery metal. The continent is projected to account for almost 11% of global supply this year, compared with close to zero at the start of the decade, according to S&P Global Commodity Insights. That’s projected to increase to more than 14% by 2028.

World

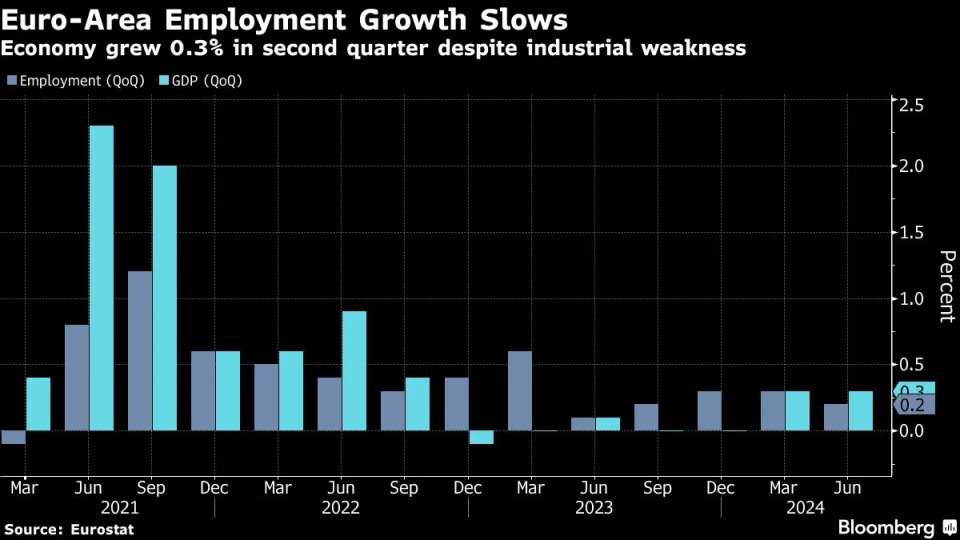

New Zealand’s central bank cut interest rates, embarking on an easing cycle much sooner than previously indicated as the economy slumps and inflation slows. Namibia and the Philippines also lowered borrowing costs. Zambia’s central bank held its key interest rate after six straight hikes to support its drought-battered economy. Norway and Uruguay also stood pat.

—With assistance from Andrew Atkinson, Ella Ceron, William Clowes, Patrick Gillespie, James Mayger, Swati Pandey, Jana Randow, Tom Rees, Augusta Saraiva, Zoe Schneeweiss, Mark Schroers and Manuela Tobias.