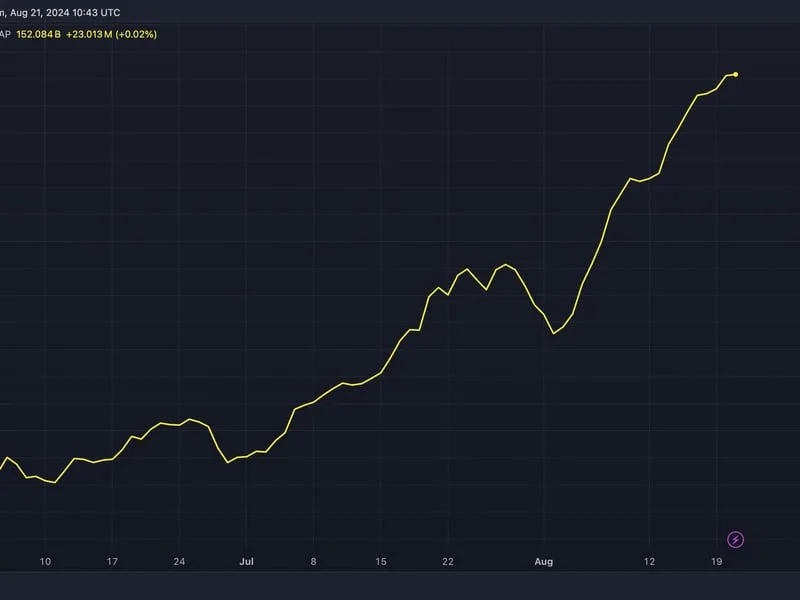

Super Micro ( SMCI ) stock plunged more than 26% this week, extending the stock’s long streak of volatility as investors weigh the company’s AI-fueled growth against questionable accounting practices, growing competition, and macroeconomic uncertainties.

Super Micro stock’s drop partly erased gains from a three-week rally beginning at the start of February . That rally was fueled by the server maker’s ambitious long-term revenue outlook and investors’ optimism that the company would mitigate the risk of a Nasdaq delisting by submitting its delayed filings to the US Securities and Exchange Commission.

Super Micro Computer makes massive server racks designed by Nvidia ( NVDA ) using the chipmaker’s GPUs (graphics processing units, or AI chips) for data centers, and that hardware is necessary to train and run artificial intelligence models. The company was part of a group of leading AI-themed stocks that thrived as artificial intelligence went mainstream following the launch of ChatGPT.

That’s because Super Micro was an early mover in the burgeoning market for AI servers, Wedbush analyst Matthew Bryson told Yahoo Finance. The company partnered with Meta ( META ) to make the large-scale GPU servers that powered its first AI Research SuperCluster before ChatGPT debuted, Bryson said.

“ Super Micro was the right company at the right time,” Bryson told Yahoo Finance in an interview Friday. "They were in the right product at the right time, and they turned that into a leadership position in AI servers."

But a Hindenburg report in August accused the server maker of accounting violations, and the fallout from the report — Super Micro faced an investigation from the US Department of Justice and its accountant resigned — rocked the stock , with shares dropping roughly 24% from the time the accusations were released through the end of 2024.

Shares had recovered those losses by mid-February — before this week’s rout.

Super Micro submitted delayed quarterly and annual filings to the US Securities and Exchange Commission on Wednesday. While the details in the company’s earnings results were in line with expectations, Super Micro said in its annual 10-K report that it’s still working to resolve “material weaknesses and deficiencies in our internal control over financial reporting and disclosure controls and procedures.”

It’s not the first time Super Micro has faced such issues. Its former CFO was charged by the SEC in connection with “widespread” accounting violations in 2020 . Bryson wrote in a recent note to investors that he believes "SMCI's second flirtation with questionable financials will necessarily continue to weigh somewhat on the company's perceived risk profile.”

Still, Bryson told Yahoo Finance, the “questionable” financials should be less of a factor in the stock’s performance going forward than Super Micro’s narrowing competitive moat in the AI server industry. That’s because server companies are increasingly reliant on Nvidia’s server designs to make their products, meaning there is little room for differentiation, he said.

And though there’s growing demand for data center servers, given that countries across the globe are announcing mammoth investments in their own domestic AI infrastructure, server makers’ margins are being compressed.

" You've got this huge revenue ramp, but at the same time, what are the gross margins going to look like?" Bryson said.

Barclays analyst George Wang echoed Bryson's thoughts in a note to investors Thursday: “There seems to be little appetite for meaningful multiple expansion given the lower-margin AI server business." Bryson and Wang have Neutral ratings on SMCI.

Adding pressure to Super Micro stock this week was macroeconomic uncertainty that dragged down stocks across the board , as well as a plunge in Nvidia shares following the company’s fourth quarter earnings .

While Nvidia said it’s achieved full-scale production of its Blackwell AI chips , which are used in Super Micro’s servers, Leverage Shares senior researcher Sandeep Rao said there’s still industry concern about glitches and overheating problems related to Blackwell server systems .

“SMCI made a pretty big deal about the fact that it is closely aligned with Nvidia's Blackwell launch,” he told Yahoo Finance in an interview. “So, we have to look at Nvidia and SMCI in tandem. If Nvidia is having trouble, that means SMCI is also having trouble … there is going to be volatility in SMCI as a stock.”