Shareholders of Caleres would probably like to forget the past six months even happened. The stock dropped 59.8% and now trades at $16.98. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Caleres, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we're swiping left on Caleres for now. Here are three reasons why you should be careful with CAL and a stock we'd rather own.

Why Do We Think Caleres Will Underperform?

The owner of Dr. Scholl's, Caleres (NYSE:CAL) is a footwear company offering a range of styles.

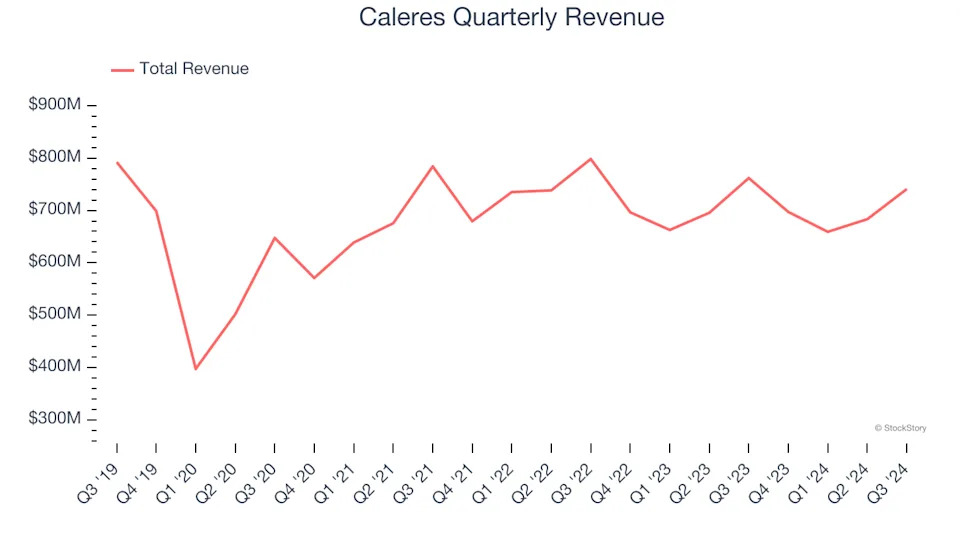

1. Revenue Spiraling Downwards

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Caleres’s demand was weak over the last five years as its sales fell at a 1.1% annual rate. This wasn’t a great result and signals it’s a low quality business.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Caleres’s revenue to stall. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

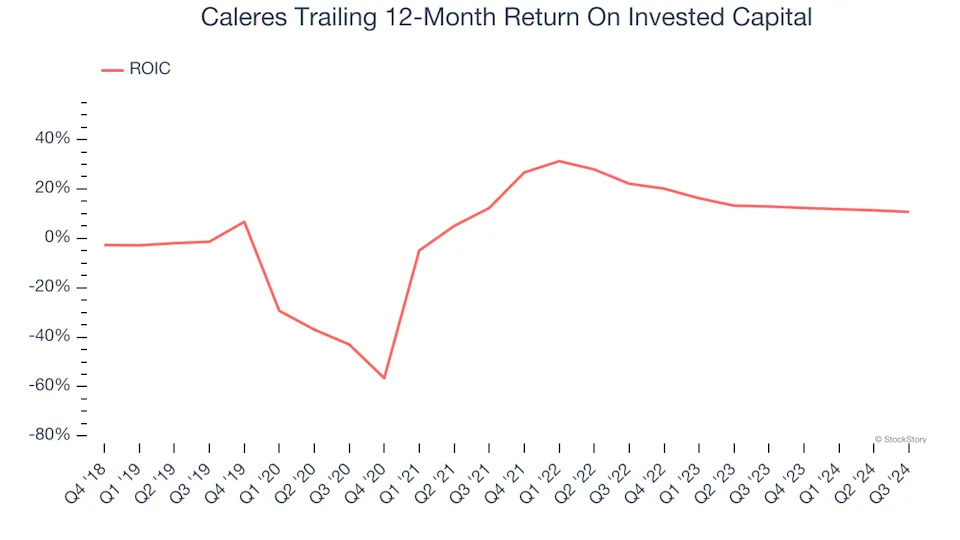

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Caleres historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

We see the value of companies helping consumers, but in the case of Caleres, we’re out. Following the recent decline, the stock trades at 3.7× forward price-to-earnings (or $16.98 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward the AmazonandPayPal of Latin America .

Stocks We Would Buy Instead of Caleres

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free .