Energy and renewable energy projects company Ameresco (NYSE:AMRC) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 20.7% year on year to $532.7 million. On the other hand, the company’s full-year revenue guidance of $1.9 billion at the midpoint came in 1.8% below analysts’ estimates. Its non-GAAP profit of $0.88 per share was 12.6% above analysts’ consensus estimates.

Is now the time to buy Ameresco? Find out in our full research report .

Ameresco (AMRC) Q4 CY2024 Highlights:

CEO George Sakellaris commented, “The fourth quarter represented a strong and resilient finish to an excellent year for Ameresco. Our team continued to deliver solid results in a dynamic business environment while positioning the Company for future growth and adding to our multi-year visibility. Our record revenue performance was driven by growth across our business lines, reflecting robust demand for cost effective projects that provide energy savings and resilience. This was also a record quarter in project contract conversions with over $1 billion, bringing our contracted project backlog to over $2.5 billion at year-end, approximately twice 2023 levels. We also placed a record 241 MWe of energy assets into service during the year. These accomplishments have added considerably to our total multiyear revenue visibility which now stands at almost $10 billion. During the quarter, we also successfully divested our AEG business unit allowing us to remain focused on our core businesses and the exciting growth opportunities within our target markets.”

Company Overview

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE:AMRC) provides energy and renewable energy solutions for various sectors.

Energy Products and Services

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

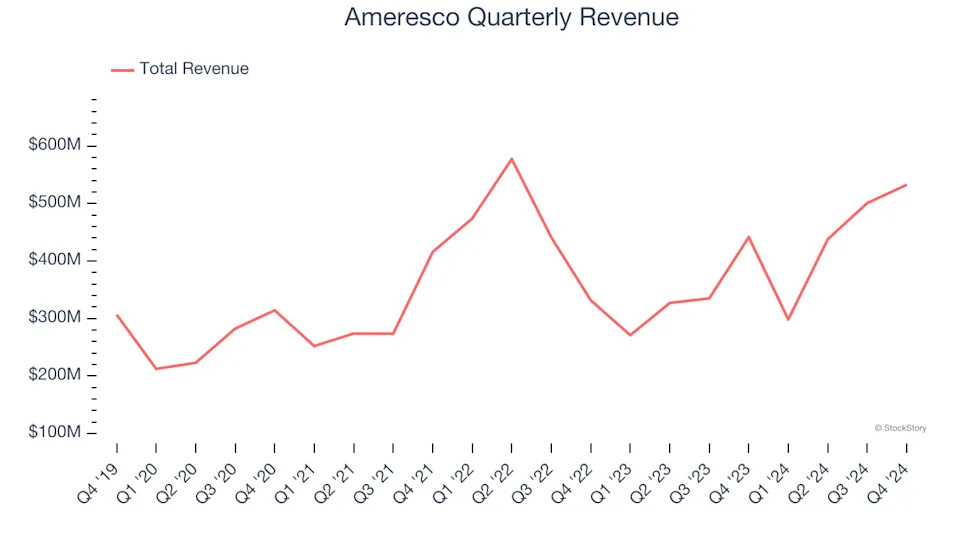

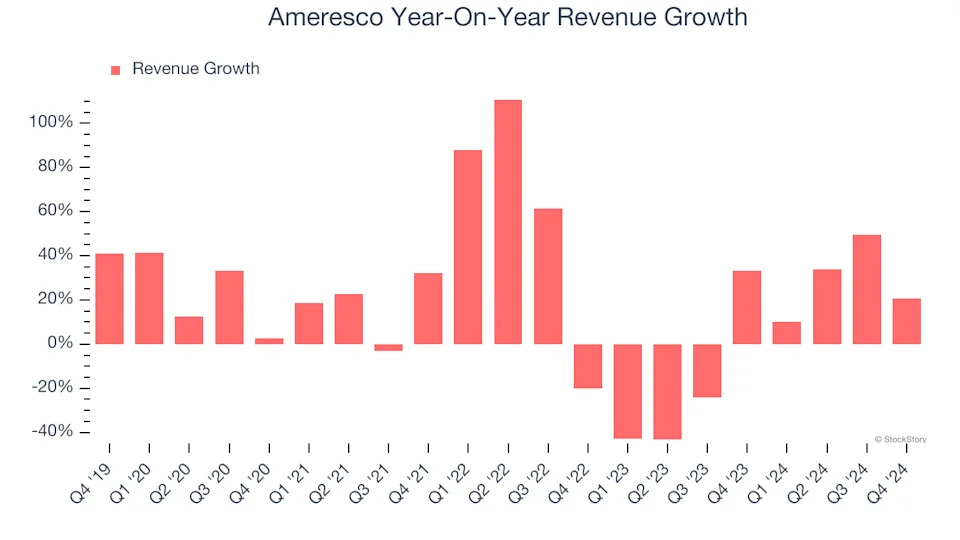

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Ameresco’s 15.3% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Ameresco’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.5% over the last two years.

This quarter, Ameresco reported robust year-on-year revenue growth of 20.7%, and its $532.7 million of revenue topped Wall Street estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 10.5% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

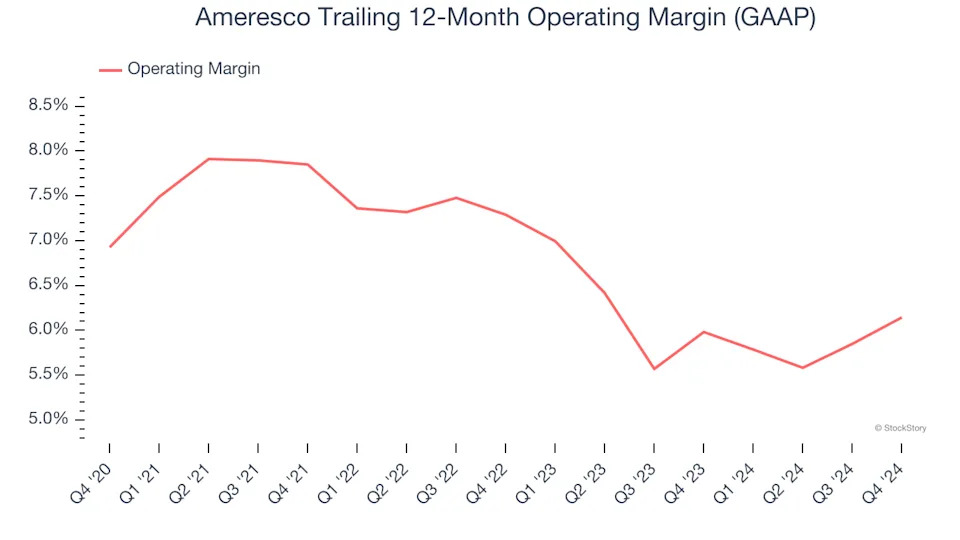

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Ameresco was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Ameresco’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises an eyebrow about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Ameresco generated an operating profit margin of 8.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

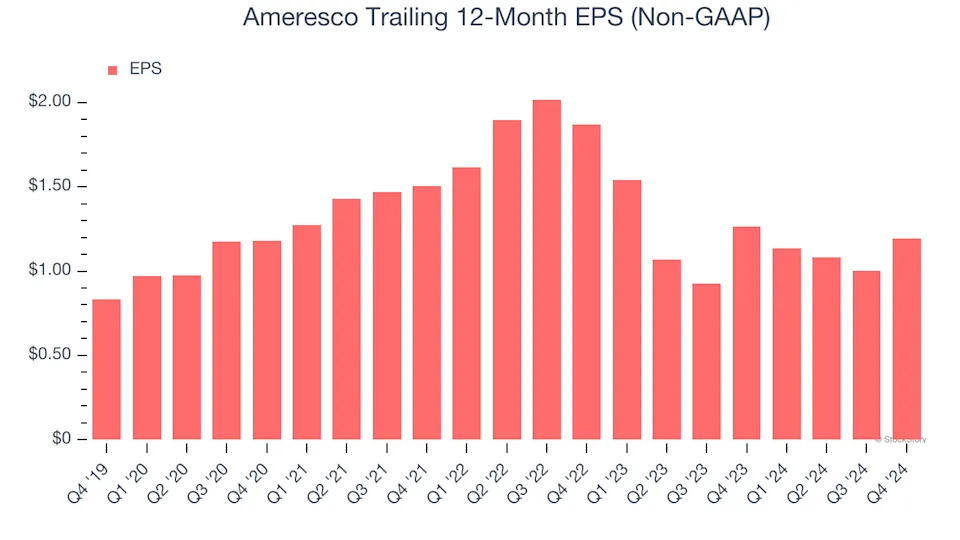

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

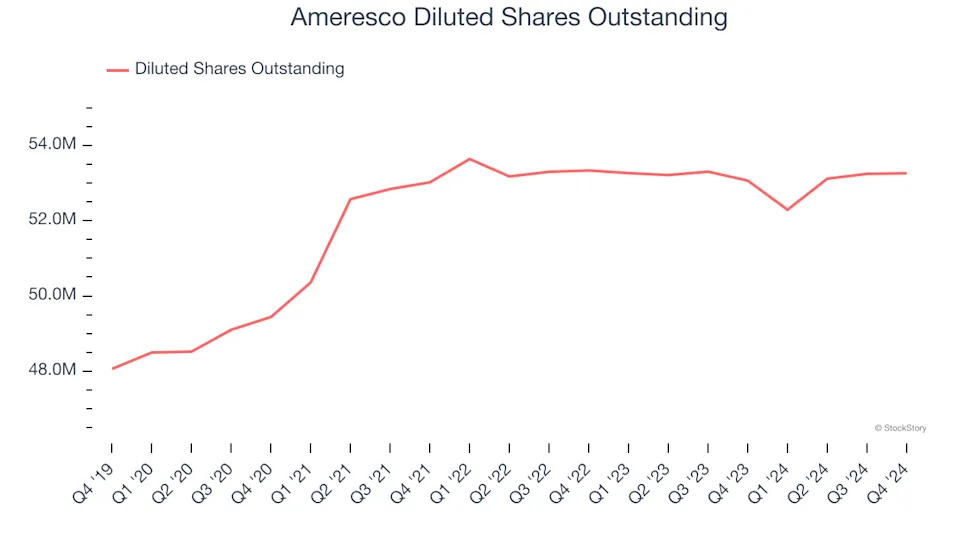

Ameresco’s EPS grew at an unimpressive 7.4% compounded annual growth rate over the last five years, lower than its 15.3% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

We can take a deeper look into Ameresco’s earnings to better understand the drivers of its performance. A five-year view shows Ameresco has diluted its shareholders, growing its share count by 10.8%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Ameresco, its two-year annual EPS declines of 20.1% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Ameresco reported EPS at $0.88, up from $0.69 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Ameresco’s full-year EPS of $1.19 to grow 29.8%.

Key Takeaways from Ameresco’s Q4 Results

We were impressed by how significantly Ameresco blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed significantly and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 12.4% to $16 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .