Key Takeaways

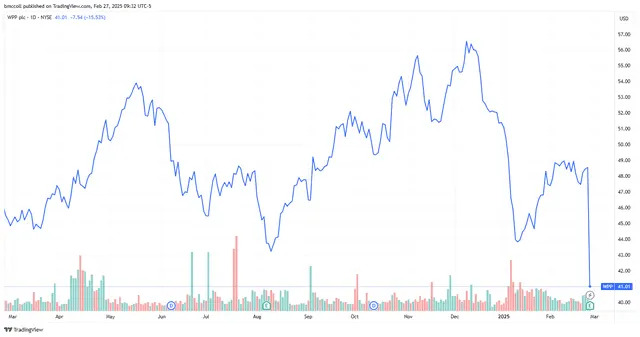

U.S.-listed shares of WPP Plc ( WPP ) sank 15% Thursday when the giant advertising firm's revenue declined and it gave soft guidance as North America and China sales slid.

The London-based owner of agencies including GroupM and VML reported fourth-quarter like-for-like revenue less pass-through costs fell 2.3% year-over-year. It declined 1.4% in North America and 5.1% in the U.K. For the rest of the world, revenue less pass-through costs lost 4.8%, with China dropping 21.2%. Western Continental Europe saw a gain of 1.4%.

CEO Mark Read said sales were "impacted by weaker client discretionary spend." Read added that while "we remain cautious given the overall macro environment, we are confident in our medium-term targets and believe our focus on innovation, a simpler client-facing offer and operational excellence will support our growth and deliver greater value for our shareholders."

WPP sees full-year like-for-like revenue less pass-through costs to be flat to down 2%, missing the Visible Alpha estimate of a 0.35% increase.

The news sent U.S.-listed shares of WPP into negative territory for the past year.

Read the original article on Investopedia