Dental products company Dentsply Sirona (NASDAQ:XRAY) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 10.6% year on year to $905 million. The company’s full-year revenue guidance of $3.55 billion at the midpoint came in 5% below analysts’ estimates. Its non-GAAP profit of $0.26 per share was 40.1% below analysts’ consensus estimates.

Is now the time to buy Dentsply Sirona? Find out in our full research report .

Dentsply Sirona (XRAY) Q4 CY2024 Highlights:

"In 2024 we made meaningful progress on our transformational agenda to strengthen our foundation and position the company for long-term success. While we were pleased to see improvement in several areas of the business, Byte, persistent macro pressures and competitive dynamics negatively impacted Q4 and 2024 full year results. Improvements in Q4 included a return to growth in Europe and imaging globally, as well as continued growth of Wellspect Healthcare and SureSmile," said Simon Campion, President and Chief Executive Officer.

Company Overview

Founded in 1899, Dentsply Sirona (NASDAQ:XRAY) is a leading manufacturer of dental equipment, consumables, and technology solutions.

Dental Equipment & Technology

The dental equipment and technology industry encompasses companies that manufacture orthodontic products, dental implants, imaging systems, and digital tools for dental professionals. These companies benefit from recurring revenue streams tied to consumables, ongoing maintenance, and growing demand for aesthetic and restorative dentistry. However, high R&D costs, significant capital investment requirements, and reliance on discretionary spending make them vulnerable to economic cycles. Over the next few years, tailwinds for the sector include innovation in digital workflows, such as 3D printing and AI-driven diagnostics, which enhance the efficiency and precision of dental care. However, headwinds include economic uncertainty, which could reduce patient spending on elective procedures, regulatory challenges, and potential pricing pressures from consolidated dental service organizations (DSOs).

Sales Growth

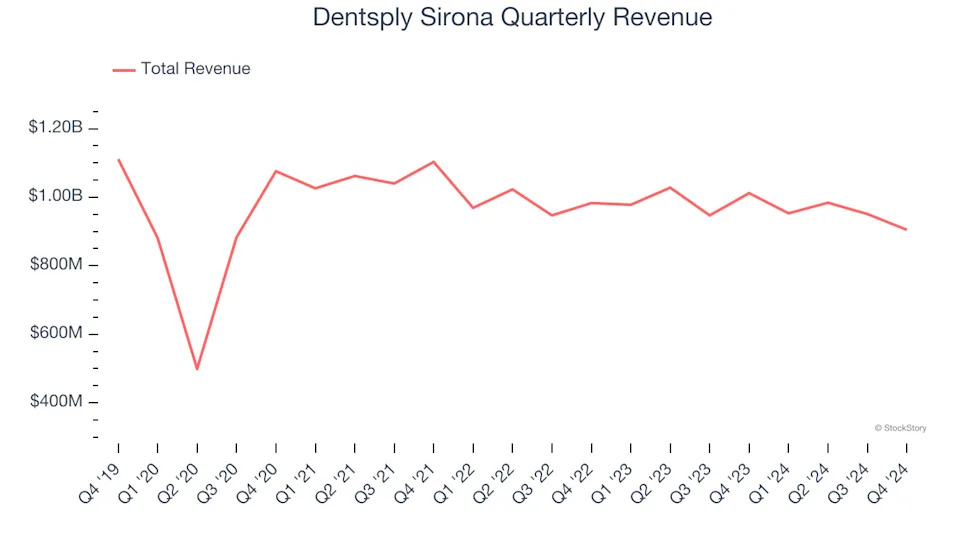

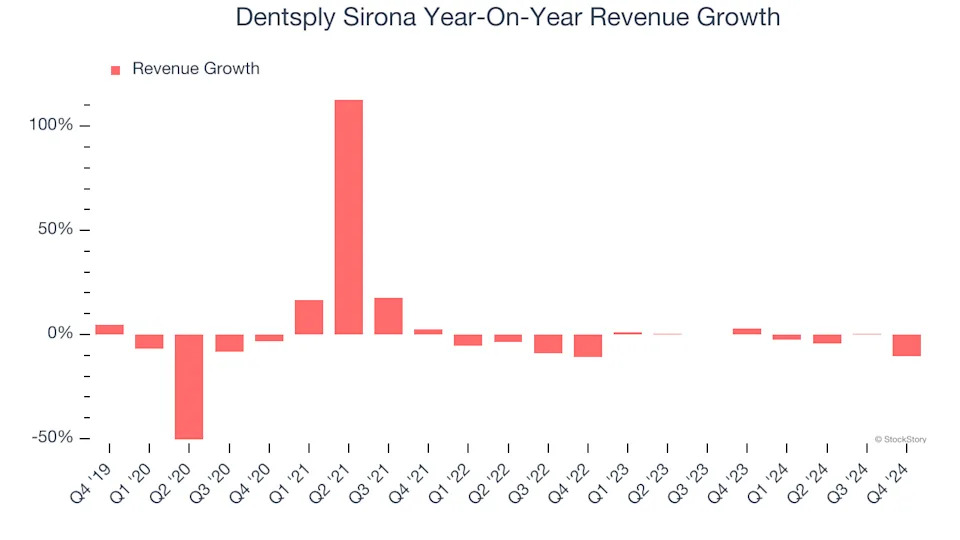

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Dentsply Sirona’s demand was weak over the last five years as its sales fell at a 1.2% annual rate. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Dentsply Sirona’s annualized revenue declines of 1.7% over the last two years align with its five-year trend, suggesting its demand consistently shrunk.

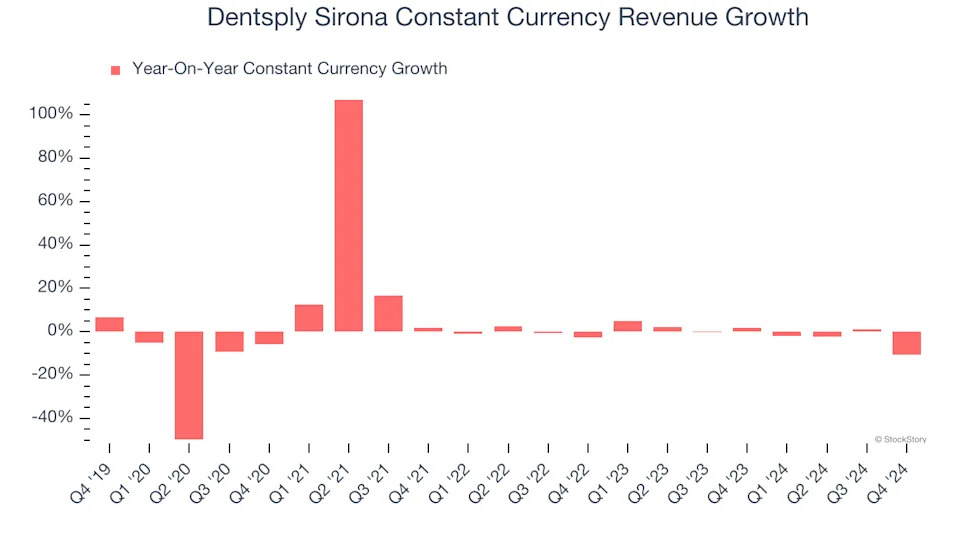

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales were flat. Because this number aligns with its normal revenue growth, we can see Dentsply Sirona’s foreign exchange rates have been steady.

This quarter, Dentsply Sirona missed Wall Street’s estimates and reported a rather uninspiring 10.6% year-on-year revenue decline, generating $905 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 1.9% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

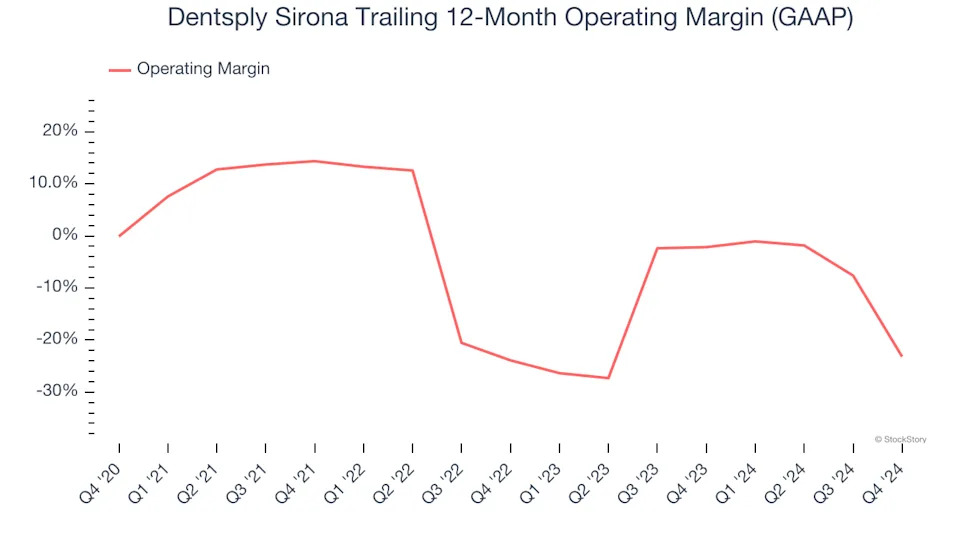

Operating Margin

Dentsply Sirona’s high expenses have contributed to an average operating margin of negative 6.7% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Dentsply Sirona’s operating margin decreased by 23.1 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. Still, shareholders will want to see Dentsply Sirona become more profitable in the future.

Dentsply Sirona’s operating margin was negative 56.2% this quarter. The company's consistent lack of profits raise a flag.

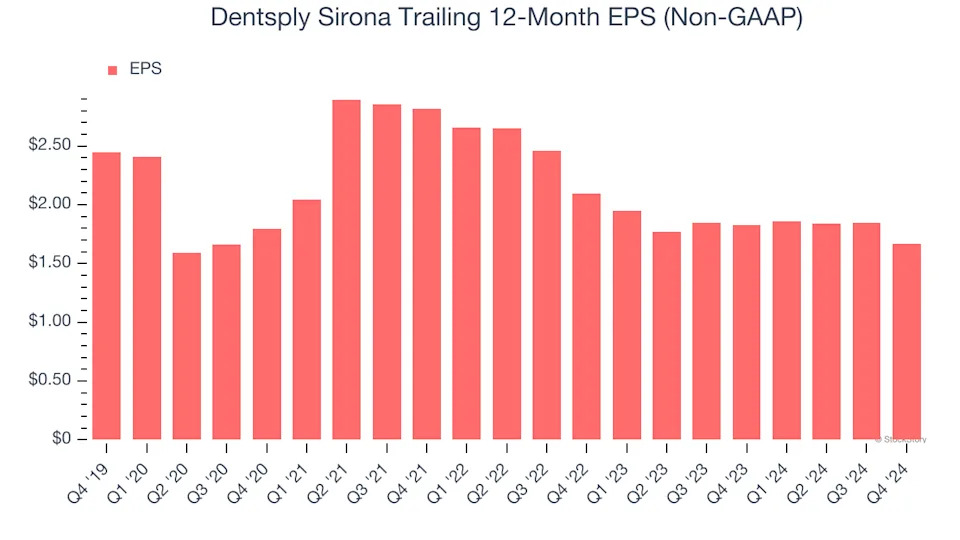

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Dentsply Sirona, its EPS declined by more than its revenue over the last five years, dropping 7.4% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Dentsply Sirona’s earnings to better understand the drivers of its performance. As we mentioned earlier, Dentsply Sirona’s operating margin declined by 23.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Dentsply Sirona reported EPS at $0.26, down from $0.44 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Dentsply Sirona’s full-year EPS of $1.67 to grow 14.3%.

Key Takeaways from Dentsply Sirona’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed significantly and its EPS fell short of Wall Street’s estimates. Adding to the disappointment was that full-year revenue also fell short of expectations. Overall, this was a softer quarter. The stock traded down 5% to $17.88 immediately after reporting.

Dentsply Sirona may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .