Healthcare tech company Privia Health Group (NASDAQ:PRVA) announced better-than-expected revenue in Q4 CY2024, with sales up 4.6% year on year to $460.9 million. On the other hand, the company’s full-year revenue guidance of $1.85 billion at the midpoint came in 2.2% below analysts’ estimates. Its non-GAAP profit of $0.21 per share was in line with analysts’ consensus estimates.

Is now the time to buy Privia Health? Find out in our full research report .

Privia Health (PRVA) Q4 CY2024 Highlights:

Company Overview

Founded in 2016, Privia Health Group (NASDAQ: PRVA) partners with physicians to establish technology-driven medical practices, aiming to improve healthcare delivery efficiency and patient experience.

Healthcare Technology for Providers

The healthcare technology industry focuses on delivering software, data analytics, and workflow solutions to hospitals, clinics, and other care facilities. These companies enable providers to streamline operations, optimize patient outcomes, and transition to value-based care models. They boast subscription-based revenues or long-term contracts, providing financial stability and growth potential. However, they face challenges such as lengthy sales cycles, significant upfront investment in technology development, and reliance on providers’ adoption of new tools, which can be hindered by budget constraints or resistance to change.

Over the next few years, the sector is poised for growth as providers increasingly prioritize digital transformation and efficiency in response to rising healthcare costs and patient demand for seamless care. Tailwinds include the growing adoption of AI-driven tools for patient engagement and operational improvements, government incentives for digitization, and the expansion of telehealth and remote patient monitoring. However, headwinds such as tightening hospital budgets, cybersecurity threats, and the fragmented nature of healthcare systems could slow adoption.

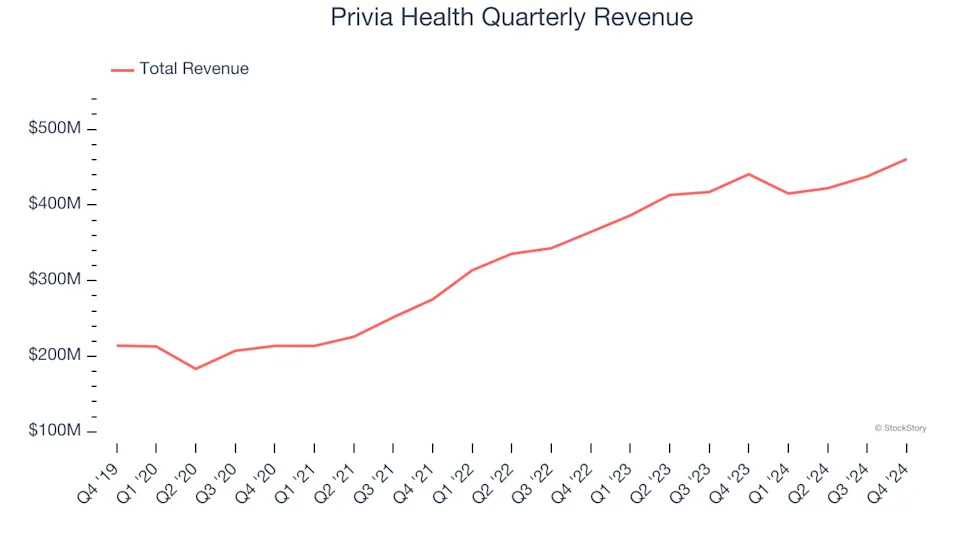

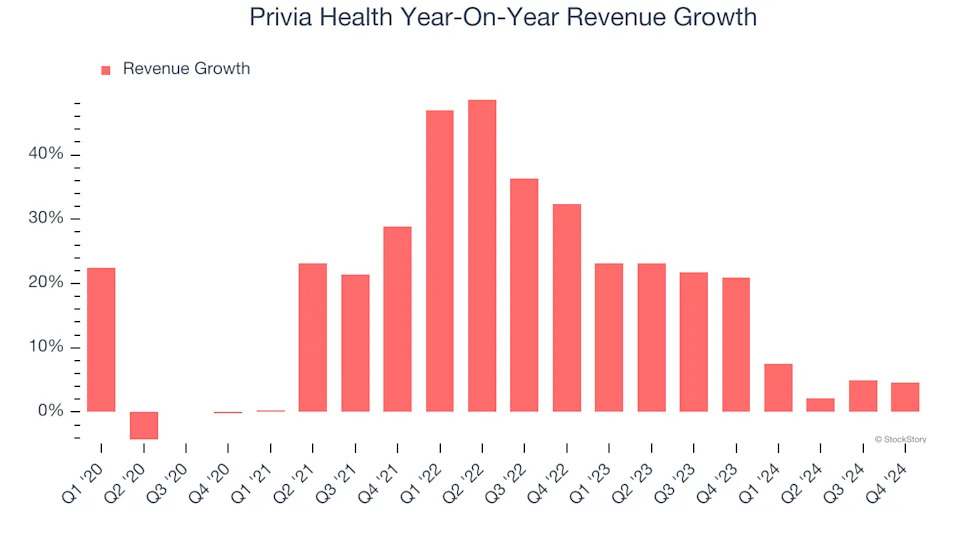

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Privia Health’s sales grew at an impressive 17.2% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Privia Health’s annualized revenue growth of 13.1% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

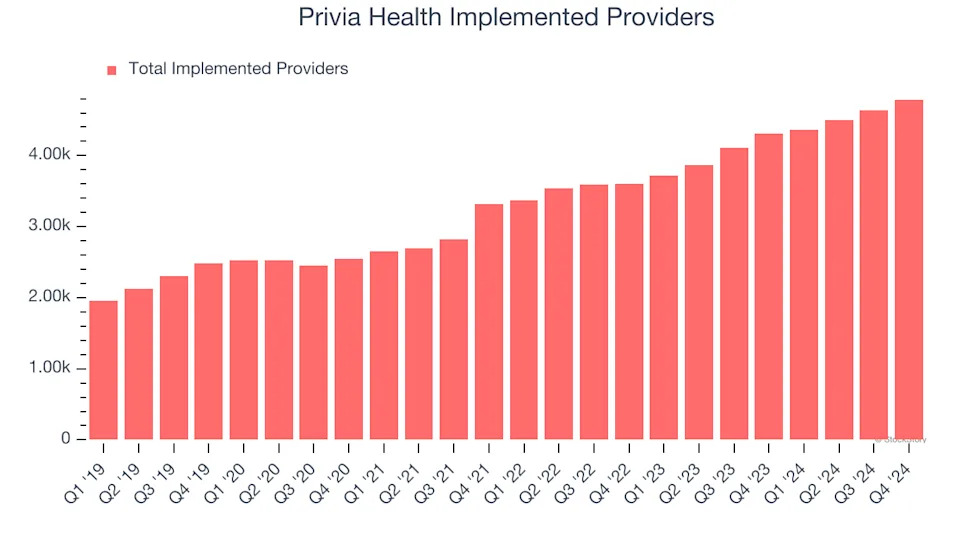

We can dig further into the company’s revenue dynamics by analyzing its number of implemented providers, which reached 4,789 in the latest quarter. Over the last two years, Privia Health’s implemented providers averaged 13.9% year-on-year growth. Because this number is in line with its sales growth, we can see the company’s underlying demand was fairly consistent.

This quarter, Privia Health reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 10.3%.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

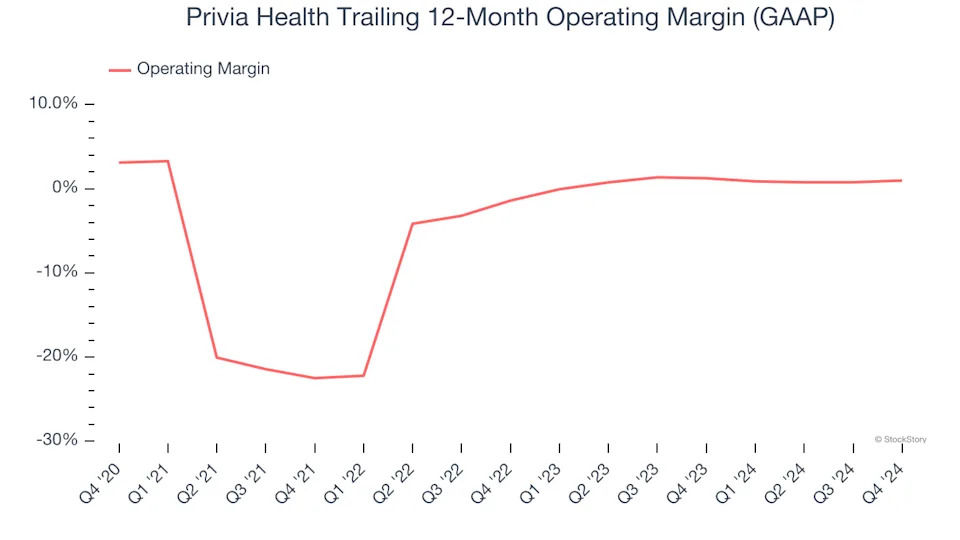

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although Privia Health was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.7% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Privia Health’s operating margin decreased by 2.1 percentage points over the last five years, but it rose by 2.4 percentage points on a two-year basis. Still, shareholders will want to see Privia Health become more profitable in the future.

This quarter, Privia Health generated an operating profit margin of 1.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

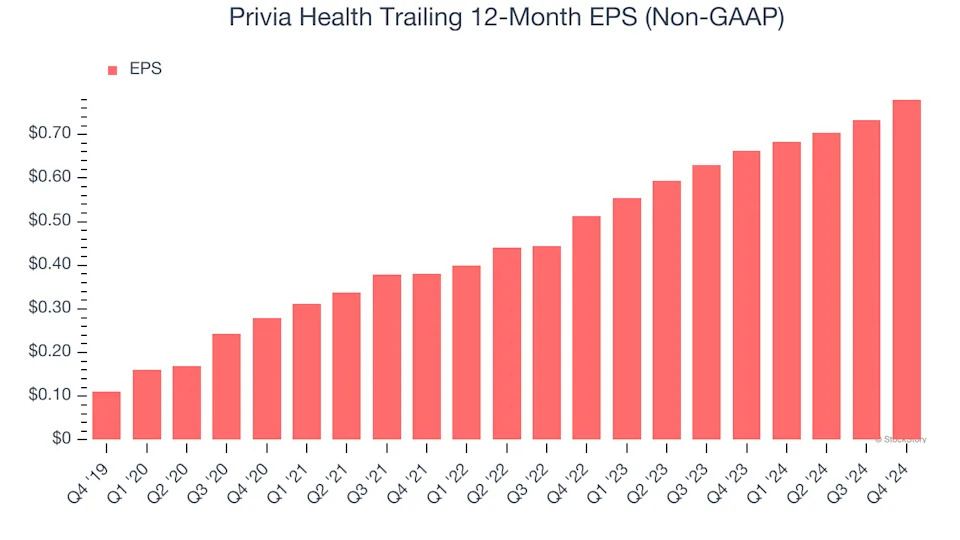

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Privia Health’s EPS grew at an astounding 47.5% compounded annual growth rate over the last five years, higher than its 17.2% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Privia Health reported EPS at $0.21, up from $0.16 in the same quarter last year. This print beat analysts’ estimates by 4.6%. Over the next 12 months, Wall Street expects Privia Health’s full-year EPS of $0.78 to grow 15.1%.

Key Takeaways from Privia Health’s Q4 Results

We were impressed by how significantly Privia Health blew past analysts’ revenue expectations this quarter. We were also glad its sales volume outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed. Overall, this quarter was mixed. The areas below expectations seem to be driving the move, and shares traded down 2.3% to $23.50 immediately following the results.

Is Privia Health an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .